FUND OF ACCOUNTING PRIN W/ACC <CUSTOM>

25th Edition

ISBN: 9781264725403

Author: Wild

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 5PSA

Problem 6-5A

Lower of cost or market

P2

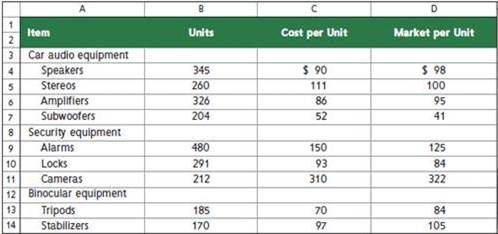

A physical inventory of Liverpool Company taken at December 31 reveals the following.

Required

1. Compute the lower of cost or market for the inventory applied separately to each item.

2. If the market amount is less than the recorded cost of the inventory, then record the LCM adjustment to the Merchandise Inventory account.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide the correct answer to this general accounting problem using accurate calculations.

Accounting question and right solution

Can you solve this general accounting problem with appropriate steps and explanations?

Chapter 6 Solutions

FUND OF ACCOUNTING PRIN W/ACC <CUSTOM>

Ch. 6 - Inventory ownership Homestead Crafts, a...Ch. 6 - QS 6-2 Inventory costs C2

A car dealer acquires a...Ch. 6 - Prob. 3QSCh. 6 - Prob. 4QSCh. 6 - Perpetual: Inventory costing with FIFO P1 A...Ch. 6 - Perpetual: Inventory costing with LIFO Refer to...Ch. 6 - Perpetual Inventory costing with weighted average...Ch. 6 - Periodic: Inventory costing with FIFO P3 Refer to...Ch. 6 - Periodic: Inventory costing with LIFO Refer to the...Ch. 6 - Periodic: Inventory costing with weighted average...

Ch. 6 - Perpetual: Assigning costs with FIFO Trey Monson...Ch. 6 - QS6-11

Perpetual Inventory costing with LIFO

Refer...Ch. 6 - QS 6-12

Perpetual: Inventory costing with weighted...Ch. 6 - QS6.13

Perpetual Inventory costing with specific...Ch. 6 - Periodic: Inventory costing with FIFO P3 Refer to...Ch. 6 - Periodic Inventory costing with LIFO P3 Refer to...Ch. 6 - Periodic: Inventory costing with weighted average...Ch. 6 - Periodic: Inventory costing with specific...Ch. 6 - QS 6-18 Contrasting inventory costing methods...Ch. 6 - Inventory errors A2 In taking a physical inventory...Ch. 6 - Prob. 21QSCh. 6 - Prob. 22QSCh. 6 - Prob. 23QSCh. 6 - Prob. 24QSCh. 6 - Prob. 25QSCh. 6 - Prob. 26QSCh. 6 - Exercise 6-1 Inventory ownership C1

1. At...Ch. 6 - Exercise 6-2

Inventory costs

C2

Walberg...Ch. 6 - Exercise 6-3 Perpetual Inventory costing methods...Ch. 6 - Prob. 4ECh. 6 - Prob. 5ECh. 6 - Exercise 6-5A Periodic: Inventory costing P3 Refer...Ch. 6 - Prob. 7ECh. 6 - Exercise 6-7 Perpetual Inventory costing...Ch. 6 - Exercise 6.8 Specific identification Refer to the...Ch. 6 - Prob. 10ECh. 6 - Prob. 11ECh. 6 - Prob. 12ECh. 6 - Prob. 13ECh. 6 - Prob. 14ECh. 6 - Prob. 15ECh. 6 - Prob. 16ECh. 6 - Prob. 17ECh. 6 - Prob. 18ECh. 6 - Prob. 19ECh. 6 - Prob. 20ECh. 6 - Prob. 21ECh. 6 - Problem 6-1A

Perpetual: Alternative cost...Ch. 6 - Prob. 2PSACh. 6 - Prob. 3PSACh. 6 - Prob. 4PSACh. 6 - Problem 6-5A Lower of cost or market P2 A physical...Ch. 6 - Prob. 6PSACh. 6 - Prob. 7PSACh. 6 - Prob. 8PSACh. 6 - Prob. 9PSACh. 6 - Prob. 10PSACh. 6 - Prob. 1PSBCh. 6 - Prob. 2PSBCh. 6 - Prob. 3PSBCh. 6 - Prob. 4PSBCh. 6 - Prob. 5PSBCh. 6 - Prob. 6PSBCh. 6 - Prob. 7PSBCh. 6 - Prob. 8PSBCh. 6 - Prob. 9PSBCh. 6 - Prob. 10PSBCh. 6 - Prob. 6.1SPCh. 6 - Prob. 6.2SPCh. 6 - AA 6-1 Use Apple's financial statements in...Ch. 6 - AA 6-2 Comparative figures for Apple and Google...Ch. 6 - Prob. 3AACh. 6 - Prob. 1DQCh. 6 - Where is the amount of merchandise inventory...Ch. 6 - If costs are declining, will the LIFO or FIFO...Ch. 6 - Prob. 4DQCh. 6 - Prob. 5DQCh. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - Prob. 8DQCh. 6 - BTN 6-3 Golf Challenge Corp. is a retail sports...Ch. 6 - Prob. 2BTNCh. 6 - Prob. 3BTNCh. 6 - Prob. 4BTNCh. 6 - Prob. 5BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardBella Brands operates with two divisions, Aftershave and Deodorant. The Aftershave Division produces a chemical that the Deodorant Division also uses. The Aftershave Division also sells this chemical to other firms for $10 per ounce. The cost information for the Aftershave Division is as follows: Variable costs per ounce $ 6.00 Fixed costs per ounce $ 15.00 Monthly production capacity 30,000 ounces If the Aftershave Division is not operating at full capacity and is able to supply the Deodorant Division with its needs for the chemical, what is the minimum transfer price that the Aftershave Division will accept? Multiple Choice None of the choices is correct. $10.00 per ounce $6.00 per ounce $15.00 per ounce $3.00 per ouncearrow_forwardBrar Incorporated supplied the following financial information for analysis: Depreciable assets (purchased at the beginning of year 1) $ 4,500,000 Profits before depreciation (all in cash flows at end of year): Year 1 960,000 Year 2 1,400,000 Year 3 2,100,000 Replacement cost of depreciable assets at end of: Year 1 $ 5,000,000 Year 2 6,200,000 Year 3 7,600,000 The assets are depreciated at a rate of 12% per year and have no salvage value. What is the ROI for year 2 using historical cost, net book value? Multiple Choice 26.60% 24.72% 25.15% 22.64% None of these.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License