Hepworth Credit Corporation is a wholly owned subsidiary of a large manufacturer of computers. Hepworth is in the business of financing computers, software, and other services that the parent corporation sells. Hepworth has two departments that are involved in financing services: the Credit Department and the Business Practices Department. The Credit Department receives requests for financing from field sales representatives, records customer information on a preprinted form, and then enters the information into the computer system to check the creditworthiness of the customer. (Other actions may be taken if the customer is not in the database.) Once creditworthiness information is known, a printout is produced with this information plus other customer-specific information. The completed form is transferred to the Business Practices Department.

The Business Practices Department modifies the standard loan covenant as needed (in response to customer request or customer risk profile). When this activity is completed, the loan is priced. This is done by keying information from the partially processed form into a personal computer spreadsheet program. The program provides a recommended interest rate for the loan. Finally, a form specifying the loan terms is attached to the transferred-in document. A copy of the loan-term form is sent to the sales representative and serves as the quote letter.

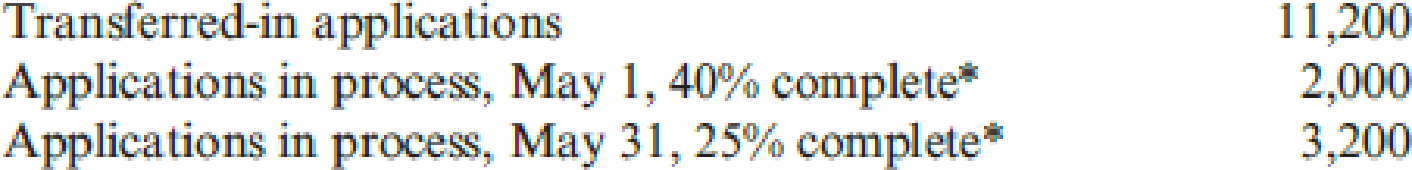

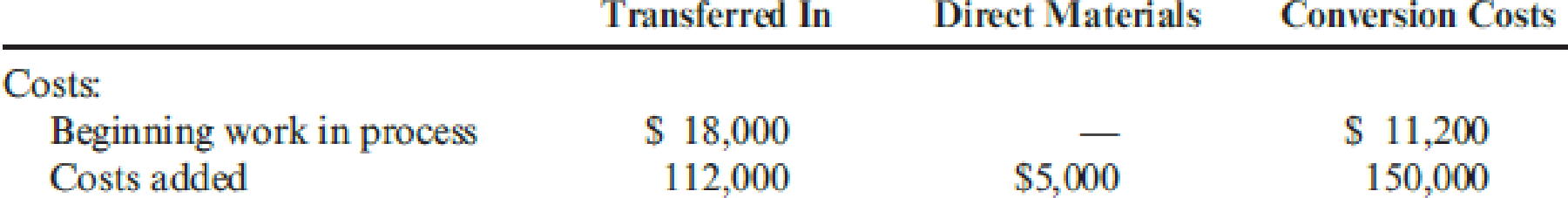

The following cost and service activity data for the Business Practices Department are provided for the month of May:

*All materials and supplies are used at the end of the process

Required:

- 1. How would you define the output of the Business Practices Department?

- 2. Using the FIFO method, prepare the following for the Business Practices Department:

- a. A physical flow schedule

- b. An equivalent units schedule

- c. Calculation of unit costs

- d. Cost of ending work in

process and cost of units transferred out - e. A cost reconciliation

Trending nowThis is a popular solution!

Chapter 6 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

- Please fill all cells! I need helparrow_forwardHilary owns a fruit smoothie shop at the local mall. Each smoothie requires 1/2 pound of mixed berries, which are expected to cost $5.50 per pound during the summer months. Shop employees are paid $7.00 per hour. Variable overhead consists of utilities and supplies, with a variable overhead rate of $0.12 per minute of direct labor time. Each smoothie should require 4 minutes of direct labor time. Determine the following standard costs per smoothie: Direct materials cost Direct labor cost Variable overhead costarrow_forwardgeneral accountingarrow_forward

- The following financial information is provided for Brightstar Corp.: Net Income (2023): $500 million Total Assets on January 1, 2023: $3,500 million Total Assets on December 31, 2023: $4,500 million What is Brightstar Corp. _ s return on assets (ROA) for 2023? A. 11.80% B. 12.50% C. 13.20% D. 14.00%arrow_forwardPLEASE FILL ALL CELLS. ALL RED CELLS ARE INCORRECT OR EMPTY.arrow_forwardAssume Bright Cleaning Service had a net income of $300 for the year. The company's beginning total assets were $4,500, and ending total assets were $4,100. Calculate Bright Cleaning Service's Return on Assets (ROA). A. 6.50% B. 7.25% C. 6.98% D. 5.80%arrow_forward

- what is the investment turnover?arrow_forwardA California-based company had a raw materials inventory of $135,000 on December 31, 2022, and $115,000 on December 31, 2023. During 2023, the company purchased $160,000 worth of raw materials, incurred direct labor costs of $230,000, and manufacturing overhead costs of $340,000. What is the total manufacturing cost incurred by the company? A. $720,000 B. $750,000 C. $705,000 D. $735,000arrow_forwardPLEASE HELP WITH THIS PROBLEM. ALL RED CELLS ARE EMPTY OR INCORRECT.arrow_forward

- Suppose during 2023, BlueStar Shipping reported the following financial information (in millions): Net Sales: $40,000 Net Income: $150 Total Assets at Beginning of Year: $26,000 • Total Assets at End of Year: $24,800 Calculate the following: (a) Asset Turnover (b) Return on Assets (ROA) as a percentagearrow_forwardprovide correct answer accounting questionarrow_forwardKubin Company’s relevant range of production is 11,000 to 14,000 units. When it produces and sells 12,500 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 7.20 Direct labor $ 4.20 Variable manufacturing overhead $ 1.70 Fixed manufacturing overhead $ 5.20 Fixed selling expense $ 3.70 Fixed administrative expense $ 2.70 Sales commissions $ 1.20 Variable administrative expense $ 0.70 Required: For financial accounting purposes, what is the total product cost incurred to make 12,500 units? For financial accounting purposes, what is the total period cost incurred to sell 12,500 units? For financial accounting purposes, what is the total product cost incurred to make 14,000 units? For financial accounting purposes, what is the total period cost incurred to sell 11,000 units?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,