To determine:

Project Analysis:

Project analysis means analyzing the various related aspects of the project on the basis of the benchmarks previously decided by the firm and the deviations so located should be worked upon.

Net Present Value:

The net present value is the differential amount between the net

Explanation of Solution

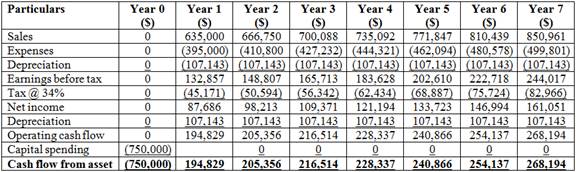

Given,

The cost price of the facility is $750,000.

The estimated life of facility is 7 years.

The estimated revenue at the end of the first year is $635,000.

The current revenues are increased at 5% inflation rate per annum.

The estimated cost at the end of the first year of producing the units is $395,000.

The costs are increased at 4% per annum.

The real discount rate is 7%

The company falls under 34% of tax bracket.

Calculation of net

| Net Present Value | |||

| Particulars | Present Value factor @ 12.35% |

Net Cash Flows ($) |

Present Value ($) |

| Initial investment | 1 | (750,000) | (750,000) |

| Year 1 | 0.89 | 194,829 | 173,398 |

| Year 2 | 0.792 | 205,356 | 162,642 |

| Year 3 | 0.705 | 216,514 | 152,642 |

| Year 4 | 0.628 | 228,337 | 143,396 |

| Year 5 | 0.559 | 240,866 | 134,644 |

| Year 6 | 0.497 | 254,137 | 126,306 |

| Year 7 | 0.443 | 268,194 | 118,810 |

| Net Present Value | 261,838 | ||

Table (1)

Working notes:

Calculation of annual sales revenue for year 2,

Calculation of annual sales revenue for year 3,

Calculation of annual sales revenue for year 4,

Calculation of annual sales revenue for year 5,

Calculation of annual sales revenue for year 6,

Calculation of annual sales revenue for year 7,

Calculation of annual expenses for year 2,

Calculation of annual expenses for year 3,

Calculation of annual expenses for year 4,

Calculation of annual expenses for year 5,

Calculation of annual expenses for year 6,

Calculation of annual expenses for year 7,

Calculation of annual

Calculation of nominal interest rate,

Calculation of annual cash flows,

Thus, the net present value is $261,838.

Want to see more full solutions like this?

Chapter 6 Solutions

EBK CORPORATE FINANCE

- What is the 50/30/20 budgeting rule in finance?arrow_forwardHow do student loans impact long-term financial health?arrow_forwardWith regard to foreign currency translation methods used by foreign MNCs, Multiple Choice a. foreign currency translation methods are generally only used by U.S. based MNCs since foreign firms have a built-in hedge by being foreign. b. are generally the same methods used by U.S.-based firms. c. are exactly the same methods used by U.S.-based firms since GAAP is GAAP. d. none of the options.arrow_forward

- Cray Research sold a supercomputer to the Max Planck Institute in Germany on credit and invoiced €11.60 million payable in six months. Currently, the six-month forward exchange rate is $1.18 per euro and the foreign exchange adviser for Cray Research predicts that the spot rate is likely to be $113 per euro in six months.Required: a. What is the expected gain/loss from a forward hedge?Note: A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Round your final answer in whole dollars not in millions.arrow_forwardWhat is the time value of money and how is it calculated? need answer!arrow_forwardHelp me in this question! What is the time value of money and how is it calculated?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College