Concept explainers

2.

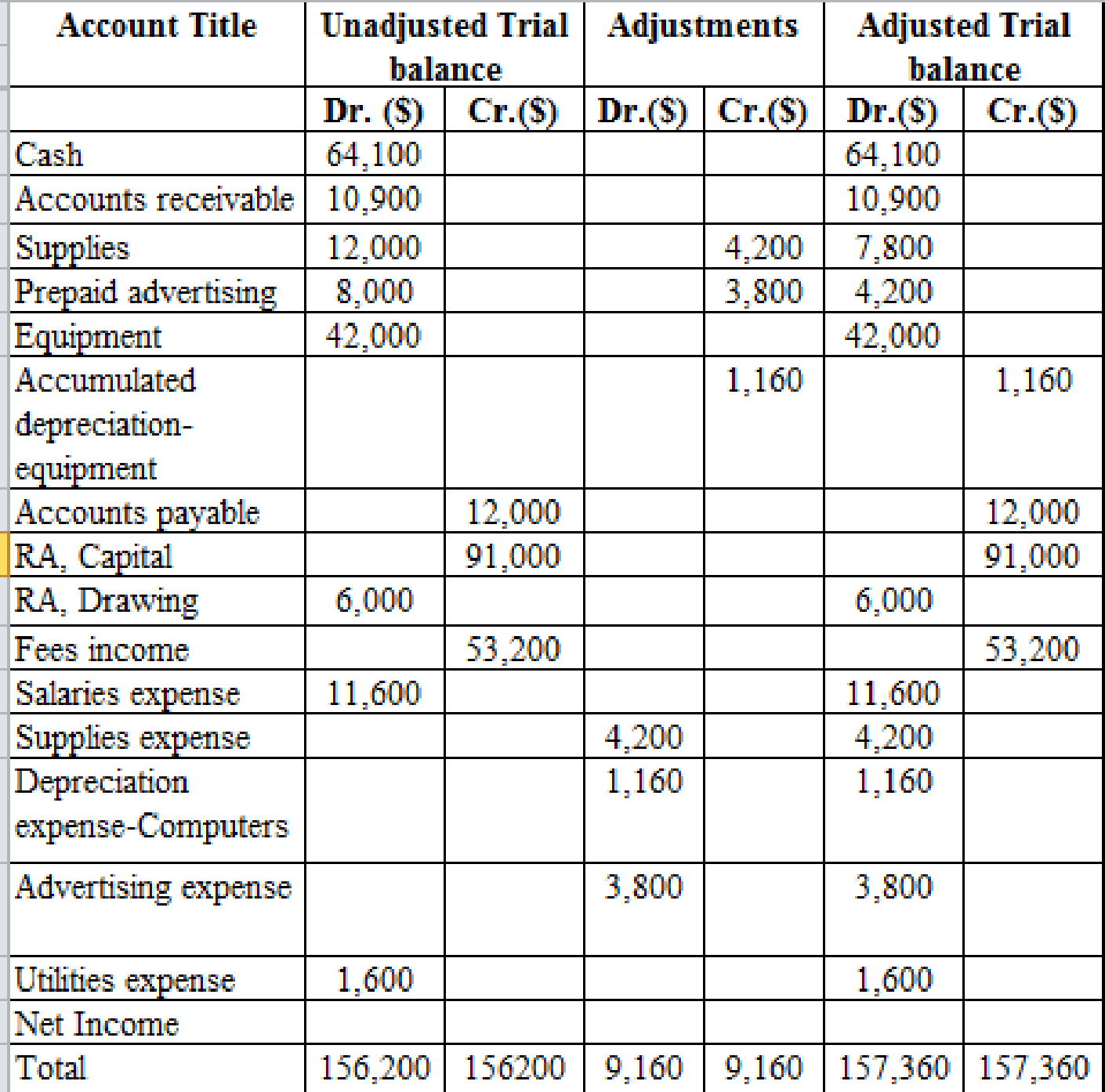

Prepare the worksheet of the Company HPGS.

2.

Explanation of Solution

Worksheet of the Company HPGS is as follows:

Table (1)

3.

