Concept explainers

1.

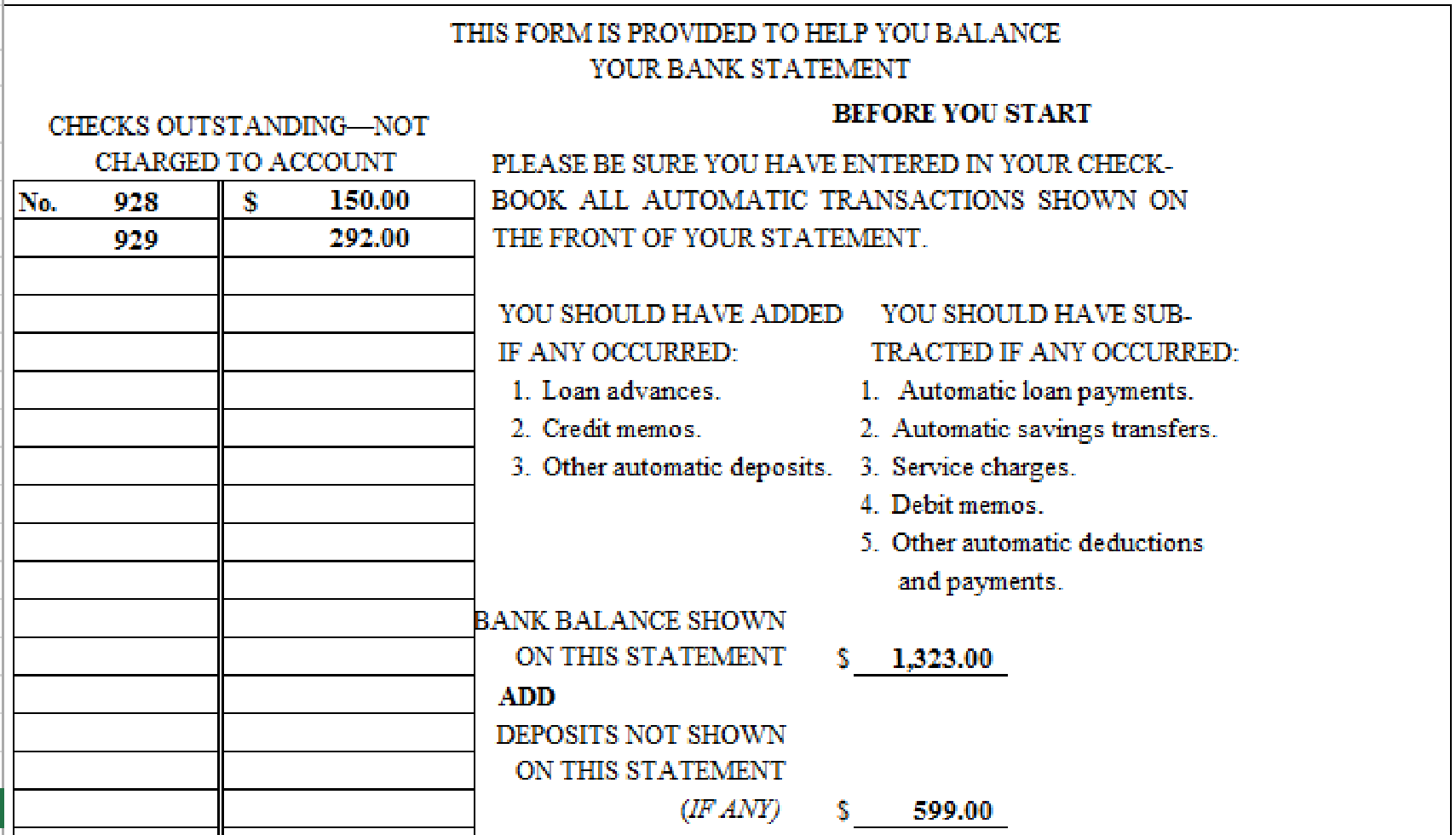

Prepare the bank reconciliation for Company B, as on August 31, 20--.

1.

Explanation of Solution

Bank reconciliation: Bank statement is prepared by bank. The company maintains its own records from its perspective. This is why the cash balance per bank and cash balance per books seldom agree. Bank reconciliation is the statement prepared by company to remove the differences and disagreement between cash balance per bank and cash balance per books.

Prepare the bank reconciliation for Company B, as on August 31, 20--.

| Company B | ||

| Bank Reconciliation | ||

| August 31, 20-- | ||

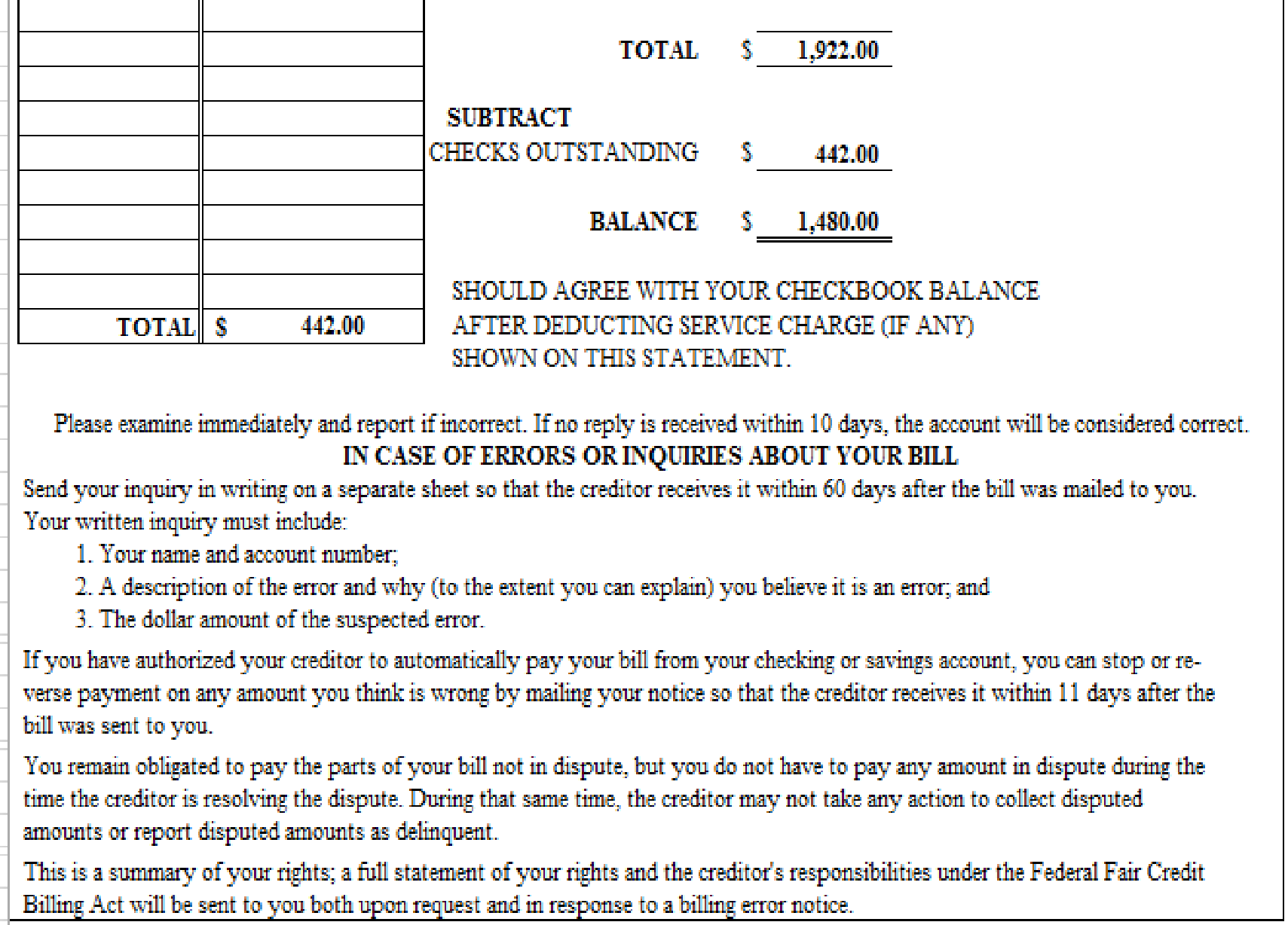

| Bank statement balance | $1,323 | |

| Add: Deposit in transit | 599 | |

| 1,922 | ||

| Deduct: Outstanding checks: | ||

| Number: 928 | $150 | |

| Number: 929 | 292 | 442 |

| Adjusted bank statement balance | $1,480 | |

| Ledger balance of cash | $1,563 | |

| Add: | ||

| Error in recording Check Number: 925 | 27.00 | |

| 1,590 | ||

| Deduct: | ||

| NSF check from customer | $95 | |

| Bank service and collection charges | 15 | 110 |

| Adjusted ledger balance of cash | $1,480 | |

Table (1)

Working Notes:

Calculate book error in recording Check Number: 925.

