Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 5PA

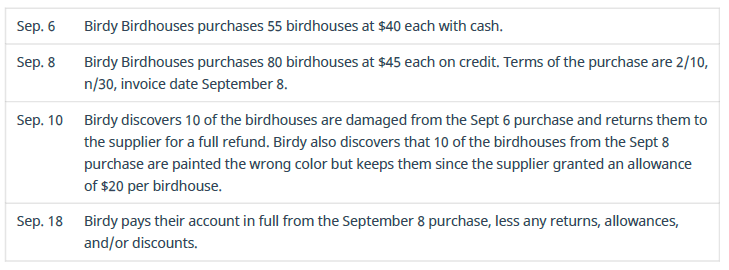

Review the following transactions for Birdy Birdhouses and record any required

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is break-even analysis, and how is it calculated?

subject-general accounting

How do you account for depreciation using the double-declining balance method?

Chapter 6 Solutions

Principles of Accounting Volume 1

Ch. 6 - Which of the following is an example of a contra...Ch. 6 - What accounts are used to recognize a retailers...Ch. 6 - Which of the following numbers represents the...Ch. 6 - If a customer purchases merchandise on credit and...Ch. 6 - Which of the following is a disadvantage of the...Ch. 6 - Which of the following is an advantage of the...Ch. 6 - Which of the following is not a reason for the...Ch. 6 - Which of the following is not included when...Ch. 6 - Which of the following accounts are used when...Ch. 6 - A retailer pays on credit for $650 worth of...

Ch. 6 - A retailer returns $400 worth of inventory to a...Ch. 6 - A retailer obtains a purchase allowance from the...Ch. 6 - Which of the following accounts are used when...Ch. 6 - A customer pays on credit for $1,250 worth of...Ch. 6 - A customer returns $870 worth of merchandise and...Ch. 6 - A customer obtains a purchase allowance from the...Ch. 6 - Which of the following is not a characteristic of...Ch. 6 - Which two accounts are used to recognize shipping...Ch. 6 - Which of the following is not a characteristic of...Ch. 6 - A multi-step income statement ________. A....Ch. 6 - Which of the following accounts would be reported...Ch. 6 - A simple income statement ________. A. combines...Ch. 6 - Which of the following accounts would not be...Ch. 6 - Which of the following accounts are used when...Ch. 6 - A retailer obtains a purchase allowance from the...Ch. 6 - A customer returns $690 worth of merchandise and...Ch. 6 - A customer obtains an allowance from the retailer...Ch. 6 - What are some benefits to a retailer for offering...Ch. 6 - What do credit terms of 4/10, n/30 mean in regard...Ch. 6 - What is the difference between a sales return and...Ch. 6 - If a retailer made a purchase in the amount of...Ch. 6 - What are two advantages and disadvantages of the...Ch. 6 - What are two advantages and disadvantages of the...Ch. 6 - Sunrise Flowers sells flowers to a customer on...Ch. 6 - Sunrise Flowers sells flowers to a customer on...Ch. 6 - Name two situations where cash would be remitted...Ch. 6 - If a retailer purchased inventory in the amount of...Ch. 6 - A retailer discovers that 50% of the total...Ch. 6 - Name two situations where cash would be remitted...Ch. 6 - If a customer purchased merchandise in the amount...Ch. 6 - A customer discovers 60% of the total merchandise...Ch. 6 - What are the main differences between FOB...Ch. 6 - A buyer purchases $250 worth of goods on credit...Ch. 6 - A seller sells $800 worth of goods on credit to a...Ch. 6 - Which statement and where on the statement is...Ch. 6 - The following is select account information for...Ch. 6 - What is the difference between a multi-step and...Ch. 6 - How can an investor or lender use the Gross Profit...Ch. 6 - The following is select account information for...Ch. 6 - If a retailer purchased inventory in the amount of...Ch. 6 - A customer discovers 50% of the total merchandise...Ch. 6 - What is the difference in reporting requirements...Ch. 6 - On March 1, Bates Board Shop sells 300 surfboards...Ch. 6 - Marx Corp. purchases 135 fax machines on credit...Ch. 6 - Match each of the following terms with the best...Ch. 6 - The following is selected information from Mars...Ch. 6 - On April 5, a customer returns 20 bicycles with a...Ch. 6 - Record journal entries for the following purchase...Ch. 6 - Record journal entries for the following purchase...Ch. 6 - Record the journal entry for each of the following...Ch. 6 - Record journal entries for the following sales...Ch. 6 - Record the journal entries for the following sales...Ch. 6 - Record the journal entry or entries for each of...Ch. 6 - Review the following situations and record any...Ch. 6 - Review the following situations and record any...Ch. 6 - Review the following situations and record any...Ch. 6 - The following select account data is taken from...Ch. 6 - Record journal entries for the following purchase...Ch. 6 - Record journal entries for the following purchase...Ch. 6 - Record the journal entries for the following sales...Ch. 6 - Record the journal entry or entries for each of...Ch. 6 - On June 1, Lupita Candy Supplies sells 1,250 candy...Ch. 6 - Ariel Enterprises purchases 32 cellular telephones...Ch. 6 - For each of the following statements, fill in the...Ch. 6 - The following is selected information from Orange...Ch. 6 - On April 20, Barrio Bikes purchased 30 bicycles at...Ch. 6 - Blue Barns purchased 888 gallons of paint at $19...Ch. 6 - Canary Lawnmowers purchased 300 lawnmower parts at...Ch. 6 - Record journal entries for the following purchase...Ch. 6 - Blue Barns sold 136 gallons of paint at $31 per...Ch. 6 - Canary Lawnmowers sold 70 lawnmower parts at $5.00...Ch. 6 - Record journal entries for the following sales...Ch. 6 - Review the following situations and record any...Ch. 6 - Review the following situations and record any...Ch. 6 - Review the following situations and record any...Ch. 6 - The following select account data is taken from...Ch. 6 - Canary Lawnmowers purchased 300 lawnmower parts at...Ch. 6 - Record journal entries for the following purchase...Ch. 6 - Canary Lawnmowers sold 75 lawnmower parts at $5.00...Ch. 6 - Record journal entries for the following sales...Ch. 6 - Record journal entries for the following...Ch. 6 - Record journal entries for the following...Ch. 6 - Costume Warehouse sells costumes and accessories....Ch. 6 - Pharmaceutical Supplies sells medical supplies to...Ch. 6 - Review the following transactions for Birdy...Ch. 6 - Review the following transactions for Dish Mart...Ch. 6 - Review the following sales transactions for Birdy...Ch. 6 - Review the following sales transactions for Dish...Ch. 6 - Record the following purchase transactions of...Ch. 6 - The following is the adjusted trial balance data...Ch. 6 - The following is the adjusted trial balance data...Ch. 6 - Review the following transactions for Birdy...Ch. 6 - Review the following sales transactions for Dish...Ch. 6 - Record journal entries for the following...Ch. 6 - Record journal entries for the following...Ch. 6 - Costume Warehouse sells costumes and accessories...Ch. 6 - Pharmaceutical Supplies sells medical supplies and...Ch. 6 - Review the following transactions for April...Ch. 6 - Review the following transactions for Dish Mart...Ch. 6 - Review the following sales transactions for April...Ch. 6 - Review the following sales transactions for Dish...Ch. 6 - Record the following purchase transactions of...Ch. 6 - Record the following sales transactions of Money...Ch. 6 - Record the following sales transactions of Custom...Ch. 6 - The following is the adjusted trial balance data...Ch. 6 - Following is the adjusted trial balance data for...Ch. 6 - Review the following transactions for April...Ch. 6 - Review the following sales transactions for Dish...Ch. 6 - Conduct research on a real-world retailers trade...Ch. 6 - You have decided to open up a small convenience...Ch. 6 - You own your own outdoor recreation supply store....Ch. 6 - You own a clothing store and use a periodic...

Additional Business Textbook Solutions

Find more solutions based on key concepts

S6-2 Determining inventory costing methods

Ward Hard ware does not expect costs to change dramatically and want...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

(Capital structure theory) Match each of the following definitions to the appropriate terms:

Foundations Of Finance

1. Based on the descriptions and analyses in this chapter, would Boeing be better described as a global firm or...

Operations Management

The put-call parity. Introduction: Option is a contract to purchase a financial asset from one party and sell i...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Small Business Analysis Purpose: To help you understand the importance of cash flows in the operation of a smal...

Financial Accounting, Student Value Edition (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journalize the following transaction: Purchased equipment worth $10,000, paying $4,000 in cash and the balance on credit.arrow_forwardExplain the difference between accrued expense and prepaid expense with examples. No aiarrow_forwardExplain the difference between accrued expense and prepaid expense with examples. Need helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY