Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 6PA

Lower-of-cost-or-market inventory

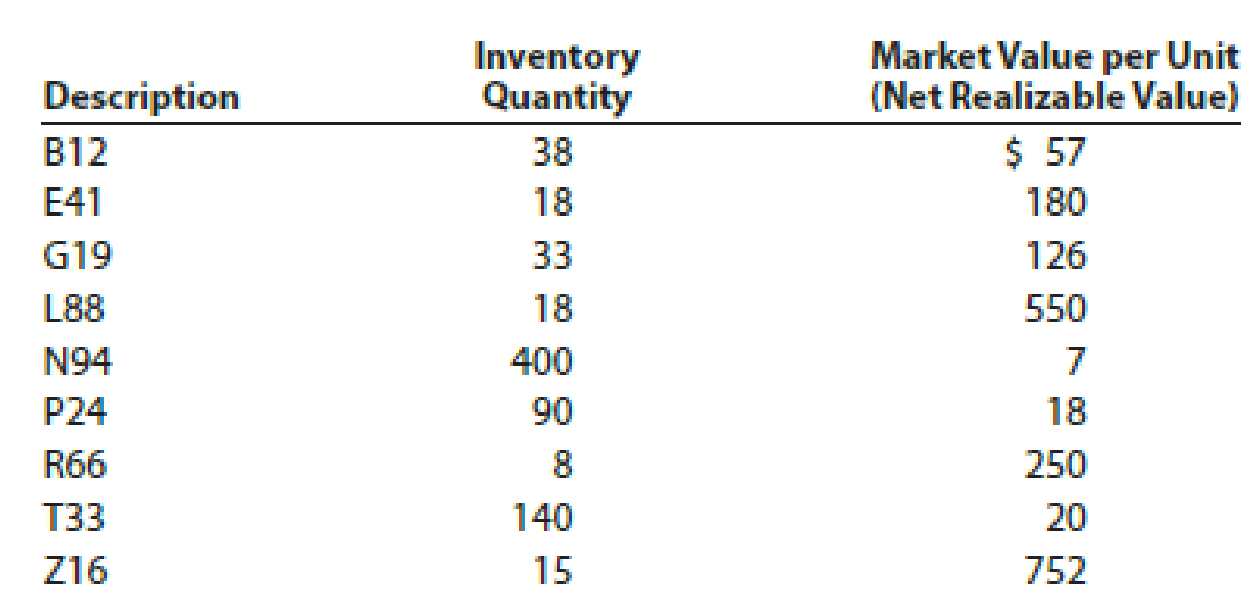

Data on the physical inventory of Ashwood Products Company as of December 31 follow:

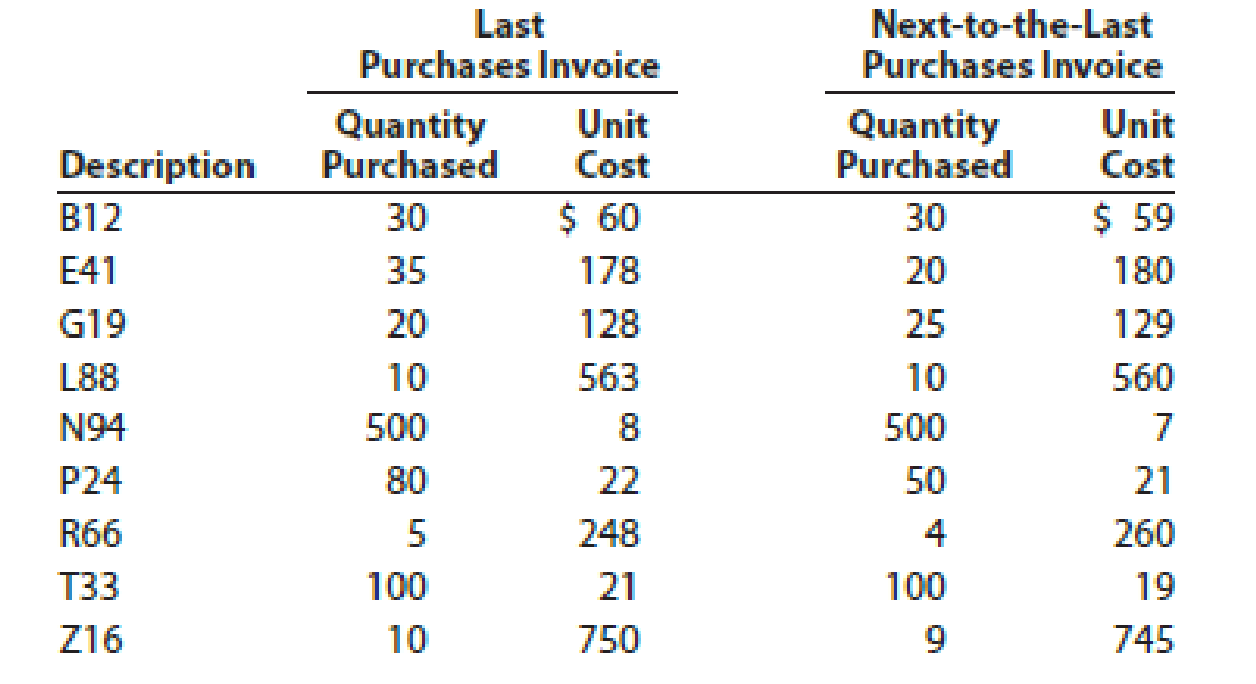

Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows:

Instructions

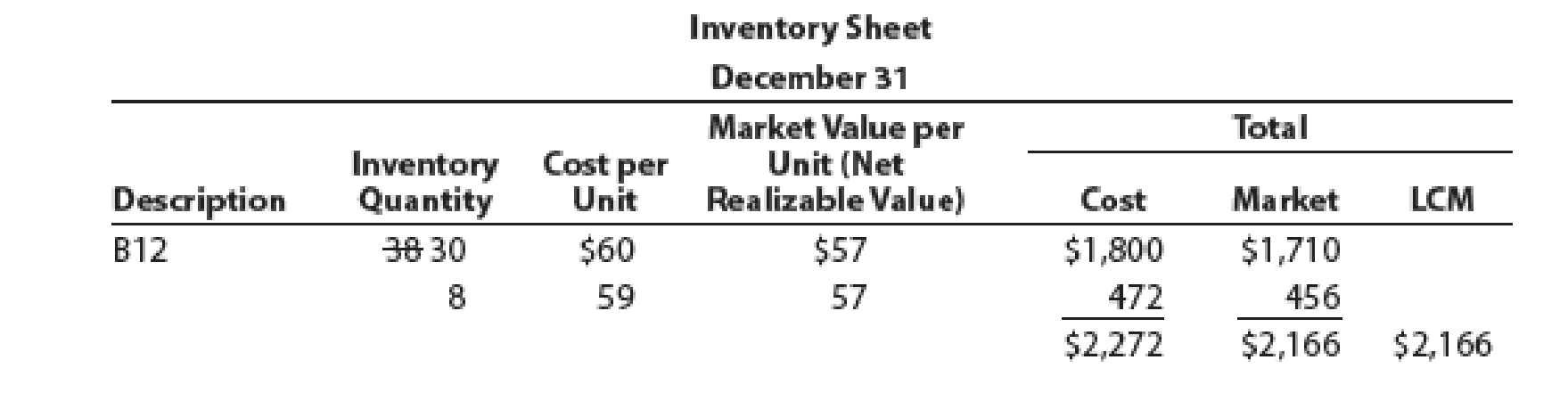

Determine the inventory at cost and also at the lower of cost or market applied on an item-by-item basis, using the first-in, first-out method. Record the appropriate unit costs on the inventory sheet, and complete the pricing of the inventory. When there are two different unit costs applicable to an item, proceed as follows:

- 1. Draw a line through the quantity, and insert the quantity and unit cost of the last purchase.

- 2. On the following line, insert the quantity and unit cost of the next-to-the-last purchase.

- 3. Total the cost and market columns and insert the lower of the two totals in the LCM column. The first item on the inventory sheet has been completed as an example.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Which of the following is a temporary account?A. EquipmentB. Accounts PayableC. Utilities ExpenseD. Common Stock

Unearned revenue becomes revenue when:A. A sale is madeB. Cash is receivedC. The service is performedD. The revenue is recorded

What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assets

Chapter 6 Solutions

Financial And Managerial Accounting

Ch. 6 - Before inventory purchases are recorded, the...Ch. 6 - Why is it important to take a physical inventory...Ch. 6 - Prob. 3DQCh. 6 - If inventory is being valued at cost and the price...Ch. 6 - Prob. 5DQCh. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - The inventory at the end of the year was...Ch. 6 - Prob. 9DQCh. 6 - Prob. 10DQ

Ch. 6 - Cost flow methods The following three identical...Ch. 6 - Perpetual inventory using FIFO Beginning...Ch. 6 - Perpetual inventory using LIFO Beginning...Ch. 6 - Beginning inventory, purchases, and sales for...Ch. 6 - The units of an item available for sale during the...Ch. 6 - On the basis of the following data, determine the...Ch. 6 - Effect of inventory errors During the taking of...Ch. 6 - Financial statement data for years ending December...Ch. 6 - Control of inventories Triple Creek Hardware Store...Ch. 6 - Prob. 2ECh. 6 - Perpetual inventory using FIFO Beginning...Ch. 6 - Perpetual inventory using LIFO Assume that the...Ch. 6 - Perpetual inventory using LIFO Beginning...Ch. 6 - Perpetual inventory using FIFO Assume that the...Ch. 6 - FIFO and LIFO costs under perpetual inventory...Ch. 6 - Weighted average cost flow method under perpetual...Ch. 6 - Weighted average cost flow method under perpetual...Ch. 6 - Assume that the business in Exercise 6-9 maintains...Ch. 6 - Assume that the business in Exercise 6-9 maintains...Ch. 6 - The units of an item available for sale during the...Ch. 6 - Periodic inventory by three methods; cost of goods...Ch. 6 - Prob. 14ECh. 6 - On the basis of the following data, determine the...Ch. 6 - Based on the data in Exercise 6-15 part (a) and...Ch. 6 - Effect of errors in physical inventory Madison...Ch. 6 - Fonda Motorcycle Shop sells motorcycles, ATVs, and...Ch. 6 - Error in inventory During 20Y5, the accountant...Ch. 6 - Retail method A business using the retail method...Ch. 6 - Retail method A business using the retail method...Ch. 6 - Retail method A business using the retail method...Ch. 6 - Retail method On the basis of the following data,...Ch. 6 - Prob. 24ECh. 6 - Gross profit method Based on the following data,...Ch. 6 - Gross profit method Based on the following data,...Ch. 6 - FIFO perpetual inventory The beginning inventory...Ch. 6 - The beginning inventory at Midnight Supplies and...Ch. 6 - The beginning inventory for Midnight Supplies and...Ch. 6 - Periodic inventory by three methods The beginning...Ch. 6 - Periodic inventory by three methods Dymac...Ch. 6 - Lower-of-cost-or-market inventory Data on the...Ch. 6 - Retail method; gross profit method Selected data...Ch. 6 - FIFO perpetual inventory The beginning inventory...Ch. 6 - LIFO perpetual inventory The beginning inventory...Ch. 6 - Prob. 3PBCh. 6 - Periodic inventory by three methods The beginning...Ch. 6 - Pappas Appliances uses the periodic inventory...Ch. 6 - Lower-of-cost-or-market inventory Data on the...Ch. 6 - Retail method; gross profit method Selected data...Ch. 6 - Amazon.com, Inc. (AMZN) is one of the largest...Ch. 6 - Darden Restaurants, Inc. (DRI) is the largest...Ch. 6 - The general merchandise retail industry has a...Ch. 6 - Monster Beverage Corporation (MNST) develops,...Ch. 6 - Ethics in Action Sizemo Elektroniks sells...Ch. 6 - Anstead Co. is experiencing a decrease in sales...Ch. 6 - Communication Golden Eagle Company began...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardWhich of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardWhat type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenueneed helparrow_forwardno ai What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forward

- Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forwardHelp Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License