Concept explainers

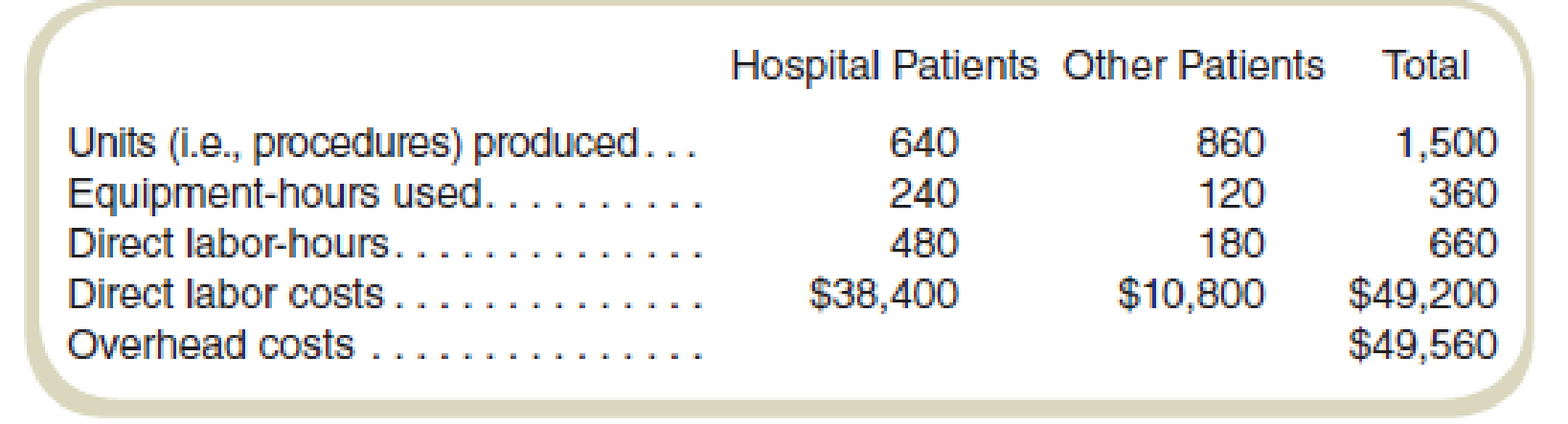

Owl-Eye Radiologists (OR) does various types of diagnostic imaging. Radiologists perform tests using sophisticated equipment. OR’s management wants to compute the costs of performing tests for two different types of patients: those who are hospitalized (including those in emergency rooms) and those who are not hospitalized but are referred by physicians. The data for June for the two categories of patients follow:

The accountant first assigns

Required

- a. Compute the predetermined overhead rates assuming that Owl-Eye Radiologists uses equipment-hours to allocate equipment-related overhead costs and labor-hours to allocate labor-related overhead costs.

- b. Compute the total costs of production and the cost per unit for each of the two types of patients undergoing tests in June.

a.

Calculate the predetermined overhead rates using equipment-hours for the allocation of equipment related overhead costs and labor-hours to allocate labor-related overhead costs.

Answer to Problem 50P

The Cost per unit is $46 for the overhead rates when using equipment-hours for allocation.

The Cost per unit is $50 for the overhead rates when using labor-hours for allocation.

Explanation of Solution

Predetermined overhead rate:

The predetermined overhead rate is the rate computed for applying manufacturing overheads to the work-in-process inventory. This rate can be computed by dividing the total amount of manufacturing overheads by the base of allocation.

