Managerial Accounting (5th Edition)

5th Edition

ISBN: 9780134067254

Author: Braun

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 6.52BE

Using regression analysis output to predict

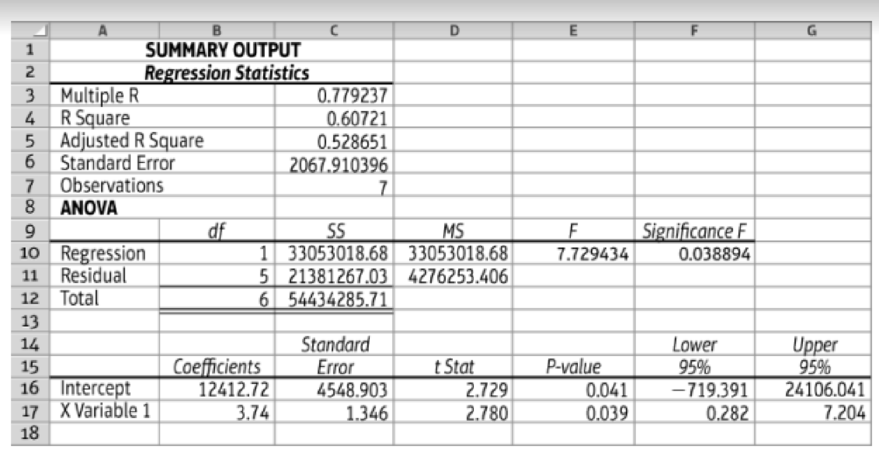

Using the data provided in E6-50B, the laboratory manager performed a regression analysis to predict total laboratory overhead costs. The output generated by Excel is as follows:

Requirements

- 1. Determine the lab’s cost equation (use the output from the Excel regression).

- 2. Determine the R-square (use the output from the Excel regression).

- 3. Predict the total laboratory overhead for the month if 2,700 tests are performed.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Answer this without using chatgtp or AI

Nicole is a calendar-year taxpayer who accounts for her business using the cash method. On average, Nicole sends out bills for about $12,000 of her services on the first of each month. The bills are due by the end of the month, and typically 70 percent of the bills are paid on time and 98 percent are paid within 60 days.

a. Suppose that Nicole is expecting a 2 percent reduction in her marginal tax rate next year. Ignoring the time value of money, estimate the tax savings for Nicole if she postpones mailing the December bills until January 1 of next year.

General accounting

Chapter 6 Solutions

Managerial Accounting (5th Edition)

Ch. 6 - (Learning Objective 1) A graph of a variable cost...Ch. 6 - (Learning Objective 2) Which of the following is...Ch. 6 - (Learning Objective 2) In the cost equation...Ch. 6 - Prob. 4QCCh. 6 - Prob. 5QCCh. 6 - (Learning Objective 3) Which of the following is...Ch. 6 - Prob. 7QCCh. 6 - (Learning Objective 5) Which of the following is...Ch. 6 - Prob. 9QCCh. 6 - Prob. 10QC

Ch. 6 - Identify cost behavior (Learning Objectives 1 2)...Ch. 6 - Prob. 6.2SECh. 6 - Compute fixed costs per unit (Learning Objective...Ch. 6 - Prob. 6.4SECh. 6 - Predict and graph total mixed costs (Learning...Ch. 6 - Prob. 6.6SECh. 6 - Prepare and analyze a scatterplot (Learning...Ch. 6 - Prob. 6.8SECh. 6 - Use the high-low method (Learning Objective 4)...Ch. 6 - Prob. 6.10SECh. 6 - Prob. 6.11SECh. 6 - Prob. 6.12SECh. 6 - Write a cost equation given regression output...Ch. 6 - Prepare a contribution margin income statement...Ch. 6 - Prepare income statements using variable costing...Ch. 6 - Prepare income statements using variable costing...Ch. 6 - Identify cost behavior graph (Learning Objectives...Ch. 6 - Prob. 6.18SECh. 6 - Prob. 6.19SECh. 6 - Prob. 6.20AECh. 6 - Prepare income statement in two formats (Learning...Ch. 6 - Prob. 6.22AECh. 6 - Prob. 6.23AECh. 6 - Sustainability and cost estimation (Learning...Ch. 6 - Create a scatterplot (Learning Objective 3) Melody...Ch. 6 - Continuation of E6-25A: High-low method (Learning...Ch. 6 - Continuation of E6-25A: Regression analysis...Ch. 6 - Regression analysis using Excel output (Learning...Ch. 6 - Prob. 6.29AECh. 6 - Using the high-low method to predict overhead for...Ch. 6 - Using regression analysis output to predict...Ch. 6 - Performing a regression analysis to predict...Ch. 6 - Prob. 6.33AECh. 6 - Prob. 6.34AECh. 6 - Compare absorption and variable costing (Learning...Ch. 6 - Prepare a contribution margin income statement...Ch. 6 - Prepare a contribution margin income statement...Ch. 6 - Prepare income statements using variable costing...Ch. 6 - Prepare a variable costing income statement given...Ch. 6 - Prob. 6.40AECh. 6 - Prob. 6.41BECh. 6 - Prepare income statement in two formats (Learning...Ch. 6 - Use unit cost data to forecast total costs...Ch. 6 - Prob. 6.44BECh. 6 - Sustainability and cost estimation (Learning...Ch. 6 - Create a scatter plot (Learning Objective 3) Tammy...Ch. 6 - Continuation of E6-46B: High-low method (Learning...Ch. 6 - Prob. 6.48BECh. 6 - Prob. 6.49BECh. 6 - Prob. 6.50BECh. 6 - Using the high-low method to predict overhead for...Ch. 6 - Using regression analysis output to predict...Ch. 6 - Prob. 6.53BECh. 6 - Prob. 6.54BECh. 6 - Prob. 6.55BECh. 6 - Prob. 6.56BECh. 6 - Prob. 6.57BECh. 6 - Prob. 6.58BECh. 6 - Prob. 6.59BECh. 6 - Prepare a variable costing income statement given...Ch. 6 - Prob. 6.61BECh. 6 - Analyze cost behavior at a hospital using various...Ch. 6 - Analyze cost behavior (Learning Objectives 1, 2,...Ch. 6 - Prob. 6.64APCh. 6 - Prob. 6.65APCh. 6 - Prob. 6.66APCh. 6 - Analyze cost behavior at a hospital using various...Ch. 6 - Analyze cost behavior (Learning Objectives 1, 2,...Ch. 6 - Prepare traditional and contribution margin income...Ch. 6 - Prob. 6.70BPCh. 6 - Prob. 6.71BPCh. 6 - Prob. 6.72SCCh. 6 - Cost Behavior in Real Companies Choose a company...Ch. 6 - Ethics of building inventory (Learning Objective...Ch. 6 - Prob. 6.76ACT

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:9781285187273

Author:Camm, Jeff.

Publisher:Cengage Learning,

GE McKinsey Matrix for SBU Strategies; Author: Wolters World;https://www.youtube.com/watch?v=FffD1Ze76JQ;License: Standard Youtube License