Concept explainers

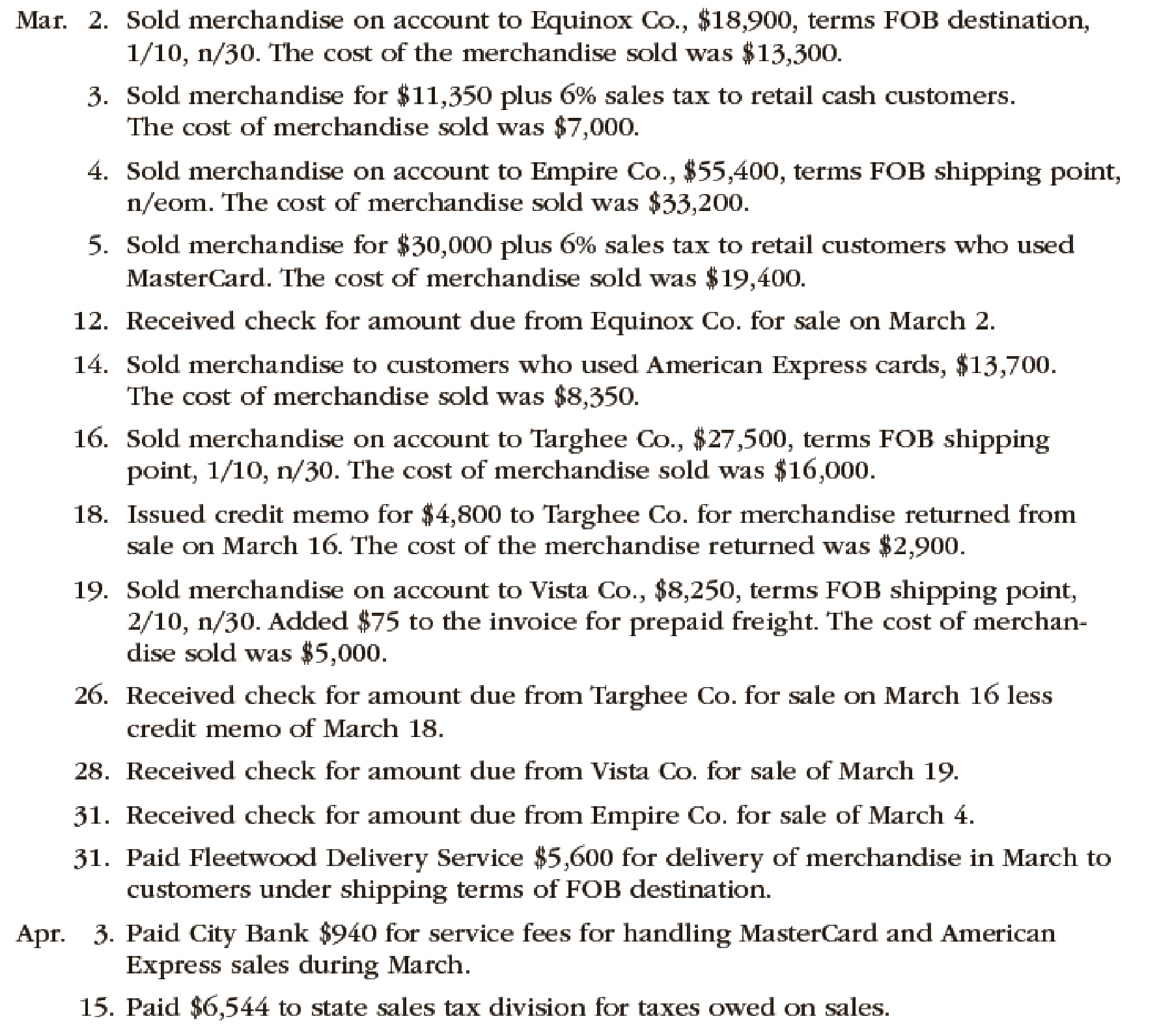

The following selected transactions were completed by Amsterdam Supply Co., which sells office supplies primarily to wholesalers and occasionally to retail customers:

Instructions

Record the sale transactions of the company.

Explanation of Solution

Sales is an activity of selling the merchandise inventory of a business.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 2 | Accounts receivable | 18,711 (1) | |

| Sales Revenue | 18,711 | ||

| (To record the sale of inventory on account) |

Table (1)

- Accounts Receivable is an asset and it is increased by $18,711. Therefore, debit accounts receivable with $18,711.

- Sales revenue is revenue and it increases the value of equity by $18,711. Therefore, credit sales revenue with $18,711.

Working Note (1):

Calculate the amount of accounts receivable.

Sales = $18,900

Discount percentage = 1%

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 2 | Cost of Merchandise Sold | 13,300 | |

| Merchandise Inventory | 13,300 | ||

| (To record the cost of goods sold) |

Table (2)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $13,300. Therefore, debit cost of merchandise sold account with $13,300.

- Merchandise Inventory is an asset and it is decreased by $13,300. Therefore, credit inventory account with $13,300.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 3 | Cash | 12,031 (3) | |

| Sales Revenue | 11,350 | ||

| Sales Tax Payable | 681 (2) | ||

| (To record the sale of inventory for cash) |

Table (3)

- Cash is an asset and it is increased by $12,031. Therefore, debit cash account with $12,031.

- Sales revenue is revenue and it increases the value of equity by $11,350. Therefore, credit sales revenue with $11,350.

- Sales tax payable is a liability and it is increased by $681. Therefore, credit sales tax payable account with $681.

Working Notes(2):

Calculate the amount of sales tax payable.

Sales revenue = $11,350

Sales tax percentage = 6%

Working Notes(3):

Calculate the amount of cash received.

Sales revenue = $11,350

Sales tax payable = $681 (2)

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 3 | Cost of Merchandise Sold | 7,000 | |

| Merchandise Inventory | 7,000 | ||

| (To record the cost of goods sold) |

Table (4)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $7,000. Therefore, debit cost of merchandise sold account with $7,000.

- Merchandise Inventory is an asset and it is decreased by $7,000. Therefore, credit inventory account with $7,000.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 4 | Accounts receivable | 55,400 | |

| Sales Revenue | 55,400 | ||

| (To record the sale of inventory on account) |

Table (5)

- Accounts Receivable is an asset and it is increased by $55,400. Therefore, debit accounts receivable with $55,400.

- Sales revenue is revenue and it increases the value of equity by $55,400. Therefore, credit sales revenue with $55,400.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 4 | Cost of Merchandise Sold | 33,200 | |

| Merchandise Inventory | 33,200 | ||

| (To record the cost of goods sold) |

Table (6)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $33,200. Therefore, debit cost of merchandise sold account with $33,200.

- Merchandise Inventory is an asset and it is decreased by $33,200. Therefore, credit inventory account with $33,200.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 5 | Cash | 31,800 (5) | |

| Sales Revenue | 30,000 | ||

| Sales Tax Payable | 1,800 (4) | ||

| (To record the sale of inventory for cash) |

Table (7)

- Cash is an asset and it is increased by $31,800. Therefore, debit cash account with $31,800.

- Sales revenue is revenue and it increases the value of equity by $30,000. Therefore, credit sales revenue with $30,000.

- Sales tax payable is a liability and it is increased by $1,800. Therefore, credit sales tax payable account with $1,800.

Working Note (4):

Calculate the amount of sales tax payable.

Sales revenue = $30,000

Sales tax percentage = 6%

Working Note (5):

Calculate the amount of cash received.

Sales revenue = $30,000

Sales tax payable = $1,800 (2)

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 5 | Cost of Merchandise Sold | 19,400 | |

| Merchandise Inventory | 19,400 | ||

| (To record the cost of goods sold) |

Table (8)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $19,400. Therefore, debit cost of merchandise sold account with $19,400.

- Merchandise Inventory is an asset and it is decreased by $19,400. Therefore, credit inventory account with $19,400.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 12 | Cash | 18,711 | |

| Accounts Receivable | 18,711 | ||

| (To record the receipt of cash against accounts receivables) |

Table (9)

- Cash is an asset and it is increased by $18,711. Therefore, debit cash account with $18,711.

- Accounts Receivable is an asset and it is increased by $18,711. Therefore, debit accounts receivable with $18,711.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 14 | Cash | 13,700 | |

| Sales Revenue | 13,700 | ||

| (To record the sale of inventory for cash) |

Table (10)

- Cash is an asset and it is increased by $13,700. Therefore, debit cash account with $13,700.

- Sales revenue is revenue and it increases the value of equity by $13,700. Therefore, credit sales revenue with $13,700.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 14 | Cost of Merchandise Sold | 8,350 | |

| Merchandise Inventory | 8,350 | ||

| (To record the cost of goods sold) |

Table (11)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $8,350. Therefore, debit cost of merchandise sold account with $8,350.

- Merchandise Inventory is an asset and it is decreased by $8,350. Therefore, credit inventory account with $8,350.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 16 | Accounts receivable | 27,225 (6) | |

| Sales Revenue | 27,225 | ||

| (To record the sale of inventory on account) |

Table (12)

- Accounts Receivable is an asset and it is increased by $27,225. Therefore, debit accounts receivable with $27,225.

- Sales revenue is revenue and it increases the value of equity by $27,225. Therefore, credit sales revenue with $27,225.

Working Note (6):

Calculate the amount of accounts receivable.

Sales = $27,500

Discount percentage = 1%

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 16 | Cost of Merchandise Sold | 16,000 | |

| Merchandise Inventory | 16,000 | ||

| (To record the cost of goods sold) |

Table (13)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $16,000. Therefore, debit cost of merchandise sold account with $16,000.

- Merchandise Inventory is an asset and it is decreased by $16,000. Therefore, credit inventory account with $16,000.

Record the journal entry for sales return.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 18 | Customer Refunds Payable | 4,752 (7) | ||

| Accounts Receivable | 4,752 | |||

| (To record sales returns) |

Table (14)

- Customer refunds payable is a liability account and it is decreased by $4,752. Therefore, debit customer refunds payable account with $4,752.

- Accounts Receivable is an asset and it is decreased by $4,752. Therefore, credit account receivable with $4,752.

Working Note (7):

Calculate the amount of refund owed to the customer.

Sales return = $4,800

Discount percentage = 1%

Record the journal entry for the return of the merchandise.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 18 | Merchandise Inventory | 2,900 | |

| Estimated Returns Inventory | 2,900 | ||

| (To record the return of the merchandise) |

Table (15)

- Merchandise Inventory is an asset and it is increased by $2,900. Therefore, debit inventory account with $2,900.

- Estimated retunrs inventory is an expense account and it increases the value of equity by $2,900. Therefore, credit estimated returns inventory account with $2,900.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 19 | Accounts receivable | 8,085 (8) | |

| Sales Revenue | 8,085 | ||

| (To record the sale of inventory on account) |

Table (16)

- Accounts Receivable is an asset and it is increased by $8,085. Therefore, debit accounts receivable with $8,085.

- Sales revenue is revenue and it increases the value of equity by $8,085. Therefore, credit sales revenue with $8,085.

Working Note (8):

Calculate the amount of accounts receivable.

Sales = $8,250

Discount percentage = 2%

Record the journal entry.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 19 | Accounts Receivable | 75 | ||

| Cash | 75 | |||

| (To record freight charges paid) |

Table (17)

- Accounts Receivable is an asset and it is increased by $75. Therefore, debit accounts receivable with $75.

- Cash is an asset and it is decreased by $75. Therefore, credit cash account with $75.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 19 | Cost of Merchandise Sold | 5,000 | |

| Merchandise Inventory | 5,000 | ||

| (To record the cost of goods sold) |

Table (18)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $5,000. Therefore, debit cost of merchandise sold account with $5,000.

- Merchandise Inventory is an asset and it is decreased by $5,000. Therefore, credit inventory account with $5,000.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 26 | Cash | 22,473 (9) | |

| Accounts Receivable | 22,473 | ||

| (To record the receipt of cash against accounts receivables) |

Table (19)

- Cash is an asset and it is increased by $22,473. Therefore, debit cash account with $22,473.

- Accounts Receivable is an asset and it is increased by $22,473. Therefore, debit accounts receivable with $22,473.

Working Note (9):

Calculate the amount of cash received.

Net accounts receivable = $22,473

Customer refunds payable = $4,752

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 28 | Cash | 8,160 (10) | |

| Accounts Receivable | 8,160 | ||

| (To record the receipt of cash against accounts receivables) |

Table (20)

- Cash is an asset and it is increased by $8,160. Therefore, debit cash account with $8,160.

- Accounts Receivable is an asset and it is increased by $8,160. Therefore, debit accounts receivable with $8,160.

Working Note (10):

Calculate the amount of cash received.

Net accounts receivable = $8,085

Freight charges = $75

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 31 | Cash | 55,400 | |

| Accounts Receivable | 55,400 | ||

| (To record the receipt of cash against accounts receivables) |

Table (21)

- Cash is an asset and it is increased by $55,400. Therefore, debit cash account with $55,400.

- Accounts Receivable is an asset and it is increased by $55,400. Therefore, debit accounts receivable with $55,400.

Record the journal entry for delivery expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 31 | Delivery expense | 5,600 | |

| Cash | 5,600 | ||

| (To record the payment of delivery expenses) |

Table (22)

- Delivery expense is an expense account and it decreases the value of equity by $5,600. Therefore, debit delivery expense account with $5,600.

- Cash is an asset and it is decreased by $5,600. Therefore, credit cash account with $5,600.

Record the journal entry for credit card expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| April 3 | Credit card expense | 940 | |

| Cash | 940 | ||

| (To record the payment of credit card expenses) |

Table (23)

- Credit card expense is an expense account and it decreases the value of equity by $940. Therefore, debit credit card expense account with $940.

- Cash is an asset and it is decreased by $940. Therefore, credit cash account with $940.

Record the journal entry for credit card expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| April 15 | Sales tax payable | 6,544 | |

| Cash | 6,544 | ||

| (To record the payment of credit card expenses) |

Table (24)

- Sales tax payable is a liability account and it is decreased by $6,544. Therefore, debit customer refunds payable account with $6,544.

- Cash is an asset and it is decreased by $6,544. Therefore, credit cash account with $6,544.

Want to see more full solutions like this?

Chapter 6 Solutions

Financial Accounting

- Please explain the correct approach for solving this financial accounting question.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forward

- I need assistance with this general accounting question using appropriate principles.arrow_forwardCan you explain this financial accounting question using accurate calculation methods?arrow_forwardCan you help me solve this financial accounting question using valid financial accounting techniques?arrow_forward

- Please provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage