Connect 1 Semester Access Card for Fundamentals of Financial Accounting

5th Edition

ISBN: 9781259128547

Author: Fred Phillips Associate Professor, Robert Libby, Patricia Libby

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 6.5SDC

Evaluating the Results of Merchandising Operations

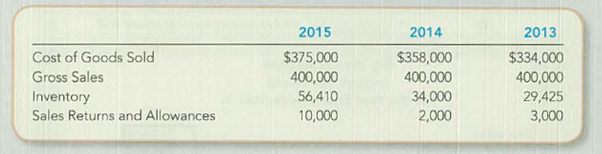

Merchandise Mavens Corporation sells goods throughout North America. One of its product lines has recently reported the following information to you at head office. Based on this information, you have become concerned that the company is experiencing difficulties selling the product.

Required:

- 1. Prepare a multistep income statement for internal reporting purposes, stopping at the gross profit subtotal. Use a separate column to report each year’s results, similar to Exhibit 6.9.

- 2. Analyze the information to identify two observations that lead to your concern.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I am looking for help with this general accounting question using proper accounting standards.

I am looking for help with this general accounting question using proper accounting standards.

I need help finding the accurate solution to this general accounting problem with valid methods.

Chapter 6 Solutions

Connect 1 Semester Access Card for Fundamentals of Financial Accounting

Ch. 6 - Prob. 1QCh. 6 - If a Chicago-based company ships goods on...Ch. 6 - Define goods available for sale. How does it...Ch. 6 - Define beginning inventory and ending inventory.Ch. 6 - Describe how transportation costs to obtain...Ch. 6 - What is the main distinction between perpetual and...Ch. 6 - Why is a physical count of inventory necessary in...Ch. 6 - What is the difference between FOB shipping point...Ch. 6 - Describe in words the journal entries that are...Ch. 6 - What is the distinction between Sales Returns and...

Ch. 6 - Prob. 11QCh. 6 - In response to the weak economy, your companys...Ch. 6 - Prob. 13QCh. 6 - Why are contra-revenue accounts used rather than...Ch. 6 - What is gross profit? How is the gross profit...Ch. 6 - Prob. 1MCCh. 6 - Prob. 2MCCh. 6 - Prob. 3MCCh. 6 - Prob. 4MCCh. 6 - Prob. 5MCCh. 6 - Prob. 6MCCh. 6 - Prob. 7MCCh. 6 - Prob. 8MCCh. 6 - Prob. 9MCCh. 6 - Prob. 10MCCh. 6 - Distinguishing among Operating Cycles Identify the...Ch. 6 - Calculating Shrinkage in a Perpetual Inventory...Ch. 6 - Prob. 6.3MECh. 6 - Inferring Purchases Using the Cost of Goods Sold...Ch. 6 - Evaluating Inventory Cost Components Assume...Ch. 6 - Prob. 6.6MECh. 6 - Recording Journal Entries for Purchases and Safes...Ch. 6 - Prob. 6.8MECh. 6 - Recording Journal Entries for Sales and Sales...Ch. 6 - Prob. 6.10MECh. 6 - Prob. 6.11MECh. 6 - Calculating Shrinkage and Gross Profit in a...Ch. 6 - Preparing a Multistep Income Statement Sellall...Ch. 6 - Prob. 6.14MECh. 6 - Computing and Interpreting the Gross Profit...Ch. 6 - Interpreting Changes in Gross Profit Percentage...Ch. 6 - Prob. 6.17MECh. 6 - Understanding Relationships among Gross Profit and...Ch. 6 - Relating Financial Statement Reporting to Type of...Ch. 6 - Prob. 6.2ECh. 6 - Identifying Shrinkage and Other Missing inventory...Ch. 6 - Prob. 6.4ECh. 6 - Prob. 6.5ECh. 6 - Inferring Missing Amounts Based on Income...Ch. 6 - Prob. 6.7ECh. 6 - Prob. 6.8ECh. 6 - Reporting Purchases, Purchase Discounts, and...Ch. 6 - Prob. 6.10ECh. 6 - Items Included in Inventory PC Mall, Inc., is a...Ch. 6 - Prob. 6.12ECh. 6 - Prob. 6.13ECh. 6 - Reporting Net Sales with Credit Sales and Sales...Ch. 6 - Prob. 6.15ECh. 6 - Prob. 6.16ECh. 6 - Prob. 6.17ECh. 6 - Determining the Effects of Credit Sales, Sales...Ch. 6 - Prob. 6.19ECh. 6 - Inferring Missing Amounts Based on Income...Ch. 6 - Prob. 6.21ECh. 6 - Prob. 6.22ECh. 6 - (Supplement 6A) Recording Purchases and Sales...Ch. 6 - Prob. 6.1CPCh. 6 - Prob. 6.2CPCh. 6 - Prob. 6.3CPCh. 6 - Prob. 6.4CPCh. 6 - (Supplement A) Recording Inventory Transactions...Ch. 6 - Prob. 6.1PACh. 6 - Reporting Purchase Transactions between Wholesale...Ch. 6 - Recording Sales with Discounts and Returns and...Ch. 6 - Prob. 6.4PACh. 6 - (Supplement A) Recording Inventory Transactions...Ch. 6 - Prob. 6.1PBCh. 6 - Reporting Purchase Transactions between Wholesale...Ch. 6 - Prob. 6.3PBCh. 6 - Prob. 6.4PBCh. 6 - (Supplement A) Recording Inventory Transactions...Ch. 6 - Accounting for Inventory Orders, Purchases, Sales,...Ch. 6 - Prob. 6.1SDCCh. 6 - Prob. 6.2SDCCh. 6 - Internet-Based Team Research: Examining an Annual...Ch. 6 - Evaluating the Results of Merchandising Operations...Ch. 6 - Prob. 6.6SDCCh. 6 - Prob. 6.1CC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- I am looking for help with this general accounting question using proper accounting standards.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardChapter Six Mini Practice Set Saved Help 30 1 points eBook Print 이 References ALLOUMILITY WUIN UI LIIS CUSUTY SERVICES FOR MEN January 2002. Assume that you are the chief accountant for Eli's Consulting Services. During January, the business will use the same types of records and procedures that you learned about in Chapters 1 through 6. The chart of accounts for Eli's Consulting Services has been expanded to include a few new accounts. Follow the instructions on the Requirements tab to complete the accounting records for the month of January. DATE TRANSACTIONS January 2 Purchased supplies for $14,000; issued Check 1015. January 2 Purchased a one-year insurance policy for $16,800. January 7 Sold services for $30,000 in cash and $20,000 on credit during the first week of January. January 12 Collected a total of $8,000 on account from credit customers during the first week of January. January 12 Issued Check 1017 for $7,200 to pay for special promotional advertising to new businesses on…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License