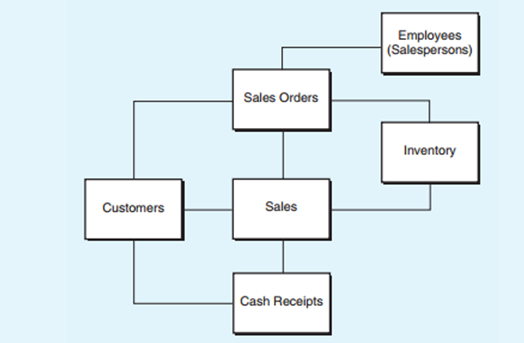

Examine Figure 6.18, which contains the REA model for Hera Industrial Supply (HIS). The model is partially completed; it includes all entities and relationships, but it does not include cardinalities or descriptions of the relationships (which would appear in diamonds on the connecting lines between entities). HIS sells replacement parts for packaging machinery to companies in several states. HIS accepts orders via telephone, fax, and mail. When an order arrives, one of the salespersons enters it as a sales order. The sales order includes the customer’s name and a list of the inventory items that the customer wants to purchase. This inventory list includes the quantity of each inventory item and the price at which HIS is currently selling the item. When the order is ready to ship, WIS completes an invoice and records the sale. Sometimes, inventory items that a customer has ordered are not in stock. In those cases, HIS will ship partial orders. Customers are expected to pay their invoices within 30 days. Most customers do pay on time; however, some customers make partial payments over two or more months. List each entity in the REA model, and identify it as a resource, event, or agent. Using Microsoft Visio, redraw the REA model to include the diamonds for each relationship and include an appropriate description in each diamond.

FIGURE 6.18 Partially Completed REA Model of the Hera Industrial Supply Sales Business

Trending nowThis is a popular solution!

Chapter 6 Solutions

Accounting Information Systems

- The beta of a stock measures: A. Total riskB. Unsystematic riskC. Systematic riskD. Credit riskarrow_forwardGive answer The beta of a stock measures: A. Total riskB. Unsystematic riskC. Systematic riskD. Credit riskarrow_forwardI need help A bond with a face value of $1,000 and a 10% coupon pays: A. $1,000 annuallyB. $10 annuallyC. $100 annuallyD. $110 annuallyarrow_forward

- I want the correct answer with financial accounting questionarrow_forwardAs a finance manager for a major utility company. Thinking about some of the capital budgeting techniques that I might use for some upcoming projects. I need help Discussing at least 2 capital budgeting techniques and how my company can benefit from the use of these tools.arrow_forwardI need assistance with this financial accounting questionarrow_forward

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE LBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE LBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning