Preparing Multistep Income Statements and Calculating Gross Profit Percentage

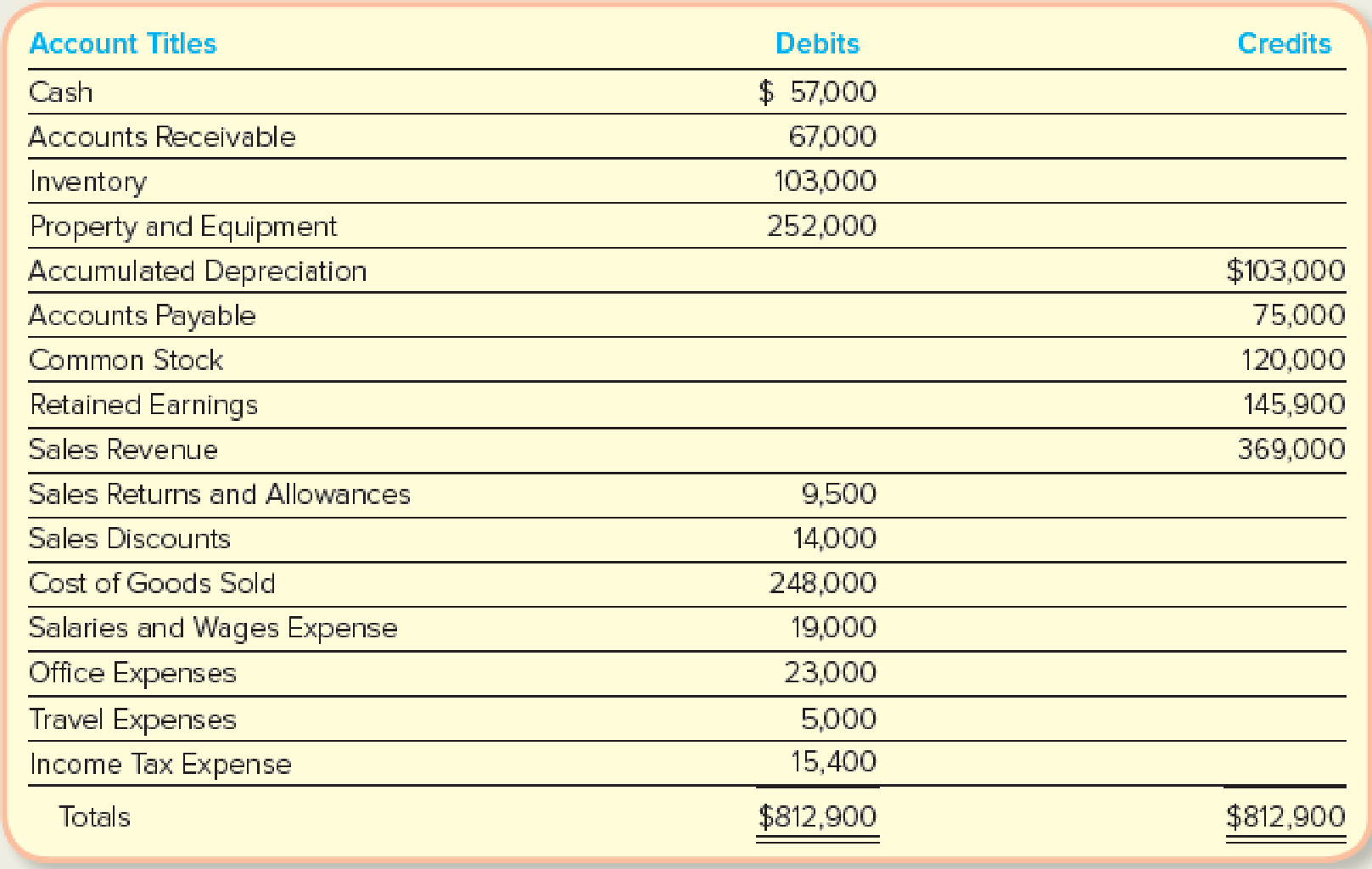

Assume that you have been hired by Big Sky Corporation as a summer intern. The company is in the process of preparing its annual financial statements. To help in the process, you are asked to prepare an income statement for internal reporting purposes and an income statement for external reporting purposes. Your boss also has requested that you determine the company’s gross profit percentage based on the statements that you are to prepare. The following adjusted

As the trial balance shows, Big Sky tracks sales returns, allowances, and discounts in separate accounts that are subtracted from the (gross) Sales Revenue to determine Net Sales. These offsetting accounts for Sales Returns and Allowances and Sales Discounts are called “contra-revenue” accounts. Your boss wants you to create the spreadsheet in a way that automatically recalculates net sales and any other related amounts whenever changes are made to the contra-revenue accounts. To do this, you know that you’ll have to use formulas throughout the worksheets and even import or link cells from one worksheet to another. Your friend Owen, an accountant, is willing to help.

