Concept explainers

Inventory by three cost flow methods

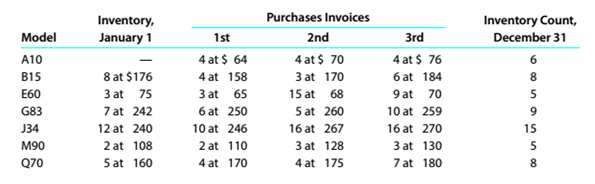

Details regarding the inventory of appliances on January 1, 20Y7, purchases invoices during the year, and the inventory count on December 31. 2O’7. of Amsterdam Appliances are summarized as follows:

Instructions

Determine the Cost of the inventory on December 31, 20Y7, by the last-in. first-out method, following the procedures indicated in (1).

Concept Introduction:

Periodic Inventory System:

The periodic inventory system records and updates the inventory at the end of a particular period. The inventory balance is not updated after each transaction and it is updated periodically.

LIFO method:

LIFO Stands for Last in First Out. Under this method, the latest units purchased are assumed to be sold first and cost of goods sold is calculated accordingly. The ending inventory in the method includes the oldest units purchased.

The Cost of the ending inventory for each Model using LIFO

Answer to Problem 6.4.2P

The Cost of the ending inventory for each Model using LIFO is as follows:

| Model | Quantity | Unit Cost | Total Cost |

| A10 | 4 | $ 64 | $ 256 |

| 2 | $ 70 | $ 140 | |

| $ 396 | |||

| B15 | 8 | $ 176 | $ 1,408 |

| E60 | 3 | $ 75 | $ 225 |

| 2 | $ 65 | $ 130 | |

| $ 355 | |||

| G83 | 7 | $ 242 | $ 1,694 |

| 2 | $ 250 | $ 500 | |

| $ 2,194 | |||

| J34 | 12 | $ 240 | $ 2,880 |

| 3 | $ 246 | $ 738 | |

| $ 3,618 | |||

| M90 | 20 | $ 108 | $ 2,160 |

| 2 | $ 110 | $ 220 | |

| 1 | $ 128 | $ 128 | |

| $ 2,508 | |||

| Q70 | 5 | $ 160 | $ 800 |

| 3 | $ 170 | $ 510 | |

| $ 1,310 |

Explanation of Solution

The Cost of the ending inventory for each Model using FIFO is calculated as follows:

| Model | Quantity | Unit Cost | Total Cost |

| A10 | 4 | $ 64 | $ 256 |

| 2 | $ 70 | $ 140 | |

| $ 396 | |||

| B15 | 8 | $ 176 | $ 1,408 |

| E60 | 3 | $ 75 | $ 225 |

| 2 | $ 65 | $ 130 | |

| $ 355 | |||

| G83 | 7 | $ 242 | $ 1,694 |

| 2 | $ 250 | $ 500 | |

| $ 2,194 | |||

| J34 | 12 | $ 240 | $ 2,880 |

| 3 | $ 246 | $ 738 | |

| $ 3,618 | |||

| M90 | 20 | $ 108 | $ 2,160 |

| 2 | $ 110 | $ 220 | |

| 1 | $ 128 | $ 128 | |

| $ 2,508 | |||

| Q70 | 5 | $ 160 | $ 800 |

| 3 | $ 170 | $ 510 | |

| $ 1,310 |

Want to see more full solutions like this?

Chapter 6 Solutions

Survey of Accounting (Accounting I)

- I am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

- I am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this financial accounting problem with accurate principles.arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,