Fundamentals Of Financial Accounting

6th Edition

ISBN: 9781260159516

Author: PHILLIPS

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 5PA

Preparing a Multistep Income Statement and Computing the Gross Profit Percentage

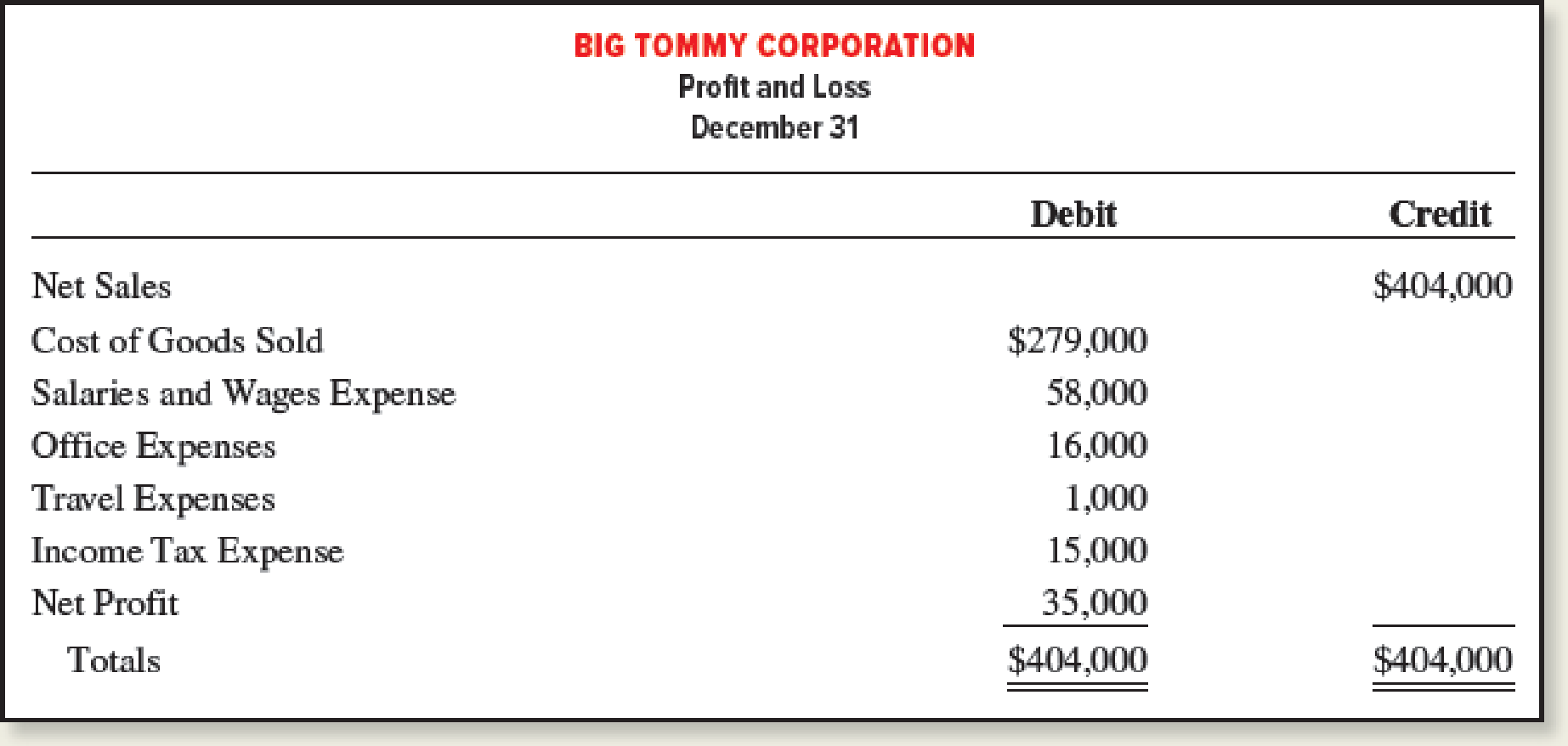

Big Tommy Corporation is a local grocery store organized seven years ago as a corporation. The bookkeeper prepared the following statement at year-end (assume that all amounts are correct, but note the incorrect format):

Required:

- 1. Prepare a properly formatted multistep income statement that would be used for external reporting purposes.

- 2. Compute and interpret the gross profit percentage (using the formula shown in this chapter and rounding to one decimal place).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Assuming no adjusting journal entries are made , net income would equal:

I need help finding the accurate solution to this general accounting problem with valid methods.

Please show me the correct way to solve this financial accounting problem with accurate methods.

Chapter 6 Solutions

Fundamentals Of Financial Accounting

Ch. 6 - Prob. 1QCh. 6 - If a Chicago-based company ships goods on...Ch. 6 - Define goods available for sale. How does it...Ch. 6 - Define beginning inventory and ending inventory.Ch. 6 - Describe how transportation costs to obtain...Ch. 6 - What is the main distinction between perpetual and...Ch. 6 - Why is a physical count of inventory necessary in...Ch. 6 - What is the difference between FOB shipping point...Ch. 6 - Describe in words the journal entries that are...Ch. 6 - What is the distinction between Sales Returns and...