Journalize the

3.

Explanation of Solution

Journalizing:

Journalizing refers to that process in which the transactions of an organization are recorded in a sequence. Based on the recorded entries, the accounts are posted to the relevant ledger accounts.

Adjusting entries of Company HPGS are as follows:

Record supplies expense:

| General Journal | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Supplies expense | 4,200 | ||

| Supplies | 4,200 | |||

| (To record supplies used) | ||||

Table (2)

- Supplies expense in an expense account and it is increased by $4,200. Therefore, debit supplies expense account with $4,200.

- Supplies are asset account and it is decreased by $4,200. Therefore, credit supplies account with $4,200.

Record advertising expense:

| General Journal | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Advertising expense | 3,800 | ||

| Prepaid Advertising | 3,800 | |||

| (To record supplies used) | ||||

Table (3)

- Advertising expense is an expense account and it is increased by $3,800. Therefore, debit Advertising expense account with $3,800.

- Prepaid Advertising is asset account and it is decreased by $3,800. Therefore, credit Prepaid Advertising account with $3,800.

Record

| General Journal | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Depreciation expense | 1,160 | ||

| | 1,160 | |||

| (To record depreciation expense) | ||||

Table (4)

- Depreciation expense in an expense account and it is increased by $1,160. Therefore, debit depreciation expense account with $1,160.

- Accumulated depreciation-equipment is an asset account and it is decreased by $1,160. Therefore, credit accumulated depreciation-equipment with $1,160.

4.

Journalize the closing entries.

4.

Explanation of Solution

| General Journal | Page 4 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Fees income | 53,200 | ||

| Income summary | 53,200 | |||

| (To transfer fees income amount) | ||||

Table (5)

- The account of fees income account gets closed by $53,200. Therefore, debit fees income account with $53,200.

- The amount of fees income transferred to income summary, the account of income summary increases by $53,200. Therefore, credit income summary account with $53,200.

| General Journal | Page 4 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Income summary | 22,360 | ||

| Depreciation expense | 1,160 | |||

| Salaries expense | 11,600 | |||

| Advertising expense | 3,800 | |||

| Utilities expense | 1,600 | |||

| Supplies expense | 4,200 | |||

| (To transfer the amount of income summary) | ||||

Table (6)

- The amount of income summary is decreases by $22,360. Therefore, debit the account of income summary with $22,360.

- Depreciation expense is an expense account and it is decreased by $1,160. Therefore, credit depreciation expense with $1,160.

- Salaries expense is an expense account and it is decreased by $11,600. Therefore, credit salaries expense with $11,600.

- Advertising expense is an expense account and it is decreased by $3,800. Therefore, credit advertising expense with $3,800.

- Utilities expense is an expense account and it is decreased by $1,600. Therefore, credit utilities expense account with $1,600.

- Supplies expense is an expense account and it is decreased by $4,200. Therefore, credit the supplies expense account with $4,200.

| General Journal | Page 4 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Income summary | 30,840 | ||

| SJ Capital | 30,840 | |||

| (To transfer the amount of income summary) | ||||

Table (7)

- The amount of income summary is decreases by $30,840. Therefore, debit the account of income summary with $30,840.

- The capital account increases by $30,840. Therefore, credit the SJ capital with $30,840.

| General Journal | Page 4 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | SJ Capital | 6,000 | ||

| SJ Drawings | 6,000 | |||

| (To transfer the amount of capital account) | ||||

Table (8)

- The amount of drawings adjusted from the capital account, the amount of capital account decreases by $6,000. Therefore, debit the account of SJ Capitalwith $6,000.

- The account of drawings increases by $6,000. Therefore, credit the account ofSJ Drawings with $6,000.

1, 3 and 4.

Prepare the ledger accounts to record the balances as of December 31, 2019 and post adjusting and closing entries.

1, 3 and 4.

Explanation of Solution

Prepare the ledger accounts to record the balances as of December 31, 2019 and post adjusting and closing entries.

