Concept explainers

Inventory by three cost flow methods

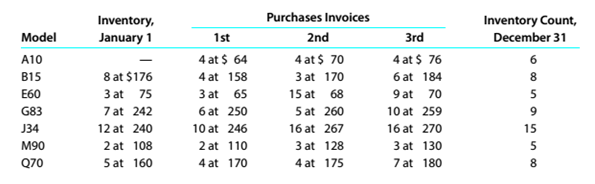

Details regarding the inventory of appliances on January 1, 20Y7, purchases invoices during the year, and the inventory count on December 31. 2O’7. of Amsterdam Appliances are summarized as follows:

Instructions

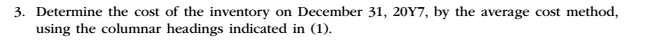

Determine the cost of the inventory on December 31, 20Y7, h the average cost method, using the columnar headings indicated in (1).

Concept Introduction:

Periodic Inventory System:

The periodic inventory system records and updates the inventory at the end of a particular period. The inventory balance is not updated after each transaction and it is updated periodically.

Average method:

Under this method, the cost per unit of the inventory is calculated as weighted average cost per unit and the cost of goods sold and inventory is calculated with the help of weighted average cost per unit.

The Cost of the ending inventory for each Model using Average Cost method

Answer to Problem 6.4.3P

The Cost of the ending inventory for each Model using Average Cost method is as follows:

| Model | Quantity | Unit Cost | Total Cost |

| A10 | 4 | $ 64 | $ 256 |

| 2 | $ 70 | $ 140 | |

| $ 396 | |||

| B15 | 8 | $ 176 | $ 1,408 |

| E60 | 3 | $ 75 | $ 225 |

| 2 | $ 65 | $ 130 | |

| $ 355 | |||

| G83 | 7 | $ 242 | $ 1,694 |

| 2 | $ 250 | $ 500 | |

| $ 2,194 | |||

| J34 | 12 | $ 240 | $ 2,880 |

| 3 | $ 246 | $ 738 | |

| $ 3,618 | |||

| M90 | 20 | $ 108 | $ 2,160 |

| 2 | $ 110 | $ 220 | |

| 1 | $ 128 | $ 128 | |

| $ 2,508 | |||

| Q70 | 5 | $ 160 | $ 800 |

| 3 | $ 170 | $ 510 | |

| $ 1,310 |

Explanation of Solution

The Cost of the ending inventory for each Model using Average Cost method is calculated as follows:

| Model | Quantity | Unit Cost | Total Cost |

| A10 | 4 | $ 64 | $ 256 |

| 2 | $ 70 | $ 140 | |

| $ 396 | |||

| B15 | 8 | $ 176 | $ 1,408 |

| E60 | 3 | $ 75 | $ 225 |

| 2 | $ 65 | $ 130 | |

| $ 355 | |||

| G83 | 7 | $ 242 | $ 1,694 |

| 2 | $ 250 | $ 500 | |

| $ 2,194 | |||

| J34 | 12 | $ 240 | $ 2,880 |

| 3 | $ 246 | $ 738 | |

| $ 3,618 | |||

| M90 | 20 | $ 108 | $ 2,160 |

| 2 | $ 110 | $ 220 | |

| 1 | $ 128 | $ 128 | |

| $ 2,508 | |||

| Q70 | 5 | $ 160 | $ 800 |

| 3 | $ 170 | $ 510 | |

| $ 1,310 |

Want to see more full solutions like this?

Chapter 6 Solutions

Survey of Accounting - With CengageNOW 1Term

- Classify the following account: Prepaid Insurance – Asset, Liability, Equity, Revenue, or Expense? Need helparrow_forwardClassify the following account: Prepaid Insurance – Asset, Liability, Equity, Revenue, or Expense?arrow_forwardJournalize the following transaction: Purchased equipment worth $10,000, paying $4,000 in cash and the balance on credit.arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College