Ch. 6 - Prob. 11QCh. 6 - In response to the weak economy, your companys...Ch. 6 - Prob. 13QCh. 6 - Why are contra-revenue accounts used rather than...Ch. 6 - What is gross profit? How is the gross profit...Ch. 6 - Prob. 1MCCh. 6 - Prob. 2MCCh. 6 - Prob. 3MCCh. 6 - Prob. 4MCCh. 6 - Prob. 5MCCh. 6 - Prob. 6MCCh. 6 - Prob. 7MCCh. 6 - Prob. 8MCCh. 6 - A company bundles a product and service that...Ch. 6 - Prob. 10MCCh. 6 - Distinguishing among Operating Cycles Identify the...Ch. 6 - Calculating Shrinkage in a Perpetual Inventory...Ch. 6 - Accounting for Inventory Transportation Costs XO...Ch. 6 - Prob. 4MECh. 6 - Evaluating Inventory Cost Components Assume...Ch. 6 - Recording Journal Entries for Purchases and Safes...Ch. 6 - Prob. 7MECh. 6 - Prob. 8MECh. 6 - Prob. 9MECh. 6 - Prob. 10MECh. 6 - Calculating Shrinkage and Gross Profit in a...Ch. 6 - Prob. 12MECh. 6 - Preparing a Multistep Income Statement Sellall...Ch. 6 - Computing and Interpreting the Gross Profit...Ch. 6 - Computing and Interpreting the Gross Profit...Ch. 6 - Interpreting Changes in Gross Profit Percentage...Ch. 6 - Determining the Cause of Increasing Gross Profit...Ch. 6 - Understanding Relationships among Gross Profit and...Ch. 6 - Prob. 19MECh. 6 - Recording Journal Entries for Purchase Discounts...Ch. 6 - Recording Journal Entries for Sales and Sales...Ch. 6 - Recording Journal Entries for Sales and Sales...Ch. 6 - Prob. 23MECh. 6 - Prob. 24MECh. 6 - Relating Financial Statement Reporting to Type of...Ch. 6 - Inferring Merchandise Purchases The Gap, Inc., is...Ch. 6 - Identifying Shrinkage and Other Missing inventory...Ch. 6 - Prob. 4ECh. 6 - Prob. 5ECh. 6 - Inferring Missing Amounts Based on Income...Ch. 6 - Reporting Purchases and Purchase Discounts Using a...Ch. 6 - Reporting Purchases, Purchase Discounts, and...Ch. 6 - Items Included in Inventory PCM, Inc., is a direct...Ch. 6 - Prob. 10ECh. 6 - Reporting Net Sales after Sales Discounts The...Ch. 6 - Reporting Net Sales after Sales Discounts and...Ch. 6 - Determining the Effects of Credit Sales, Sales...Ch. 6 - Analyzing and Recording Sales and Gross Profit...Ch. 6 - Prob. 15ECh. 6 - Inferring Missing Amounts Based on Income...Ch. 6 - Analyzing Gross Profit Percentage on the Basis of...Ch. 6 - Analyzing Gross Profit Percentage on the Basis of...Ch. 6 - (Supplement 6A) Recording Journal Entries for...Ch. 6 - (Supplement 6A) Recording Journal Entries for...Ch. 6 - (Supplement 6A) Recording Journal Entries for...Ch. 6 - (Supplement 6A) Recording Journal Entries for...Ch. 6 - Prob. 23ECh. 6 - Prob. 24ECh. 6 - (Supplement 6A) Recording Journal Entries for Net...Ch. 6 - Prob. 26ECh. 6 - Prob. 27ECh. 6 - Prob. 28ECh. 6 - (Supplement 6A) Recording Purchases and Sales...Ch. 6 - Purchase Transactions between Wholesale and Retail...Ch. 6 - Prob. 2CPCh. 6 - Recording Cash Sales, Credit Sales, Sales Returns,...Ch. 6 - Prob. 4CPCh. 6 - Preparing a Multistep Income Statement and...Ch. 6 - (Supplement A) Recording Inventory Transactions...Ch. 6 - Reporting Purchase Transactions between Wholesale...Ch. 6 - Reporting Sales Transactions between Wholesale and...Ch. 6 - Recording Sales with Discounts and Returns and...Ch. 6 - Prob. 4PACh. 6 - Preparing a Multistep Income Statement and...Ch. 6 - (Supplement A) Recording Inventory Transactions...Ch. 6 - Reporting Purchase Transactions between Wholesale...Ch. 6 - Prob. 2PBCh. 6 - Prob. 3PBCh. 6 - Prob. 4PBCh. 6 - Preparing a Multistep Income Statement and...Ch. 6 - (Supplement A) Recording Inventory Transactions...Ch. 6 - Reporting Cash, Inventory Orders, Purchases,...Ch. 6 - Preparing Journal Entries for Inventory Purchases,...Ch. 6 - Finding Financial Information Refer to the...Ch. 6 - Prob. 2SDCCh. 6 - Ethical Decision Making: A Mini-Case Assume you...Ch. 6 - Prob. 5SDCCh. 6 - Preparing Multistep Income Statements and...Ch. 6 - Prob. 1CC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardMona Equipment Inc. had $22.50 million in sales last year. The cost of goods sold was $12.40 million, depreciation expense was $3.60 million, interest payment on outstanding debt was $2.10 million, and the firm's tax rate was 25%. A. What was the firm's net income? B. What was the firm's cash flow?arrow_forward

- Adams Products applies manufacturing overhead to jobs based on direct labor hours used. Overhead costs are expected to total $478,600 for the year, and direct labor usage is estimated at 95,200 hours. For the year, $512,350 of overhead costs are incurred, and 98,900 hours are used. Requirement: Compute the budgeted and actual manufacturing overhead rates for the year. (Round answers to 2 decimal places.)arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardUse the gross profit method to estimate the company's first quarter-ending inventory.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License