Concept explainers

1.

Calculate the equivalent units of transferred-in, direct materials and conversion using weighted average method.

1.

Explanation of Solution

Equivalents units for production: Equivalents units are a measure of the work done during an accounting period. It includes the beginning and closing inventory of work in process and they also provide information relating to work on units that are completely processed during the period

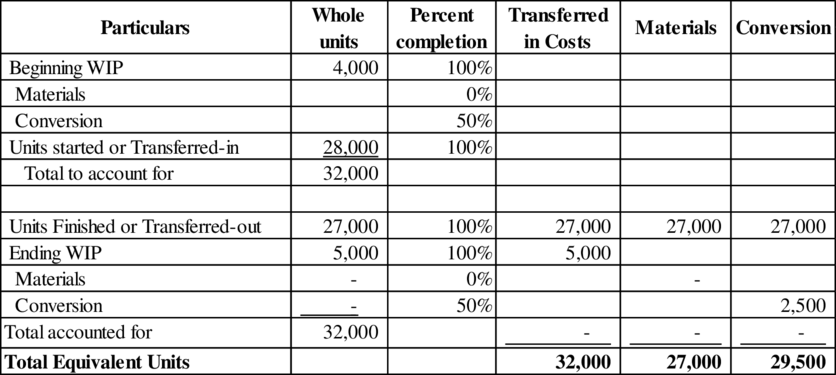

Calculate the equivalent units of transferred-in, direct materials and conversion using weighted average method.

(Table 1)

2.

Compute the unit cost of transferred-in, direct materials and conversion department.

2.

Explanation of Solution

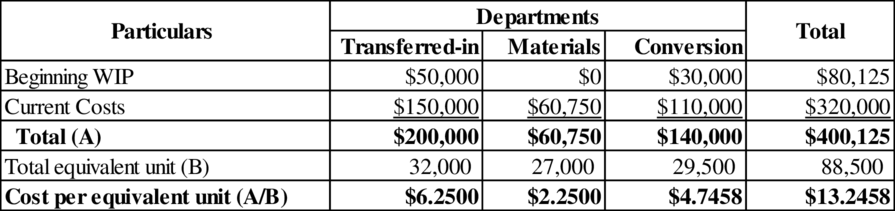

Compute the unit cost of transferred-in, direct materials and conversion department.

(Table 2)

3.

Determine the amount goods completed and transferred out during July.

3.

Explanation of Solution

Compute the amount goods completed and transferred out during July.

Therefore, the amount goods completed and transferred out during July is $357,750.

4.

Calculate the cost of work in process for the month of July.

4.

Explanation of Solution

Calculate the cost of work in process of transferred-in for the month of July.

Calculate the cost of work in process of conversion for the month of July.

Therefore, the cost of work in process for the month July is

5.

Prepare

5.

Explanation of Solution

Prepare journal entry to record the materials.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

|

Work in process inventory | 60,750 | ||

| Materials inventory | 60,750 | ||

| (To record the direct materials) |

(Table 3)

- Work in process inventory is an asset and there is an increase in the value of an asset. Hence, debit the work in process inventory $60,750.

- Materials inventory is an asset and there is a decrease in the value of an asset. Hence, credit the materials inventory by $60,750.

Prepare journal entry to record the labor assuming that labor is 50% of conversion cost.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

|

Work in process inventory (1) | 55,000 | ||

| Accrued payroll | 55,000 | ||

| (To record the direct materials) |

(Table 4)

- Work in process inventory is an asset and there is an increase in the value of an asset. Hence, debit the work in process inventory $55,000

- Accrued payroll is an expense and there is an increase in the value of equity. Hence, credit accrued payroll by $55,000.

Prepare journal entry to record the

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Work in process inventory | 55,000 | ||

| Factory overhead | 55,000 | ||

| (To record |

(Table 5)

- Work in process inventory is an asset and there is an increase in the value of an asset. Hence, debit the work in process inventory account with $55,000.

- Factory overhead (Expense) is a component of

stockholder’s equity and there is a decrease value of expense. Hence, credit the factory overhead account by $55,000.

Prepare journal entry to record the finished product.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Finished goods inventory | 357,750 | ||

| Work in process inventory | 357,750 | ||

| (To transfer cost of jobs completed to finished goods inventory) |

(Table 6)

- Finished goods inventory is an asset and there is an increase in the value of an asset. Hence, debit the finished goods inventory account with $357,750.

- Work in process inventory is an asset and there is a decrease in the value of an asset. Hence, credit the work in process inventory account with $357,750.

Working notes:

Calculate the amount of labor cost.

Want to see more full solutions like this?

Chapter 6 Solutions

Cost Management

- Please help me solve this general accounting question using the right accounting principles.arrow_forwardI want to this question answer for General accounting question not need ai solutionarrow_forwardVincent Company's cost of goods sold is $640,000 variable and $510,000 fixed. The company's selling and administrative expenses are $420,000 variable and $630,000 fixed. If the company's sales is $2,350,000, what is its net income/loss?arrow_forward

- Dakota Manufacturing uses a standard cost system in which manufacturing overhead is applied to units of product on the basis of standard machine hours. During April, the company used a denominator activity of 40,000 machine hours in computing its predetermined overhead rate. However, 52,000 standard machine hours were allowed for the month's actual production. If the fixed manufacturing overhead volume variance for April was $9,000 unfavorable, then the total budgeted fixed manufacturing overhead cost for the month was $_.arrow_forwardWhitney manufacturing produces die-cast metal tsve cars for toy shops.arrow_forwardBentley Industries applies manufacturing overhead on the basis of direct labor hours. At the beginning of the most recent year, the company based its predetermined overhead rate on a total estimated overhead of $127,500 and 5,100 estimated direct labor hours. Actual manufacturing overhead for the year amounted to $131,200 and actual direct labor hours were 4,800. The applied manufacturing overhead for the year was closest to __. Helparrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education