Concept explainers

The Number of Ending Inventory Units.

Explanation of Solution

The ending Inventory units is a difference between units of goods available for sale and units sold and has been computed as under:

| Ending Inventory Units: | |

| | UNITS |

| Units available for sale | 820 |

| Less: Units sold | |

| Mar-9 Sales | 420 |

| Mar-29 Sales | 160 |

| Ending Inventory Units: | 240 |

Requirement 3-a:

First in First Out:

The first in first out method of assigning the cost to goods sold is based on the principle that the goods that are entered first in the store room shall be issued first for sale and hence the cost shall be recorded at its initial prices of goods entered in store room. The periodic Inventory system means the records are maintained only at the end of period.

The Cost assigned to ending Inventory under FIFO.

Explanation of Solution

The FIFO method of period inventory suggests that the goods issued for sale on a particular date shall be assigned cost on the basis of cost of oldest material lies in the store during the end of period.

The Ending Inventory shall be computed as under:

| STATEMENT SHOWING INVENTORY RECORD UNDER PERIODIC FIFO METHOD | |||||||||

| | RECIEPTS | COST OF GOODS SOLD | BALANCE | ||||||

| DATE | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ |

| Balance Oct1 | 100 | 50 | 5000 | 100 | 50 | 5000 | | | |

| Purchase | | | | | | | | | |

| 5-Mar | 400 | 55 | 22000 | 400 | 55 | 22000 | | | |

| 18-Mar | 120 | 60 | 7200 | 80 | 60 | 4800 | 40 | 60 | 2400 |

| 25-Mar | 200 | 62 | 12400 | | | | 200 | 62 | 12400 |

| TOTAL | 820 | | 46600 | 580 | | 31800 | 240 | | 14800 |

Therefore, Ending Inventory is 240 units of $14800.

Requirement 3-b:

Last in First Out:

The Last in first out method of assigning the cost to goods sold is based on the principle that the goods that are entered recently in the store room shall be issued first for sale and hence the cost shall be recorded at its recent prices of goods entered in store room. The periodic Inventory system means the records are maintained at the end of period.

The Cost assigned to ending Inventory under LIFO.

Explanation of Solution

The LIFO method of periodic inventory suggests that the goods issued for sale on a particular date shall be assigned cost on the basis of cost of newest material lies in the store at the end of period.

The Ending Inventory shall be computed as under:

| STATEMENT SHOWING INVENTORY RECORD UNDER PERIODIC LIFO METHOD | |||||||||

| | RECIEPTS | COST OF GOODS SOLD | BALANCE | ||||||

| DATE | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ |

| Balance Oct1 | 100 | 50 | 5000 | | | | 100 | 50 | 5000 |

| Purchase | | | | | | | | | |

| 5-Mar | 400 | 55 | 22000 | 260 | 55 | 14300 | 140 | 55 | 7700 |

| 18-Mar | 120 | 60 | 7200 | 120 | 60 | 7200 | | | |

| 25-Mar | 200 | 62 | 12400 | 200 | 62 | 12400 | | | |

| TOTAL | 820 | | 46600 | 580 | | 33900 | 240 | | 12700 |

Therefore, Ending Inventory is 240 units of $12700.

Requirement 3-c:

Weighted Average:

The Weighted Average method of issuing inventory is based on principle that the goods shall be issued at an average of prices of goods which are lying in the store room at the end of period. The periodic Inventory system means the records are maintained at the end of period.

The Cost assigned to ending Inventory under Weighted average.

Explanation of Solution

The Weighted Average method of periodic inventory suggests that the goods issued for sale on a particular date shall be assigned cost on the basis of average cost of material lies in the store during the period.

The Ending Inventory shall be computed as under:

| STATEMENT SHOWING INVENTORY RECORD UNDER PERIODIC WEIGHTED AVERAGE METHOD | |||||||||

| | RECIEPTS | COST OF GOODS SOLD | BALANCE | ||||||

| DATE | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ |

| Balance Oct1 | 100 | 50 | 5000 | | | | | | |

| Purchase | | | | | | | | | |

| 5-Mar | 400 | 55 | 22000 | | | | | | |

| 18-Mar | 120 | 60 | 7200 | | | | | | |

| 25-Mar | 200 | 62 | 12400 | | | | | | |

| TOTAL | 820 | 56.83 | 46600 | 580 | 56.83 | 32961 | 240 | 56.83 | 13639 |

Therefore, Ending Inventory is 240 units of $13639.

Requirement 3-d:

Specific Identification:

Specific Identification method of assigning the cost to goods sold is based on the principle that the goods that have been issued for sale has been specifically identified to be issued from the particular lot of material. Therefore, the cost of that particular lot shall be assigned on the same. The periodic Inventory system means the records are maintained at the end of period.

The Cost assigned to ending Inventory under Specific Identification.

Explanation of Solution

The Specific Identification method of periodic inventory suggests that the goods issued for sale on a particular date shall be assigned cost on the basis of cost of material specifically identified as issued from the store at the end of period.