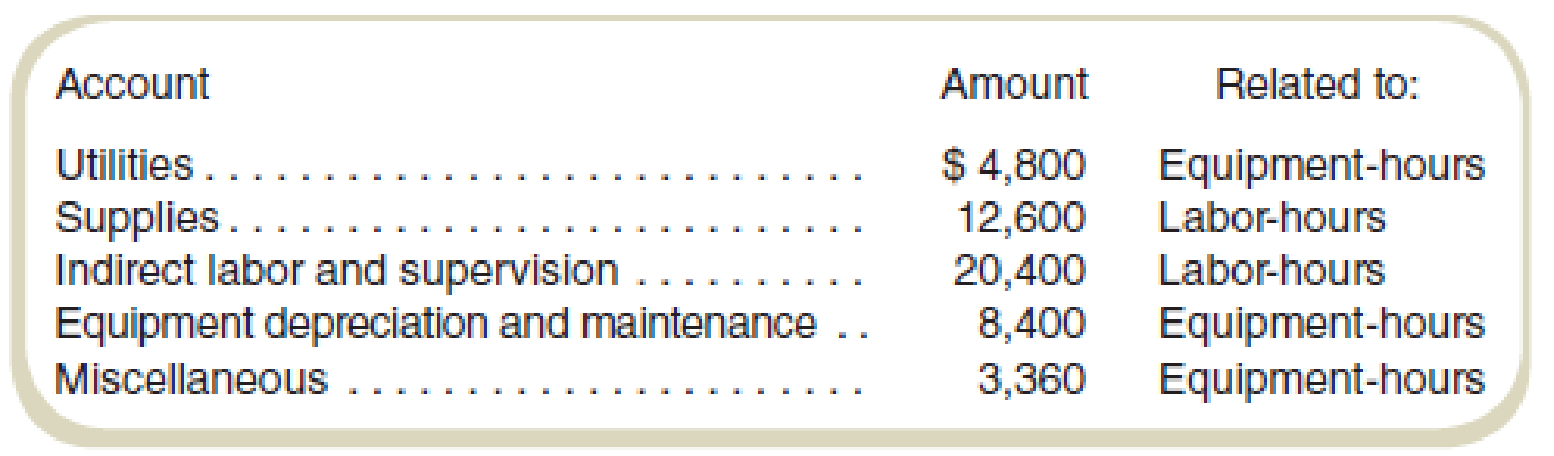

Analysis of overhead accounts by the cost accountant is as follows:

| Account | Amount | Related to: |

| Utilities | $ 4,800 | Equipment hours |

| Supplies | 12,600 | Labor-hours |

| Indirect labor and supervision | 20,400 | Labor-hours |

| Equipment depreciation and maintenance | 8,400 | Equipment hours |

| Miscellaneous | 3,360 | Equipment hours |

Compute equipment-hours related predetermined rate:

Hence, the equipment-hours related predetermined rate is $46.

Compute materials cost related predetermined rate:

Thus, the labor-hours related predetermined rate is $50.

b.

Compute the total costs of production and the cost per unit for each of the two types of patients undergoing tests in June.

Answer to Problem 50P

For hospital patients:

Total cost: $73,440

Cost per unit: $115

For other patients:

Total cost: $25,320

Cost per unit: $29

Explanation of Solution

Product cost:

Product cost includes all the costs that are attributed to the production of the product. All the money that has spent on the process of production or purchase of the product is known as product cost.

Product cost per unit:

The product cost per unit is determined by dividing the total of variable and fixed cost with the total number of units.

Compute the total cost of hospital patients:

Compute total cost of other patients:

Thus, the value of total cost for hospital patients and other patients are $73,440 and $25,320 respectively.

Compute cost per unit for product hospital patients:

Compute cost per unit for the product of other patients:

Working note 1:

Compute equipment hours related cost for hospital patients:

Working note 2:

Compute labor hours related cost for hospital patients:

Working note 3:

Compute equipment hours related cost for other patients:

Working note 4:

Compute labor hours related cost for other patients:

Want to see more full solutions like this?

Chapter 6 Solutions

Fundamentals of Cost Accounting

- Please explain the correct approach for solving this financial accounting question.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forward

- I need assistance with this general accounting question using appropriate principles.arrow_forwardCan you explain this financial accounting question using accurate calculation methods?arrow_forwardCan you help me solve this financial accounting question using valid financial accounting techniques?arrow_forward

- Please provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College