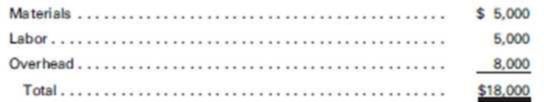

Precision Inc. manufactures wristwatches on an assembly line. The work in process inventory as of March 1 consisted of 1,000 watches that were complete as to materials and 75% complete as to labor and

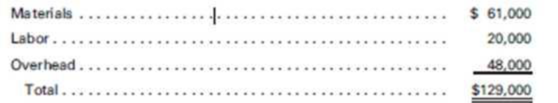

During the month, 10,000 units were started and 9,500 units were completed. The 1,500 units of ending inventory were complete as to materials and 25% complete as to labor and overhead.

The costs for March were as follows:

Calculate:

- a. Equivalent units for material, labor, and overhead, using the weighted average cost method

- b. Unit costs for materials, labor, and overhead

- c. Cost of the units completed and transferred

- d. Detailed cost of the ending inventory

- e. Total of all costs accounted for

Trending nowThis is a popular solution!

Chapter 6 Solutions

Principles of Cost Accounting

Additional Business Textbook Solutions

Principles of Microeconomics (MindTap Course List)

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

- The completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: Using the payroll registers, complete the General Journal entries as follows: February 10 Journalize the employee pay. February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. February 14 Issue the employee pay. February 24 Journalize the employee pay. February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 28 Issue the employee pay. February 28 Issue payment for the payroll liabilities. March 10 Journalize the employee pay. March 10 Journalize the employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.…arrow_forwardPlease given step by step explanation general accounting questionarrow_forwardDon't use ai solution please given answer general accountingarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning