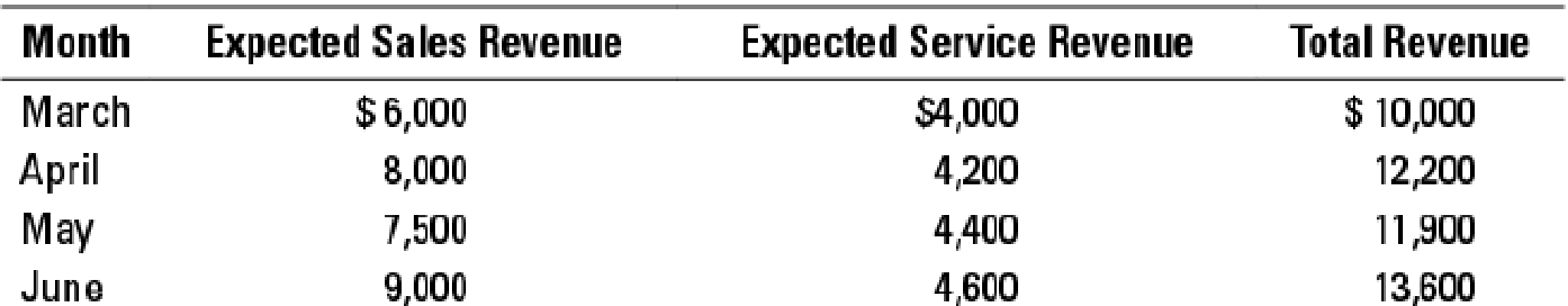

Sales and Service Revenues Budget March–-June 2018

Almost all of the sales revenues of the oxygen equipment are credit card sales; cash sales are negligible. The credit card company deposits 97% of the revenues recorded each day into HealthMart’s account overnight. For the servicing of home oxygen equipment, 60% of oxygen services billed each month is collected in the month of the service, and 40% is collected in the month following the service.

- 1. Calculate the cash that HealthMart expects to collect in April, May, and June 2018 from sales and service revenues. Show calculations for each month.

- 2. HealthMart has budgeted expenditures for May of $11,000 and requires a minimum cash balance of $250 at the end of each month. It has a cash balance on May 1 of $400.

- a. Given your answer to requirement 1, will HealthMart need to borrow cash to cover its payments for May and maintain a minimum cash balance of $250 at the end of May?

- b. Assume (independently for each situation) that (1) May total revenues might be 10% lower or that (2) total costs might be 5% higher. Under each of those two scenarios, show the total net cash for May and the amount HealthMart would have to borrow to cover its cash payments for May and maintain a minimum cash balance of $250 at the end of May. (Again, assume a balance of $400 on May 1.)

- 3. Why do HealthMart’s managers prepare a

cash budget in addition to the revenue, expenses, and operating income budget? Has preparing the cash budget been helpful? Explain briefly.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

- Need answerarrow_forwardDelta Corporation has revenues of $400,000 and deductible expenses of $390,000. It received a $50,000 dividend from Luna Enterprises, in which it holds a 15% stake. What is Delta Corporation's taxable income?arrow_forwardPlease provide correct answer this financial accounting questionarrow_forward

- PROBLEM E Mulles, the owner of a successful fertilizer business, felt that it is time to expand operations. Mulles offered to form a partnership with Lucena, the owner of a nearby warehouse. The partnership would be called Mulles & Lucena Storage and Sales. Lucena accepted Mulles' offer and the partnership was formed on July 1,2024. Presented below is the trial balance for Mulles Fertilizer Supply on June 30, 2024: Cash Accounts Receivable Allowance for Uncollectible Accounts. Inventory Prepaid Rent Store Equipment Accumulated Depreciation Notes Payable Accounts Payable Mulles, Capital Total P 229,500 2,103,000 P 117,000 1,012,500 29,250 390,000 P3,764,250 97,500 330,000 505,500 2,714,250 P3,764,250 The partners agreed to share profits and losses equally and decided to invest an equal amount in the partnership. Lucena and Mulles agreed that Lucena's land is worth P500,000 and his building P1,450,000. Lucena is to contribute cash in an amount sufficient to make his capital account…arrow_forwardPLEASE HELP. ALL RED CELLS ARE INCORRECT. NOTICE, REVENUE ACCOUNTS ARE IN THE DROPDOWN!arrow_forwardJournalize these transactions, also post the transcations to T-accounts and determine month-end balances. Finally prepare a trail balance.arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT