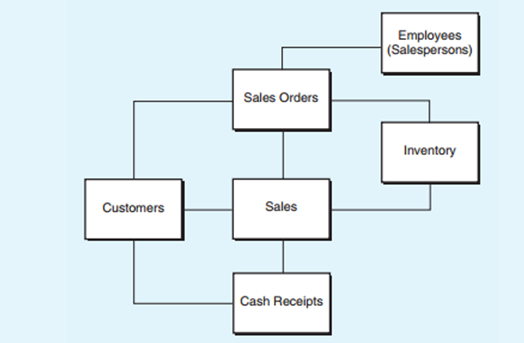

Examine Figure 6.18, which contains the REA model for Hera Industrial Supply (HIS). The model is partially completed; it includes all entities and relationships, but it does not include cardinalities or descriptions of the relationships (which would appear in diamonds on the connecting lines between entities). HIS sells replacement parts for packaging machinery to companies in several states. HIS accepts orders via telephone, fax, and mail. When an order arrives, one of the salespersons enters it as a sales order. The sales order includes the customer’s name and a list of the inventory items that the customer wants to purchase. This inventory list includes the quantity of each inventory item and the price at which HIS is currently selling the item. When the order is ready to ship, WIS completes an invoice and records the sale. Sometimes, inventory items that a customer has ordered are not in stock. In those cases, HIS will ship partial orders. Customers are expected to pay their invoices within 30 days. Most customers do pay on time; however, some customers make partial payments over two or more months. List each entity in the REA model, and identify it as a resource, event, or agent. Using Microsoft Visio, redraw the REA model to include the diamonds for each relationship and include an appropriate description in each diamond.

FIGURE 6.18 Partially Completed REA Model of the Hera Industrial Supply Sales Business

Trending nowThis is a popular solution!

Chapter 6 Solutions

Accounting Information Systems

- What is a blue-chip stock? a) A stock with high volatilityb) A stock of a well-established, financially sound companyc) A newly launched IPO stockd) A stock with high dividends but low growtharrow_forwardNeed help in this question !properly What does “liquidity” refer to in finance? a) The profitability of a companyb) The ease of converting assets into cashc) The stability of incomed) The level of debtarrow_forwardI need help in this question! What does “liquidity” refer to in finance? a) The profitability of a companyb) The ease of converting assets into cashc) The stability of incomed) The level of debtarrow_forward

- Dont use chatgpt and give answer What does “liquidity” refer to in finance? a) The profitability of a companyb) The ease of converting assets into cashc) The stability of incomed) The level of debtarrow_forwardThe opportunity cost of holding cash is inversely related to the level of market interest rates. Question 9 options: True Falsearrow_forwardYour firm deals strictly with four customers. The average amount that each customer pays per month along with the collection delay associated with each payment is shown below. Given this information, what is the amount of the average daily receipts? Assume that every month has 30 days. Customer Item Amount Delay A $8,500 5 days B $12,000 2 days C $16,000 3 days D $3,600 2 days Question 8 options: $8,448 $1,337 $3,342 $1,408 $10,025arrow_forward

- Which of the following is true regarding cash management? Question 7 options: The basic objective in cash management is to keep the investment in cash as low as possible while still operating efficiently and effectively. Effective cash management results in minimization of the total interest earnings involved with holding cash. A cost of holding cash is the liquidity it gives the firm. A firm should decrease its cash holdings as long as the NPV of doing so is negative. A cost of holding cash is the interest income earned on the outstanding cash balance.arrow_forwardLow default risk is a characteristic of money market securities. Question 6 options: True Falsearrow_forwardJeep Corp. held large sums of cash during the mid-1990s primarily because it would need a large amount of cash in the event of a recession. This is a[n] _____ for holding cash. Question 5 options: Adjustment motive. Compensating balances motive. Speculative motive. Transactions motive. Precautionary motive.arrow_forward

- With respect to the workings of a lockbox system, the cheque clearing process begins before the company even knows the payments have been received. Question 4 options: True Falsearrow_forwardYou are considering implementing a lockbox system for your firm. The system is expected to reduce the collection time by 1.5 days. On an average day, your firm receives 250 checks with an average value of $400 each. The daily interest rate on Treasury bills is .02%. What is the anticipated amount of the daily savings if this system is implemented? Question 3 options: $30 $25 $15 $20 $10arrow_forwardDisbursement float is virtually eliminated when payments are made electronically. Question 2 options: True Falsearrow_forward

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE LBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE LBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning