Horngren's Accounting (11th Edition)

11th Edition

ISBN: 9780133856781

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem P6.31APGA

Objectives 5, 6

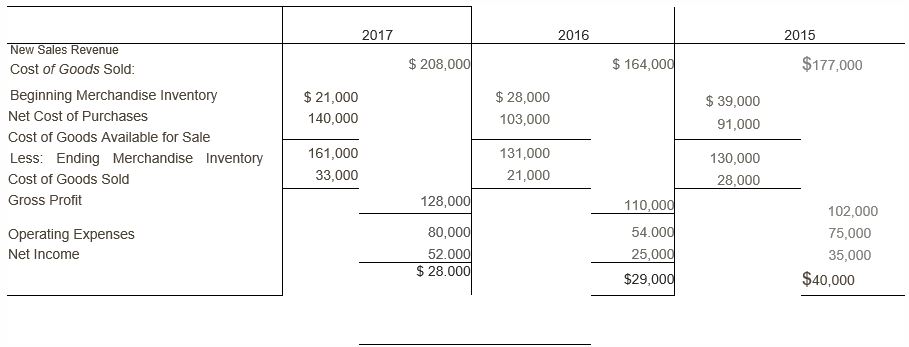

overstated $7,000 P6-31A Correcting inventory errors over a three-year period and computing inventory turnover and days sales in inventory

Lake Air Carpets's books show the following data. In early 2018, auditors found that the ending merchandise inventory for 2015 was understated by $6,000 and that the ending merchandise inventory for 2017 was overstated by $7,000. The ending merchandise inventory at December 31, 2016, was correct.

Requirements

- Prepare corrected income statements for the three years.

- State whether each year’s net income-before your corrections-is understated or overstated, and indicate the amount of the understatement or overstatement.

- Compute the inventory turnover and days’ sales in inventory using the corrected income statement for the three years. (Round all numbers to two decimals.)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Audit, Fraud, Or Forensic Accounting

Introduce yourself to your peers by sharing something unique about your background. Explain how you expect this course will help you move forward in your current or future career.

This course covers forensic accounting, so it's important to establish the differences between an audit, a fraud examination, and a forensic accounting engagement. Think about the fraud conviction of Elizabeth Holmes, as described in the video, "Elizabeth Holmes Found Guilty in Theranos Fraud Trial."

Then respond to the following:

Imagine you are assigned to the Theranos case.

Write the first five questions you would ask if you were an auditor, the first five questions as a fraud examiner, and the first five as a forensic accountant.

After your questions, explain why the questions and approaches are different among the three roles.

Be sure to respond to at least one of your classmates' posts.

Financial Account subject

ACCOUNT QUESTIONS

Chapter 6 Solutions

Horngren's Accounting (11th Edition)

Ch. 6 - Which principle or concept states that business...Ch. 6 - Which inventory costing method assigns to ending...Ch. 6 - Assume Nile.com began April with 14 units of...Ch. 6 - Suppose Nile.com used the weighted-average...Ch. 6 - Which inventory costing method results in the...Ch. 6 - Which of the following is most closely linked to...Ch. 6 - At December 31, 2018, Stevenson Company overstated...Ch. 6 - Suppose Maestro’s had cost of goods sold during...Ch. 6 - Suppose used the LIFO inventory costing method and...Ch. 6 - Prob. 1RQ

Ch. 6 - Prob. 2RQCh. 6 - Prob. 3RQCh. 6 - Prob. 4RQCh. 6 - Discuss some measures that should be taken to...Ch. 6 - Under a perpetual inventory system, what are the...Ch. 6 - When using a perpetual inventory system and the...Ch. 6 - During periods of rising costs, which inventory...Ch. 6 - What does the lower-of-cost-or market (LCM) rule...Ch. 6 - What account is debited when recording the...Ch. 6 - What is the effect on cost of goods sold, gross...Ch. 6 - When does an inventory error cancel out, and why?Ch. 6 - How is inventory turnover calculated, and what it...Ch. 6 - How is days’ sales inventory calculated, and what...Ch. 6 - When using the periodic inventory system, which...Ch. 6 - When using periodic inventory system and...Ch. 6 - Determining inventory accounting principles...Ch. 6 - Determining inventory costing methods Learning...Ch. 6 - Prob. S6.3SECh. 6 - Prob. S6.4SECh. 6 - Prob. S6.5SECh. 6 - Prob. S6.6SECh. 6 - Prob. S6.7SECh. 6 - Prob. S6.8SECh. 6 - Prob. S6.9SECh. 6 - Prob. S6.10SECh. 6 - Prob. S6A.11SECh. 6 - Prob. S6A.12SECh. 6 - Prob. S6A.13SECh. 6 - Using accounting vocabulary Learning Objective 1,...Ch. 6 - Prob. E6.15ECh. 6 - Prob. E6.16ECh. 6 - Prob. E6.17ECh. 6 - Prob. E6.18ECh. 6 - Prob. E6.19ECh. 6 - Prob. E6.20ECh. 6 - Prob. E6.21ECh. 6 - Prob. E6.22ECh. 6 - Prob. E6.23ECh. 6 - Correcting an inventory error-two years Natural...Ch. 6 - Prob. E6.25ECh. 6 - Prob. E6A.26ECh. 6 - Prob. E6A.27ECh. 6 - Prob. P6.28APGACh. 6 - Prob. P6.29APGACh. 6 - Prob. P6.30APGACh. 6 - Objectives 5, 6 overstated $7,000 P6-31A...Ch. 6 -

Jepson Electronic Center began cost $70...Ch. 6 - Prob. P6.33BPGBCh. 6 - Prob. P6.34BPGBCh. 6 - Accounting principles for inventory and applying...Ch. 6 - Prob. P6.36BPGBCh. 6 - Prob. P6A.37BPGBCh. 6 - Prob. P6.38CPCh. 6 - Prob. P6.39PSCh. 6 - Prob. 6.1DCCh. 6 - > Fraud Case 6-1 Ever since he was a kid, Carl...Ch. 6 - Prob. 6.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide answer general Accounting questionarrow_forwardDegregorio Corporation makes a product that uses a material with the following direct material standards: Standard quantity 2.7 kilos per unit Standard price $9 per kilo The company produced 5,700 units in November using 15,760 kilos of the material. During the month, the company purchased 17,830 kilos of direct material at a total cost of $156,904. The direct materials purchases variance is computed when the materials are purchased. The materials quantity variance for November is: a. $3,330 F b. $3,236 F c. $3,330 U d. $3,236 Uarrow_forwardNonearrow_forward

- The blending department had the following data for the month of March: Units in BWIP Units completed 7,200 Units in EWIP (40% complete) 750 $27,000 Total manufacturing costs Required: 1. What is the output in equivalent units for March? 2. What is the unit manufacturing cost for March?arrow_forwardGiven answer accounting questionarrow_forwardAccounting question answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License