Description:

- The deposits which are not recorded by the bank are referred to as deposits in transit. Since the deposits in transit are not reflected on the bank statement, the company should add deposits in transit to cash balance per bank, while preparation of

bank reconciliation statement . - Outstanding checks are the checks that are issued by the company, but not yet paid by the bank. When the check is issued for payment, the company deducts the cash balance immediately. But the bank deducts only when the cash is paid for the issued check. So, company deducts the bank statement balance to remove the differences.

- The accountant has recorded the check number: 925 for $47 as $74. So, the ledger cash balance decreased by $27. Therefore, the balance should be added to ledger cash balance.

- While bank reconciliation, the NSF check should be deducted from the cash balance per book. This is because the bank could not collect funds from the customer’s bank due to lack of funds. But being recorded as Accounts Receivable previously, the balance should be deducted from ledger cash balance, to increase the Accounts Receivable account.

- Banks deduct the service charge for the services rendered like lock box rental, or printed checks. But the company is not aware of such deductions. So, company deducts the ledger cash balance while bank reconciliation preparation.

2.

Prepare the

2.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in

stockholders’ equity accounts. - Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare journal entry to record book error amount.

| Date | Accounts and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| August | 31 | Cash | 27 | |||

| Accounts Payable | 27 | |||||

| (Record reduction in over-paid payable) | ||||||

Table (2)

Description:

- Cash is an asset account. When the cash is paid, the Cash account is credited by $74. The account is now debited with $27, to reverse the previously credited effect and reduce the amount of over-paid check to $47.

- Accounts Payable is a liability account. When the accounts payable is paid, the Accounts Payable account is debited by $74. The account is now credited with $27, to reverse the previously debited effect and reduce the amount of over-paid check to $47.

Prepare journal entry to record NSF check.

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| August | 31 | Accounts Receivable | 95 | |||

| Cash | 95 | |||||

| (Record NSF as increase in accounts receivable) | ||||||

Table (3)

Description:

- Accounts Receivable is an asset account. The bank has not collected the amount from the customer due to insufficient funds, which was earlier recorded as a receipt. As the collection could not be made, amount to be received increased. Therefore, increase in asset would be debited.

- Cash is an asset account. The amount is decreased because bank could not collect amount due to insufficient funds in customer’s account, and a decrease in asset is credited.

Prepare journal entry to record bank service charge.

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| August | 31 | Miscellaneous Expense | 15 | |||

| Cash | 15 | |||||

| (Record payment of bank service charges) | ||||||

Table (4)

Description:

- Miscellaneous Expense is an expense account and the amount is increased because bank has charged service charges. Expenses decrease equity account and decrease in equity is debited.

- Cash is an asset account. The amount is decreased because bank service charge is paid, and a decrease in asset is credited.

3.

Prepare the bank form to compute the adjusted bank balance.

3.

Explanation of Solution

Prepare the bank form to compute the adjusted bank balance.

Figure (1)

Want to see more full solutions like this?

Chapter 6 Solutions

College Accounting (Book Only): A Career Approach

- How much overhead is applied to work in process?arrow_forwardThompson & Sons values its goodwill at four years' purchase of the last five years' average profit. The recorded profits for the last five years were R.O 62,000, R.O 45,000, R.O 38,000, R.O 52,000, and R.O 43,000, respectively. Find out the value of goodwill.helparrow_forwardCan you solve this financial accounting problem with appropriate steps and explanations?arrow_forward

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardPlease given correct answer for General accounting question I need step by step explanationarrow_forwardI need help with this financial accounting question using accurate methods and procedures.arrow_forward

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardLawrence Industries plans to produce 30,000 units next period at a denominator activity of 45,000 direct labor hours. The direct labor wage rate is $16.00 per hour. The company's standards allow 2.2 yards of direct materials for each unit of product; the material costs $8.50 per yard. The company's budget includes a variable manufacturing overhead cost of $3.25 per direct labor hour and fixed manufacturing overhead of $270,000 per period. Using 45,000 direct labor hours as the denominator activity, compute the predetermined overhead rate and break it down into variable and fixed elements.arrow_forwardexplain properly all the answer for General accounting question Please given fastarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning