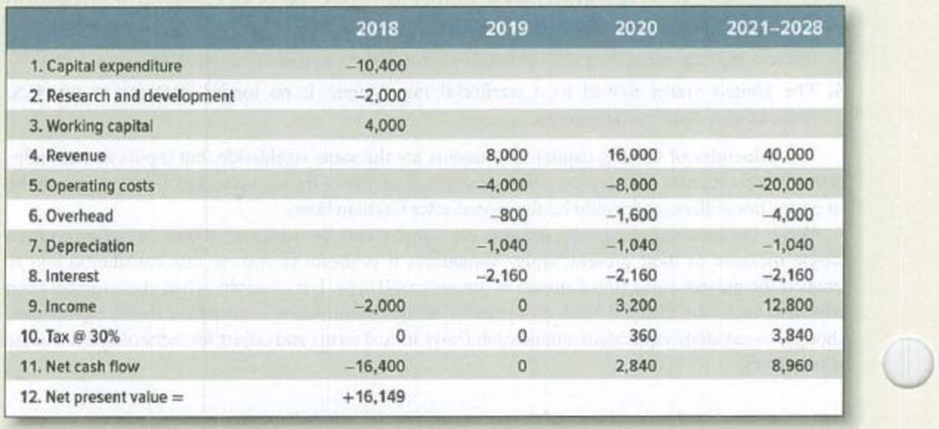

Cash flows Reliable Electric, a major Ruritanian producer of electrical products, is considering a proposal to manufacture a new type of industrial electric motor that would replace most of its existing product line. A research breakthrough has given Reliable a two-year lead on its competitors. The project proposal is summarized in Table 6.4.

- a. Read the notes to the table carefully. Which entries make sense? Which do not? Why or why not?

- b. What additional information would you need to construct a version of Table 6.4 that makes sense?

Construct such a table and recalculate NPV. Make additional assumptions as necessary.

TABLE 6.4 Cash flows and present value of Reliable Electric’s proposed investment ($thousands). See Problem 2.

Notes:

1. Capital expenditure: $8 million for new machinery and $2.4 million for a warehouse extension. The full cost of the extension has been charged to this project, although only about half of the space is currently needed. Since the new machinery will be housed in an existing factory building, no charge has been made for land and building.

2. Research and development: $1.82 million spent in 2017. This figure was corrected for 10% inflation from the time of expenditure to date. Thus 1.82 × 1.1 = $2 million.

3. Working capital: Initial investment in inventories.

4. Revenue: These figures assume sales of 2,000 motors in 2019, 4,000 in 2020, and 10,000 per year from 2021 through 2028. The Initial unit price of $4,000 is

5. Operating costs: These include all direct and indirect costs. Indirect costs (heat, light, power,

6. Overhead: Marketing and administrative costs, assumed equal to 10% of revenue.

7.

8. Interest: Charged on capital expenditure and working capital at Reliable’s current borrowing rate of 15%.

9. Income: Revenue less the sum of research and development, operating costs, overhead, depreciation, and interest.

10. Tax: 30% of income. However, income is negative in 2018. This loss is carried forward and deducted from taxable income in 2020.

11. Net cash flow: Assumed equal to income less tax.

12.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

PRIN.OF CORPORATE FINANCE

- What is the primary purpose of diversification in a portfolio? a) To maximize returnsb) To reduce riskc) To increase leveraged) To focus on a single asset classarrow_forwardI need help! A company’s weighted average cost of capital (WACC) is used to: A) Determine the average cost of producing goods B) Evaluate the return on investment projects C) Estimate the company's growth rate D) Measure the level of debt in the companyarrow_forwardNeed help!! What does the term "liquidity" refer to in finance? A) The ability to convert assets into cash quickly without significant loss of value B) The ability to increase company profits C) The level of debt in the company D) The diversity of the investment portfolioarrow_forward

- I need answer step by step. A company’s weighted average cost of capital (WACC) is used to: A) Determine the average cost of producing goods B) Evaluate the return on investment projects C) Estimate the company's growth rate D) Measure the level of debt in the companyarrow_forwardDon't use ai A company’s weighted average cost of capital (WACC) is used to: A) Determine the average cost of producing goods B) Evaluate the return on investment projects C) Estimate the company's growth rate D) Measure the level of debt in the companyarrow_forwardA company’s weighted average cost of capital (WACC) is used to: A) Determine the average cost of producing goods B) Evaluate the return on investment projects C) Estimate the company's growth rate D) Measure the level of debt in the companyarrow_forward

- I need help! Which of the following best defines "diversification" in investment? A) Investing in a single type of asset for high returns B) Spreading investments across different assets to reduce risk C) Putting all funds into low-risk bonds D) Focusing on high-risk, high-return investmentsarrow_forwardWhich of the following best defines "diversification" in investment? A) Investing in a single type of asset for high returns B) Spreading investments across different assets to reduce risk C) Putting all funds into low-risk bonds D) Focusing on high-risk, high-return investmentsarrow_forwardWhich of the following best describes the "efficient market hypothesis"? A) Stocks are always priced higher than their actual value. B) It is impossible to outperform the market consistently due to all information being already reflected in stock prices. C) Only insider information can help outperform the market. D) The market reacts slowly to new information.arrow_forward

- The "time value of money" concept states that: A) Money today is worth more than the same amount in the future B) Money tomorrow is worth more than today’s money C) Money and time have no relation in financial decisions D) Time has no impact on financial investmentsarrow_forwardI need help. If net income is $25,000 and total equity is $125,000, what is the return on equity (ROE)?A. 10%B. 15%C. 20%D. 25%arrow_forwardI need help!!Which of the following is NOT a type of financial market? A) Capital Market B) Money Market C) Labor Market D) Commodity Marketarrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College