Supplies account:

| Supplies Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31, 2019 | Balance | 12,000 | 12,000 (debit) | |

| Adjusting | 4,200 | 7,800(debit) | ||

Table (9)

Prepaid Advertising Account:

| Prepaid Advertising Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31, 2019 | Balance | 8,000 | 8,000 (debit) | |

| Adjusting | 3,800 | 4,200 (debit) | ||

Table (10)

Accumulated depreciation account:

| Accumulated Depreciation Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31, 2019 | Adjusting | 1,160 | 1,160 (credit) | |

Table (11)

SJ Capital account:

| SJ Capital Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31, 2019 | Balance | 91,000 (credit) | ||

| Closing | 30,840 | 121,840 (credit) | ||

| Closing | 6,000 | 115,840 (credit) | ||

Table (12)

SJ Drawings account:

| SJ Drawings Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31, 2019 | Balance | 6,000 (debit) | ||

| Closing | 6,000 | - | ||

Table (13)

Income Summary Account:

| Income Summary Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31, 2019 | Closing | 53,200 (credit) | ||

| Closing | 22,360 | 30,840 (credit) | ||

| Closing | 30,840 | - | ||

Table (14)

Fees Income Account:

| Fees Income Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31, 2019 | Balance | 53,200 (credit) | ||

| closing | 53,200 | - | ||

Table (15)

Salaries Expense Account:

| Salaries Expense Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31,2019 | Balance | 11,600 (debit) | ||

| Closing | 11,600 | - | ||

Table (16)

Utilities Expense Account:

| Utilities Expense Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31,2019 | Balance | 1,600 (debit) | ||

| Closing | 1,600 | - | ||

Table (17)

Supplies expense:

| Supplies expense | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31,2019 | Adjusting | 4,200 | 4,200 (debit) | |

| closing | 4,200 | - | ||

Table (18)

Depreciation Expense Account:

| Depreciation Expense Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31,2019 | Adjusting | 1,160 | 1,160 (debit) | |

| Closing | 1,160 | - | ||

Table (19)

Advertising Expense Account:

| Depreciation Expense Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31,2019 | Adjusting | 3,800 | 3,800 (debit) | |

| Closing | 3,800 | - | ||

Table (20)

5.

Prepare a post-closing

5.

Explanation of Solution

Trial balance of Company HPGS is given below:

|

Company HPGS Post- closing Trial Balance December 31, 2019 | ||

| Account Title |

Debit ($) |

Credit ($) |

| Cash | 64,100 | |

| Accounts Receivable | 10,900 | |

| Supplies | 7,800 | |

| Prepaid Advertisement | 4,200 | |

| Equipment | 42,000 | |

| Accumulated Depreciation | 1,160 | |

| Accounts Payable | 12,000 | |

| SJ, Capital | 115,480 | |

| Total | 129,000 | 129,000 |

Table (21)

Want to see more full solutions like this?

Chapter 6 Solutions

COLLEGE ACCOUNTING ETEXT+CONNECT ACCESS

- Lakeshore Technologies requires $900,000 in assets and will be 100% equity financed. If the Earnings Before Interest and Taxes (EBIT) is $72,000 and the tax rate is 30%, what is the Return on Equity (ROE)?arrow_forwardAt Boston Industries, as of September 30, the company has net sales of $750,000 and a cost of goods available for sale of $620,000. Compute the estimated cost of the ending inventory, assuming the gross profit rate is 35%.arrow_forwardI am looking for a step-by-step explanation of this financial accounting problem with correct standards.arrow_forward

- I need help with this problem and accountingarrow_forwardTremont Manufacturing produced 3,500 units of finished goods requiring 15,400 actual hours at $18.75 per hour. The standard is 4.2 hours per unit of finished goods, at a standard rate of $19.00 per hour. Which of the following statements is true? a. The labor efficiency variance is $2,470 unfavorable. b. The total labor variance is $4,850 favorable. c. The labor rate variance is $3,850 favorable. d. The labor rate variance is $2,310 unfavorable. e. The labor efficiency variance is $4,940 favorable.arrow_forwardPlease show me the correct approach to solving this financial accounting question with proper techniques.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning  College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,