Concept explainers

To determine: In this problem, by using the ticker symbol given, the five year data of monthly adjusted stock prices can be downloaded. After that returns can be calculated and returns data of respective company can be plotted on xy scatter plot against the data of S&P. Then by following the steps mentioned in the questions trend line can be made. Slope of the trend line will be beta of the stock.

Explanation of Solution

First we have to down load the data of Eli Lilly (LLY) for the period between Jan 2014 and Nov 2018 (Five years). Then the returns can be calculated by using this formula:

Where LN is natural logarithm

Now this is the calculated data here under for Eli Lily. Similarly S&P Data can be obtained and Returns can be calculated as mentioned above.

| LLY Company | S&P 500 | ||||

| Date | Adj Close | Return LLY | Date | Adj Close | Return S&P |

| 12/1/2013 | null | 0 | 12/1/2013 | null | 0 |

| 1/1/2014 | 46.83643 | 0 | 1/1/2014 | 1782.59 | 0 |

| 2/1/2014 | 51.692627 | 0.0986538 | 2/1/2014 | 1859.45 | 0.04221337 |

| 3/1/2014 | 51.505238 | -0.003632 | 3/1/2014 | 1872.34 | 0.00690825 |

| 4/1/2014 | 51.715252 | 0.0040692 | 4/1/2014 | 1883.95 | 0.00618164 |

| 5/1/2014 | 52.380283 | 0.0127775 | 5/1/2014 | 1923.57 | 0.0208122 |

| 6/1/2014 | 54.853989 | 0.0461447 | 6/1/2014 | 1960.23 | 0.018879 |

| 7/1/2014 | 53.874619 | -0.018015 | 7/1/2014 | 1930.67 | -0.0151947 |

| 8/1/2014 | 56.08041 | 0.0401271 | 8/1/2014 | 2003.37 | 0.03696364 |

| 9/1/2014 | 57.679146 | 0.0281091 | 9/1/2014 | 1972.29 | -0.0156354 |

| 10/1/2014 | 58.995499 | 0.0225655 | 10/1/2014 | 2018.05 | 0.0229364 |

| 11/1/2014 | 60.587559 | 0.0266284 | 11/1/2014 | 2067.56 | 0.02423747 |

| 12/1/2014 | 61.807735 | 0.0199389 | 12/1/2014 | 2058.9 | -0.0041974 |

| 1/1/2015 | 64.504379 | 0.0427046 | 1/1/2015 | 1994.99 | -0.0315328 |

| 2/1/2015 | 62.864899 | -0.025745 | 2/1/2015 | 2104.5 | 0.05343888 |

| 3/1/2015 | 65.551598 | 0.0418496 | 3/1/2015 | 2067.89 | -0.0175492 |

| 4/1/2015 | 64.847809 | -0.010794 | 4/1/2015 | 2085.51 | 0.00848472 |

| 5/1/2015 | 71.190941 | 0.0933225 | 5/1/2015 | 2107.39 | 0.01043673 |

| 6/1/2015 | 75.853432 | 0.0634374 | 6/1/2015 | 2063.11 | -0.0212356 |

| 7/1/2015 | 76.780136 | 0.012143 | 7/1/2015 | 2103.84 | 0.01954968 |

| 8/1/2015 | 74.817703 | -0.025891 | 8/1/2015 | 1972.18 | -0.0646247 |

| 9/1/2015 | 76.492958 | 0.0221442 | 9/1/2015 | 1920.03 | -0.0267987 |

| 10/1/2015 | 74.555267 | -0.025658 | 10/1/2015 | 2079.36 | 0.07971938 |

| 11/1/2015 | 74.984871 | 0.0057457 | 11/1/2015 | 2080.41 | 0.00050474 |

| 12/1/2015 | 77.502235 | 0.0330204 | 12/1/2015 | 2043.94 | -0.0176857 |

| 1/1/2016 | 72.756081 | -0.063194 | 1/1/2016 | 1940.24 | -0.0520676 |

| 2/1/2016 | 66.22551 | -0.094047 | 2/1/2016 | 1932.23 | -0.0041369 |

| 3/1/2016 | 66.695992 | 0.0070791 | 3/1/2016 | 2059.74 | 0.06390499 |

| 4/1/2016 | 69.95623 | 0.0477249 | 4/1/2016 | 2065.3 | 0.00269576 |

| 5/1/2016 | 69.493126 | -0.006642 | 5/1/2016 | 2096.95 | 0.01520837 |

| 6/1/2016 | 73.425682 | 0.0550459 | 6/1/2016 | 2098.86 | 0.00091051 |

| 7/1/2016 | 77.285789 | 0.0512363 | 7/1/2016 | 2173.6 | 0.03499043 |

| 8/1/2016 | 72.493301 | -0.064016 | 8/1/2016 | 2170.95 | -0.00122 |

| 9/1/2016 | 75.310425 | 0.0381244 | 9/1/2016 | 2168.27 | -0.0012352 |

| 10/1/2016 | 69.286331 | -0.083371 | 10/1/2016 | 2126.15 | -0.0196168 |

| 11/1/2016 | 62.980747 | -0.095419 | 11/1/2016 | 2198.81 | 0.03360355 |

| 12/1/2016 | 69.921356 | 0.104542 | 12/1/2016 | 2238.83 | 0.01803711 |

| 1/1/2017 | 73.229668 | 0.0462295 | 1/1/2017 | 2278.87 | 0.01772631 |

| 2/1/2017 | 78.724503 | 0.0723538 | 2/1/2017 | 2363.64 | 0.036523 |

| 3/1/2017 | 80.498466 | 0.0222837 | 3/1/2017 | 2362.72 | -0.0003893 |

| 4/1/2017 | 78.536491 | -0.024675 | 4/1/2017 | 2384.2 | 0.00905013 |

| 5/1/2017 | 76.153404 | -0.030814 | 5/1/2017 | 2411.8 | 0.01150976 |

| 6/1/2017 | 79.274796 | 0.0401705 | 6/1/2017 | 2423.41 | 0.00480223 |

| 7/1/2017 | 79.621574 | 0.0043648 | 7/1/2017 | 2470.3 | 0.01916402 |

| 8/1/2017 | 78.301926 | -0.016713 | 8/1/2017 | 2471.65 | 0.00054628 |

| 9/1/2017 | 82.921219 | 0.0573188 | 9/1/2017 | 2519.36 | 0.01911904 |

| 10/1/2017 | 79.431435 | -0.042997 | 10/1/2017 | 2575.26 | 0.02194556 |

| 11/1/2017 | 82.048775 | 0.0324197 | 11/1/2017 | 2584.84 | 0.00371314 |

| 12/1/2017 | 82.39135 | 0.0041666 | 12/1/2017 | 2673.61 | 0.03376601 |

| 1/1/2018 | 79.45507 | -0.036289 | 1/1/2018 | 2823.81 | 0.0546574 |

| 2/1/2018 | 75.133568 | -0.055924 | 2/1/2018 | 2713.83 | -0.0397261 |

| 3/1/2018 | 76.036209 | 0.0119422 | 3/1/2018 | 2640.87 | -0.0272525 |

| 4/1/2018 | 79.672424 | 0.0467139 | 4/1/2018 | 2648.05 | 0.00271509 |

| 5/1/2018 | 83.573997 | 0.0478089 | 5/1/2018 | 2705.27 | 0.02137819 |

| 6/1/2018 | 84.436729 | 0.0102701 | 6/1/2018 | 2718.37 | 0.00483075 |

| 7/1/2018 | 97.77562 | 0.1466728 | 7/1/2018 | 2816.29 | 0.03538795 |

| 8/1/2018 | 104.544014 | 0.0669329 | 8/1/2018 | 2901.52 | 0.02981431 |

| 9/1/2018 | 106.772926 | 0.0210962 | 9/1/2018 | 2913.98 | 0.00428509 |

| 10/1/2018 | 107.89727 | 0.0104752 | 10/1/2018 | 2711.74 | -0.0719293 |

| 11/1/2018 | 118.046219 | 0.0898967 | 11/1/2018 | 2760.17 | 0.01770175 |

| 12/1/2018 | 115.839996 | -0.018866 | 12/1/2018 | 2695.95 | -0.0235416 |

| 12/6/2018 | 115.839996 | 0 | 12/6/2018 | 2695.95 | 0 |

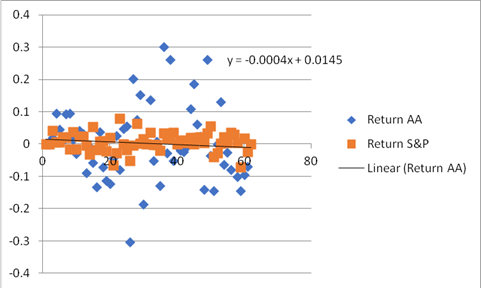

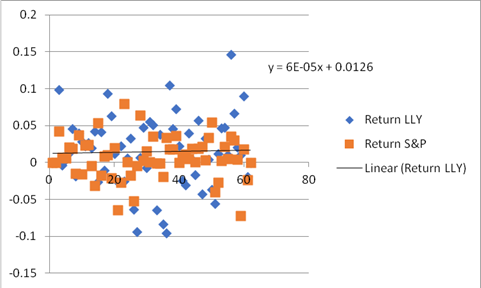

Now scatter plot between return of Eli Lilly and S&P 500 can be made like this:

The trend line can also be obtained by clicking on any blue point and following the steps. This trend line shows that the slope is -0.0004. This slope is beta of Stock Eli Lilly.

Similarly data can be obtained for the next firm AA and returns can be calculated.

| AA Company | S&P 500 | ||||

| Date | Adj Close | Return AA | Date | Adj Close | Return S&P |

| 12/1/2013 | null | 0 | 12/1/2013 | null | 0 |

| 1/1/2014 | 26.76451 | 0 | 1/1/2014 | 1782.59 | 0 |

| 2/1/2014 | 27.29933 | 0.019786 | 2/1/2014 | 1859.45 | 0.04221337 |

| 3/1/2014 | 30.00557 | 0.094521 | 3/1/2014 | 1872.34 | 0.00690825 |

| 4/1/2014 | 31.40442 | 0.045566 | 4/1/2014 | 1883.95 | 0.00618164 |

| 5/1/2014 | 31.73083 | 0.01034 | 5/1/2014 | 1923.57 | 0.0208122 |

| 6/1/2014 | 34.79342 | 0.09214 | 6/1/2014 | 1960.23 | 0.018879 |

| 7/1/2014 | 38.29848 | 0.095982 | 7/1/2014 | 1930.67 | -0.0151947 |

| 8/1/2014 | 38.81255 | 0.013333 | 8/1/2014 | 2003.37 | 0.03696364 |

| 9/1/2014 | 37.6662 | -0.02998 | 9/1/2014 | 1972.29 | -0.0156354 |

| 10/1/2014 | 39.23465 | 0.040797 | 10/1/2014 | 2018.05 | 0.0229364 |

| 11/1/2014 | 40.47537 | 0.031133 | 11/1/2014 | 2067.56 | 0.02423747 |

| 12/1/2014 | 37.031 | -0.08894 | 12/1/2014 | 2058.9 | -0.0041974 |

| 1/1/2015 | 36.70266 | -0.00891 | 1/1/2015 | 1994.99 | -0.0315328 |

| 2/1/2015 | 34.68578 | -0.05652 | 2/1/2015 | 2104.5 | 0.05343888 |

| 3/1/2015 | 30.35504 | -0.13337 | 3/1/2015 | 2067.89 | -0.0175492 |

| 4/1/2015 | 31.52978 | 0.03797 | 4/1/2015 | 2085.51 | 0.00848472 |

| 5/1/2015 | 29.36827 | -0.07102 | 5/1/2015 | 2107.39 | 0.01043673 |

| 6/1/2015 | 26.25399 | -0.1121 | 6/1/2015 | 2063.11 | -0.0212356 |

| 7/1/2015 | 23.24008 | -0.12194 | 7/1/2015 | 2103.84 | 0.01954968 |

| 8/1/2015 | 22.25113 | -0.04349 | 8/1/2015 | 1972.18 | -0.0646247 |

| 9/1/2015 | 22.81595 | 0.025067 | 9/1/2015 | 1920.03 | -0.0267987 |

| 10/1/2015 | 21.09177 | -0.07858 | 10/1/2015 | 2079.36 | 0.07971938 |

| 11/1/2015 | 22.10739 | 0.047029 | 11/1/2015 | 2080.41 | 0.00050474 |

| 12/1/2015 | 23.38675 | 0.056258 | 12/1/2015 | 2043.94 | -0.0176857 |

| 1/1/2016 | 17.2735 | -0.303 | 1/1/2016 | 1940.24 | -0.0520676 |

| 2/1/2016 | 21.15944 | 0.202913 | 2/1/2016 | 1932.23 | -0.0041369 |

| 3/1/2016 | 22.79773 | 0.074575 | 3/1/2016 | 2059.74 | 0.06390499 |

| 4/1/2016 | 26.58148 | 0.153554 | 4/1/2016 | 2065.3 | 0.00269576 |

| 5/1/2016 | 22.06001 | -0.18645 | 5/1/2016 | 2096.95 | 0.01520837 |

| 6/1/2016 | 22.12414 | 0.002903 | 6/1/2016 | 2098.86 | 0.00091051 |

| 7/1/2016 | 25.3461 | 0.135956 | 7/1/2016 | 2173.6 | 0.03499043 |

| 8/1/2016 | 24.05732 | -0.05219 | 8/1/2016 | 2170.95 | -0.00122 |

| 9/1/2016 | 24.27107 | 0.008846 | 9/1/2016 | 2168.27 | -0.0012352 |

| 10/1/2016 | 21.3561 | -0.12795 | 10/1/2016 | 2126.15 | -0.0196168 |

| 11/1/2016 | 28.85664 | 0.301002 | 11/1/2016 | 2198.81 | 0.03360355 |

| 12/1/2016 | 28.08 | -0.02728 | 12/1/2016 | 2238.83 | 0.01803711 |

| 1/1/2017 | 36.45 | 0.260884 | 1/1/2017 | 2278.87 | 0.01772631 |

| 2/1/2017 | 34.59 | -0.05238 | 2/1/2017 | 2363.64 | 0.036523 |

| 3/1/2017 | 34.4 | -0.00551 | 3/1/2017 | 2362.72 | -0.0003893 |

| 4/1/2017 | 33.73 | -0.01967 | 4/1/2017 | 2384.2 | 0.00905013 |

| 5/1/2017 | 32.94 | -0.0237 | 5/1/2017 | 2411.8 | 0.01150976 |

| 6/1/2017 | 32.65 | -0.00884 | 6/1/2017 | 2423.41 | 0.00480223 |

| 7/1/2017 | 36.4 | 0.108724 | 7/1/2017 | 2470.3 | 0.01916402 |

| 8/1/2017 | 43.88 | 0.18689 | 8/1/2017 | 2471.65 | 0.00054628 |

| 9/1/2017 | 46.62 | 0.060571 | 9/1/2017 | 2519.36 | 0.01911904 |

| 10/1/2017 | 47.78 | 0.024578 | 10/1/2017 | 2575.26 | 0.02194556 |

| 11/1/2017 | 41.51 | -0.14067 | 11/1/2017 | 2584.84 | 0.00371314 |

| 12/1/2017 | 53.87 | 0.260639 | 12/1/2017 | 2673.61 | 0.03376601 |

| 1/1/2018 | 52.02 | -0.03495 | 1/1/2018 | 2823.81 | 0.0546574 |

| 2/1/2018 | 44.97 | -0.14563 | 2/1/2018 | 2713.83 | -0.0397261 |

| 3/1/2018 | 44.96 | -0.00022 | 3/1/2018 | 2640.87 | -0.0272525 |

| 4/1/2018 | 51.2 | 0.129966 | 4/1/2018 | 2648.05 | 0.00271509 |

| 5/1/2018 | 48.07 | -0.06308 | 5/1/2018 | 2705.27 | 0.02137819 |

| 6/1/2018 | 46.88 | -0.02507 | 6/1/2018 | 2718.37 | 0.00483075 |

| 7/1/2018 | 43.27 | -0.08013 | 7/1/2018 | 2816.29 | 0.03538795 |

| 8/1/2018 | 44.67 | 0.031843 | 8/1/2018 | 2901.52 | 0.02981431 |

| 9/1/2018 | 40.4 | -0.10047 | 9/1/2018 | 2913.98 | 0.00428509 |

| 10/1/2018 | 34.99 | -0.14377 | 10/1/2018 | 2711.74 | -0.0719293 |

| 11/1/2018 | 31.81 | -0.09528 | 11/1/2018 | 2760.17 | 0.01770175 |

| 12/1/2018 | 29.65 | -0.07032 | 12/1/2018 | 2695.95 | -0.0235416 |

| 12/6/2018 | 29.65 | 0 | 12/6/2018 | 2695.95 | 0 |

Then we can again prepare scatter plot between returns of AA and S&P like mentioned below.

Scatter Plot can be made by using MS Excel plot function by selecting Returns of LLY and S&P.4

The scatter plot will look like this.

Also then we can insert regression equation. The regression equation will look like this:

Y = 6E-05x + 0.0126

t

t

Now from the trend line we have the slope of trend line that shows that beta of stock AA is -0.00006.

The result shows that Eli Lilly has a negative beta and AA has positive beta. Eli Lilly's negative beta is useful to diversify the portfolio in which this stock would be added, for the reason that this stock's returns are negatively correlated with market returns and thus increasing diversification, lowering risk at the cost of less expected returns.

Want to see more full solutions like this?

Chapter 6 Solutions

ESSENTIALS OF INVESTMENTS>LL<+CONNECT

- Chee Chew's portfolio has a beta of 1.27 and earned a return of 13.6% during the year just ended. The risk-free rate is currently 4.6%. The return on the market portfolio during the year just ended was 10.5%. a. Calculate Jensen's measure (Jensen's alpha) for Chee's portfolio for the year just ended. b. Compare the performance of Chee's portfolio found in part a to that of Carri Uhl's portfolio, which has a Jensen's measure of -0.25. Which portfolio performed better? Explain. c. Use your findings in part a to discuss the performance of Chee's portfolio during the period just ended.arrow_forwardDuring the year just ended, Anna Schultz's portfolio, which has a beta of 0.91, earned a return of 8.1%. The risk-free rate is currently 4.1%, and the return on the market portfolio during the year just ended was 9.4%. a. Calculate Treynor's measure for Anna's portfolio for the year just ended. b. Compare the performance of Anna's portfolio found in part a to that of Stacey Quant's portfolio, which has a Treynor's measure of 1.39%. Which portfolio performed better? Explain. c. Calculate Treynor's measure for the market portfolio for the year just ended. d. Use your findings in parts a and c to discuss the performance of Anna's portfolio relative to the market during the year just ended.arrow_forwardNeed answer.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education