The Ending Inventory shall be computed as under:

| STATEMENT SHOWING INVENTORY RECORD UNDER PERIODIC SPECIFIC IDENTIFICATION METHOD | |||||||||

| | RECIEPTS | COST OF GOODS SOLD | BALANCE | ||||||

| DATE | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ |

| Balance Oct1 | 100 | 50 | 5000 | 80 | 50 | 4000 | 20 | 50 | 1000 |

| Purchase | | | | | | | | | |

| 5-Mar | 400 | 55 | 22000 | 340 | 55 | 18700 | 60 | 55 | 3300 |

| 18-Mar | 120 | 60 | 7200 | 40 | 60 | 2400 | 80 | 60 | 4800 |

| 25-Mar | 200 | 62 | 12400 | 120 | 62 | 7440 | 80 | 62 | 4960 |

| TOTAL | 820 | | 46600 | 580 | | 32540 | 2400 | | 14060 |

Therefore, Ending Inventory is 240 units of $14060.

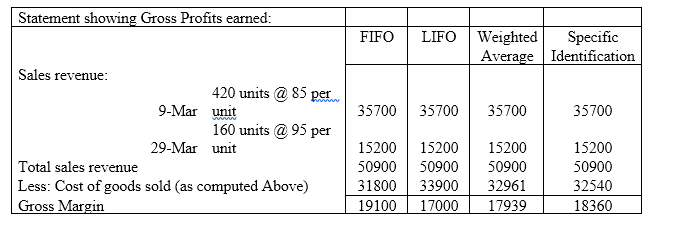

Requirement 4:

Gross Profits:

Gross Profits means excess of sales revenue over the cost of goods sold.

Gross profits earned by the company under various methods.

Explanation of Solution

The Gross profits is computed as a difference between the sales revenue and cost of goods sold as assigned under various methods and has been computed as under:

Want to see more full solutions like this?

Chapter 6 Solutions

Fundamental Accounting Principles

- A firm has a market value equal to its book value. Currently, the firm has excess cash of $1,000, other assets of $5,500, and equity of $6,500. The firm has 650 shares of stock outstanding and a net income of $600. The firm has decided to spend half of its excess cash on a share repurchase program. How many shares of stock will be outstanding after the stock repurchase is completed? a. 625 shares b. 640 shares c. 600 shares d. 630 shares e. 615 sharesarrow_forwardProvide correct answer general accounting questionarrow_forwardanswer plzarrow_forward

- The controller of Afton Manufacturing has collected the following monthly expense data for use in analyzing the cost behavior of maintenance costs: ⚫ January: $2,800 and 3,500 machine hours • February: $3,200 and 4,200 machine hours ⚫ March: $3,800 and 6,000 machine hours ⚫ April: $4,500 and 7,500 machine hours • May: $3,600 and 5,200 machine hours • June: $5,200 and 7,000 machine hours Using the high-low method, determine the estimated fixed cost element and the variable cost per unit of machine hour.arrow_forwardSubject general accountingarrow_forwardFinancial accountingarrow_forward

- Delta Corp. had the following data last year: • Net income = $1,200 • Net operating profit after taxes (NOPAT) = $1,100 • Total assets = $4,500 Total operating capital = $3,500 For the just-completed year, Delta Corp. reported: • Net income = $1,500 • NOPAT = $1,375 • Total assets = $3,800 Total operating capital = $3,900 How much free cash flow (FCF) did Delta generate during the just-completed year?arrow_forwardSlotnick Chemical received $380,000 from customers as deposits on returnable containers during 2024. Fifteen percent of the containers were not returned. The deposits are based on the container cost marked up 25%. How much profit did Slotnick realize on the forfeited deposits? Note: Do not round intermediate calculations. Multiple Choice $11,400 $0 $14,250 $57,000arrow_forwardPlease see an attachment for details financial accounting questionarrow_forward

- manufacturing overhead cost for may?arrow_forwardHarald Dunn and his wife Evadne operate a successful snack packaging business, Healthy Snacks, in St Mary, Jamaica. The bulk buying of the raw materials (nuts, dried fruits, etc), the packaging and delivery to corporate area shops are done by the members of the family. The accounts for Mr. Dunn’s business at 31st December 2014 showed a profit of $4,500,000 after charging: $180,000 depreciation of equipment and office furniture; $750,000 for salary to his wife Evadne who supervises the office, $496,000 to his 18 year old son Shane, and $1,720,000 to himself. $78,000 interest on a loan he had obtained to expand his business 3 years ago (a) Prepare the statement; with notes where applicable; of the Healthy Snacks business showing the taxable profits and income tax liability for the year of assessment 2014 for Harold Dunn. (b) Shane is a part-time student at the University of the West Indies. What is his tax liability, if anyarrow_forwardBranch Company, a building materials supplier, has $17,400,000 of notes payable due April 12, 2025. At December 31, 2024, Branch signed an agreement with First Bank to borrow up to $17,400,000 to refinance the notes on a long-term basis. The agreement specified that borrowings would not exceed 80% of the value of the collateral that Branch provided. At the date of issue of the December 31, 2024, financial statements, the value of Branch's collateral was $19,800,000. On its December 31, 2024, balance sheet, Branch should classify the notes as follows:arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education