| From: | Owentheaccountant@yahoo.com |

| To: | Helpme@hotmail.com |

| Cc: | |

| Subject: | Excel Help |

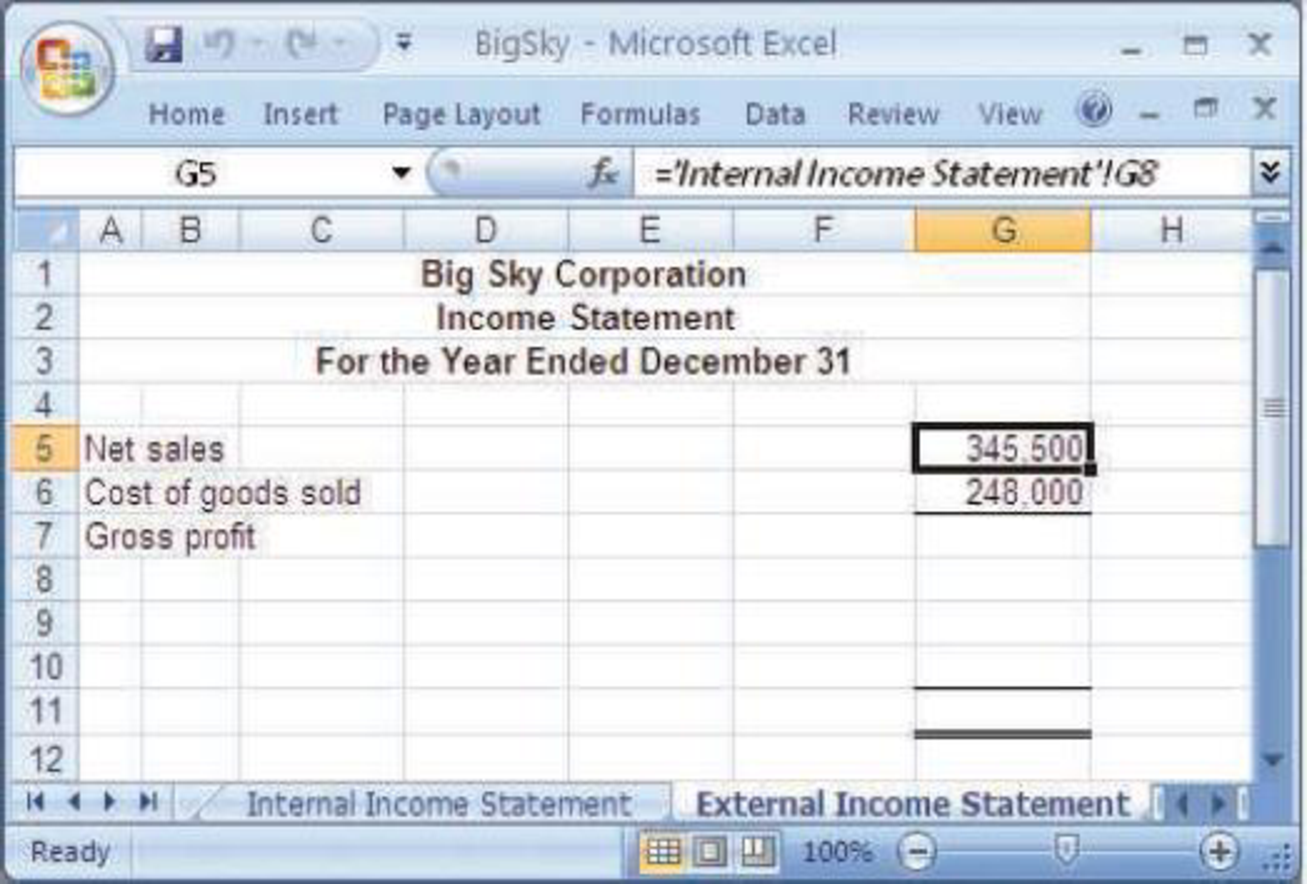

Sounds like you are going to get some great experience this summer. Okay, to import a number from another spreadsheet, you first click on the cell where you want the number to appear. For example, if you want to enter the Net Sales balance in the external income statement, click on the cell in the external income statement where the Net Sales number is supposed to appear. Enter the equals sign (=) and then click on the tab that takes you to the worksheet containing the internal income statement. In that worksheet, click on the cell that contains the amount you want to import into the external income statement and then press enter. This will create a link from the internal income statement cell to the external income statement cell. Here’s a screen shot showing the formula that will appear after you import the number.

Don’t forget to save the file using a name that indicates who you are.

Required:

Enter the trial balance information into a spreadsheet and complete the following:

- 1. Prepare a multistep income statement that would be used for internal reporting purposes, by classifying sales returns and allowances and sales discounts as contra-revenue accounts, and subtracting them from Sales Revenue to show Net Sales.

- 2. Prepare a multistep income statement that would be used for external reporting purposes, beginning with the amount for Net Sales.

- 3. Compute the gross profit percentage (round to one decimal place).

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

GEN COMBO LL FUNDAMENTALS OF FINANCIAL ACCOUNTING; CONNECT ACCESS CARD

- Please explain the correct approach for solving this financial accounting question.arrow_forwardI need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forwardI need help Book value of an asset equals:A. Market valueB. Cost minus accumulated depreciationC. Net incomeD. Sale pricearrow_forward

- Book value of an asset equals:A. Market valueB. Cost minus accumulated depreciationC. Net incomeD. Sale price no AIarrow_forwardBook value of an asset equals:A. Market valueB. Cost minus accumulated depreciationC. Net incomeD. Sale pricearrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forward

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage