Refer to the data in Exercise 6-39. The president of Tiger Furnishings is confused about the differences in costs that result from using direct labor costs and machine-hours.

Required

- a. Explain why the two product costs are different.

- b. How would you respond to the president when asked to recommend one allocation base or the other?

- c. The president says to choose the allocation base that results in the highest income. Is this an appropriate basis for choosing an allocation base?

a.

Explain the difference between the two products costs.

Explanation of Solution

Product cost:

Product cost includes all the costs that are attributed to the production of the product. All the money that has spent on the process of production or purchase of the product is known as product cost.

Product cost per unit:

The product cost per unit is determined by dividing the total of variable and fixed cost with the total number of units.

Predetermined overhead rate:

The predetermined overhead rate is the rate computed for applying manufacturing overheads to the work-in-process inventory. This rate can be computed by dividing the total amount of manufacturing overheads by the base of allocation.

Difference between the two products costs:

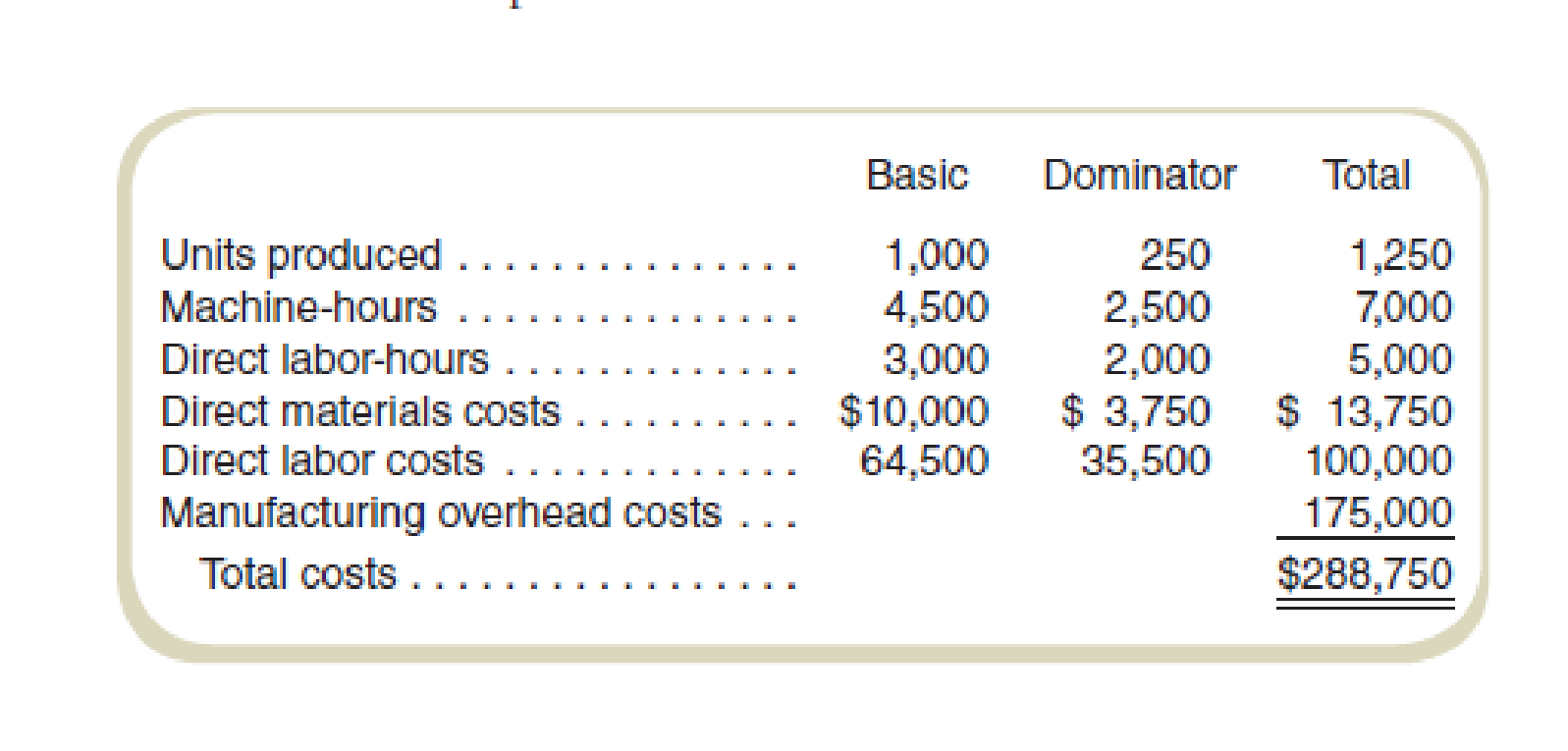

While using direct-labor costs the allocation of overheads is as follows:

For Product B: $112,875 (2)

For Product D: $62,125 (3)

And,

While using Machine-hours the allocation of overheads is as follows:

For Product B: $112,500 (5)

For Product D: $62,500 (6)

This shows the difference between the two methods of allocation is either increase or decrease of $375. This difference exists due to the different bases used for the calculation of predetermined rates. If the direct-labor costs are used then the resulting predetermined rate is $1.75 or 175% approximately. The process is oriented in terms of the base of direct-labor costs.

But, when machine-hours are used for the allocation of overheads with respect to the predetermined rate the resulting $25 will be giving a different result. The base for Compute both the predetermined rates is different.

The sum of allocation would be $175,000 for either method used for Compute cost allocation. But the allocations to both the products using the different methods would be different. The reason for this is that when direct-labor costs are used as a base the result is computed using direct-labor costs. But, when machine-hours are used as a base the computed result would be with respect to the machine-hours.

Thus, the allocation of overheads differs due to a different base of allocation used.

Working note 1:

Compute the predetermined overhead rate using direct labor costs as the base for allocation:

Working note 2:

Allocation of predetermined overhead costs using direct labor costs as the base for allocation:

For Basic:

For Dominator:

Working note 3:

The predetermined overhead rate while using machine-hours for cost allocation:

Working note 4:

Allocation of predetermined overhead costs using machine-hours as the base for allocation:

For Basic:

For Dominator:

b.

Describe the points to be taken into consideration when recommending one allocation base or the other.

Explanation of Solution

The points to be taken into consideration when recommending one allocation base or the other:

1) The method of production that is being used by the company in accordance with the operations and the availability of the resources.

2) The pooling of cost should be done but should correspond to the process of allocation that represents an accurate picture.

3) Either of the cost systems can be used as they both represent an accurate picture. But, if the product is labor intensive then the use of labor-hours cost is recommended. It would present facts clearly.

Hence, the recommendations to use any base for allocation should be in accordance with the production process. The company can use two-stage allocation for allocation of overheads.

c.

Comment on whether using the allocation base that results in the highest income is appropriate or not.

Explanation of Solution

It is not appropriate to choose the highest income generating base for the allocation of cost. The consideration should be to report the data accurately and consistently. While choosing the base to allocate the cost, the cost system should be in accordance with the base that is being used by the process and not the base which is generating more income.

Hence, the base that results in highest income should not be used as this is not an appropriate basis for choosing an allocation base.

Want to see more full solutions like this?

Chapter 6 Solutions

FUNDAMENTALS OF...(LL)-W/ACCESS>CUSTOM<

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forwardCan you demonstrate the accurate steps for solving this financial accounting problem with valid procedures?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College