Concept explainers

To determine: In this problem, by using the ticker symbol given, the five year data of monthly adjusted stock prices can be downloaded. After that returns can be calculated and returns data of respective company can be plotted on xy scatter plot against the data of S&P. Then by following the steps mentioned in the questions trend line can be made. Slope of the trend line will be beta of the stock.

Explanation of Solution

First we have to down load the data of Eli Lilly (LLY) for the period between Jan 2014 and Nov 2018 (Five years). Then the returns can be calculated by using this formula:

Where LN is natural logarithm

Now this is the calculated data here under for Eli Lily. Similarly S&P Data can be obtained and Returns can be calculated as mentioned above.

| LLY Company | S&P 500 | ||||

| Date | Adj Close | Return LLY | Date | Adj Close | Return S&P |

| 12/1/2013 | null | 0 | 12/1/2013 | null | 0 |

| 1/1/2014 | 46.83643 | 0 | 1/1/2014 | 1782.59 | 0 |

| 2/1/2014 | 51.692627 | 0.0986538 | 2/1/2014 | 1859.45 | 0.04221337 |

| 3/1/2014 | 51.505238 | -0.003632 | 3/1/2014 | 1872.34 | 0.00690825 |

| 4/1/2014 | 51.715252 | 0.0040692 | 4/1/2014 | 1883.95 | 0.00618164 |

| 5/1/2014 | 52.380283 | 0.0127775 | 5/1/2014 | 1923.57 | 0.0208122 |

| 6/1/2014 | 54.853989 | 0.0461447 | 6/1/2014 | 1960.23 | 0.018879 |

| 7/1/2014 | 53.874619 | -0.018015 | 7/1/2014 | 1930.67 | -0.0151947 |

| 8/1/2014 | 56.08041 | 0.0401271 | 8/1/2014 | 2003.37 | 0.03696364 |

| 9/1/2014 | 57.679146 | 0.0281091 | 9/1/2014 | 1972.29 | -0.0156354 |

| 10/1/2014 | 58.995499 | 0.0225655 | 10/1/2014 | 2018.05 | 0.0229364 |

| 11/1/2014 | 60.587559 | 0.0266284 | 11/1/2014 | 2067.56 | 0.02423747 |

| 12/1/2014 | 61.807735 | 0.0199389 | 12/1/2014 | 2058.9 | -0.0041974 |

| 1/1/2015 | 64.504379 | 0.0427046 | 1/1/2015 | 1994.99 | -0.0315328 |

| 2/1/2015 | 62.864899 | -0.025745 | 2/1/2015 | 2104.5 | 0.05343888 |

| 3/1/2015 | 65.551598 | 0.0418496 | 3/1/2015 | 2067.89 | -0.0175492 |

| 4/1/2015 | 64.847809 | -0.010794 | 4/1/2015 | 2085.51 | 0.00848472 |

| 5/1/2015 | 71.190941 | 0.0933225 | 5/1/2015 | 2107.39 | 0.01043673 |

| 6/1/2015 | 75.853432 | 0.0634374 | 6/1/2015 | 2063.11 | -0.0212356 |

| 7/1/2015 | 76.780136 | 0.012143 | 7/1/2015 | 2103.84 | 0.01954968 |

| 8/1/2015 | 74.817703 | -0.025891 | 8/1/2015 | 1972.18 | -0.0646247 |

| 9/1/2015 | 76.492958 | 0.0221442 | 9/1/2015 | 1920.03 | -0.0267987 |

| 10/1/2015 | 74.555267 | -0.025658 | 10/1/2015 | 2079.36 | 0.07971938 |

| 11/1/2015 | 74.984871 | 0.0057457 | 11/1/2015 | 2080.41 | 0.00050474 |

| 12/1/2015 | 77.502235 | 0.0330204 | 12/1/2015 | 2043.94 | -0.0176857 |

| 1/1/2016 | 72.756081 | -0.063194 | 1/1/2016 | 1940.24 | -0.0520676 |

| 2/1/2016 | 66.22551 | -0.094047 | 2/1/2016 | 1932.23 | -0.0041369 |

| 3/1/2016 | 66.695992 | 0.0070791 | 3/1/2016 | 2059.74 | 0.06390499 |

| 4/1/2016 | 69.95623 | 0.0477249 | 4/1/2016 | 2065.3 | 0.00269576 |

| 5/1/2016 | 69.493126 | -0.006642 | 5/1/2016 | 2096.95 | 0.01520837 |

| 6/1/2016 | 73.425682 | 0.0550459 | 6/1/2016 | 2098.86 | 0.00091051 |

| 7/1/2016 | 77.285789 | 0.0512363 | 7/1/2016 | 2173.6 | 0.03499043 |

| 8/1/2016 | 72.493301 | -0.064016 | 8/1/2016 | 2170.95 | -0.00122 |

| 9/1/2016 | 75.310425 | 0.0381244 | 9/1/2016 | 2168.27 | -0.0012352 |

| 10/1/2016 | 69.286331 | -0.083371 | 10/1/2016 | 2126.15 | -0.0196168 |

| 11/1/2016 | 62.980747 | -0.095419 | 11/1/2016 | 2198.81 | 0.03360355 |

| 12/1/2016 | 69.921356 | 0.104542 | 12/1/2016 | 2238.83 | 0.01803711 |

| 1/1/2017 | 73.229668 | 0.0462295 | 1/1/2017 | 2278.87 | 0.01772631 |

| 2/1/2017 | 78.724503 | 0.0723538 | 2/1/2017 | 2363.64 | 0.036523 |

| 3/1/2017 | 80.498466 | 0.0222837 | 3/1/2017 | 2362.72 | -0.0003893 |

| 4/1/2017 | 78.536491 | -0.024675 | 4/1/2017 | 2384.2 | 0.00905013 |

| 5/1/2017 | 76.153404 | -0.030814 | 5/1/2017 | 2411.8 | 0.01150976 |

| 6/1/2017 | 79.274796 | 0.0401705 | 6/1/2017 | 2423.41 | 0.00480223 |

| 7/1/2017 | 79.621574 | 0.0043648 | 7/1/2017 | 2470.3 | 0.01916402 |

| 8/1/2017 | 78.301926 | -0.016713 | 8/1/2017 | 2471.65 | 0.00054628 |

| 9/1/2017 | 82.921219 | 0.0573188 | 9/1/2017 | 2519.36 | 0.01911904 |

| 10/1/2017 | 79.431435 | -0.042997 | 10/1/2017 | 2575.26 | 0.02194556 |

| 11/1/2017 | 82.048775 | 0.0324197 | 11/1/2017 | 2584.84 | 0.00371314 |

| 12/1/2017 | 82.39135 | 0.0041666 | 12/1/2017 | 2673.61 | 0.03376601 |

| 1/1/2018 | 79.45507 | -0.036289 | 1/1/2018 | 2823.81 | 0.0546574 |

| 2/1/2018 | 75.133568 | -0.055924 | 2/1/2018 | 2713.83 | -0.0397261 |

| 3/1/2018 | 76.036209 | 0.0119422 | 3/1/2018 | 2640.87 | -0.0272525 |

| 4/1/2018 | 79.672424 | 0.0467139 | 4/1/2018 | 2648.05 | 0.00271509 |

| 5/1/2018 | 83.573997 | 0.0478089 | 5/1/2018 | 2705.27 | 0.02137819 |

| 6/1/2018 | 84.436729 | 0.0102701 | 6/1/2018 | 2718.37 | 0.00483075 |

| 7/1/2018 | 97.77562 | 0.1466728 | 7/1/2018 | 2816.29 | 0.03538795 |

| 8/1/2018 | 104.544014 | 0.0669329 | 8/1/2018 | 2901.52 | 0.02981431 |

| 9/1/2018 | 106.772926 | 0.0210962 | 9/1/2018 | 2913.98 | 0.00428509 |

| 10/1/2018 | 107.89727 | 0.0104752 | 10/1/2018 | 2711.74 | -0.0719293 |

| 11/1/2018 | 118.046219 | 0.0898967 | 11/1/2018 | 2760.17 | 0.01770175 |

| 12/1/2018 | 115.839996 | -0.018866 | 12/1/2018 | 2695.95 | -0.0235416 |

| 12/6/2018 | 115.839996 | 0 | 12/6/2018 | 2695.95 | 0 |

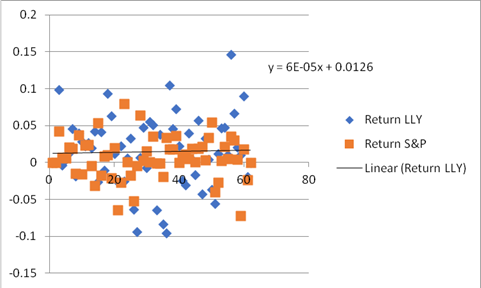

Now scatter plot between return of Eli Lilly and S&P 500 can be made like this:

The trend line can also be obtained by clicking on any blue point and following the steps. This trend line shows that the slope is -0.0004. This slope is beta of Stock Eli Lilly.

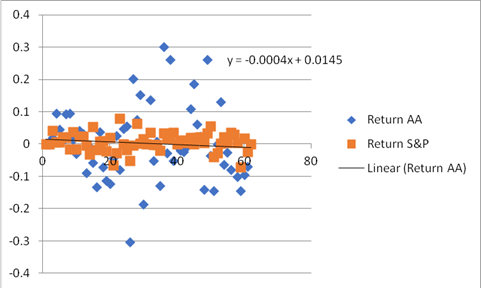

Similarly data can be obtained for the next firm AA and returns can be calculated.

| AA Company | S&P 500 | ||||

| Date | Adj Close | Return AA | Date | Adj Close | Return S&P |

| 12/1/2013 | null | 0 | 12/1/2013 | null | 0 |

| 1/1/2014 | 26.76451 | 0 | 1/1/2014 | 1782.59 | 0 |

| 2/1/2014 | 27.29933 | 0.019786 | 2/1/2014 | 1859.45 | 0.04221337 |

| 3/1/2014 | 30.00557 | 0.094521 | 3/1/2014 | 1872.34 | 0.00690825 |

| 4/1/2014 | 31.40442 | 0.045566 | 4/1/2014 | 1883.95 | 0.00618164 |

| 5/1/2014 | 31.73083 | 0.01034 | 5/1/2014 | 1923.57 | 0.0208122 |

| 6/1/2014 | 34.79342 | 0.09214 | 6/1/2014 | 1960.23 | 0.018879 |

| 7/1/2014 | 38.29848 | 0.095982 | 7/1/2014 | 1930.67 | -0.0151947 |

| 8/1/2014 | 38.81255 | 0.013333 | 8/1/2014 | 2003.37 | 0.03696364 |

| 9/1/2014 | 37.6662 | -0.02998 | 9/1/2014 | 1972.29 | -0.0156354 |

| 10/1/2014 | 39.23465 | 0.040797 | 10/1/2014 | 2018.05 | 0.0229364 |

| 11/1/2014 | 40.47537 | 0.031133 | 11/1/2014 | 2067.56 | 0.02423747 |

| 12/1/2014 | 37.031 | -0.08894 | 12/1/2014 | 2058.9 | -0.0041974 |

| 1/1/2015 | 36.70266 | -0.00891 | 1/1/2015 | 1994.99 | -0.0315328 |

| 2/1/2015 | 34.68578 | -0.05652 | 2/1/2015 | 2104.5 | 0.05343888 |

| 3/1/2015 | 30.35504 | -0.13337 | 3/1/2015 | 2067.89 | -0.0175492 |

| 4/1/2015 | 31.52978 | 0.03797 | 4/1/2015 | 2085.51 | 0.00848472 |

| 5/1/2015 | 29.36827 | -0.07102 | 5/1/2015 | 2107.39 | 0.01043673 |

| 6/1/2015 | 26.25399 | -0.1121 | 6/1/2015 | 2063.11 | -0.0212356 |

| 7/1/2015 | 23.24008 | -0.12194 | 7/1/2015 | 2103.84 | 0.01954968 |

| 8/1/2015 | 22.25113 | -0.04349 | 8/1/2015 | 1972.18 | -0.0646247 |

| 9/1/2015 | 22.81595 | 0.025067 | 9/1/2015 | 1920.03 | -0.0267987 |

| 10/1/2015 | 21.09177 | -0.07858 | 10/1/2015 | 2079.36 | 0.07971938 |

| 11/1/2015 | 22.10739 | 0.047029 | 11/1/2015 | 2080.41 | 0.00050474 |

| 12/1/2015 | 23.38675 | 0.056258 | 12/1/2015 | 2043.94 | -0.0176857 |

| 1/1/2016 | 17.2735 | -0.303 | 1/1/2016 | 1940.24 | -0.0520676 |

| 2/1/2016 | 21.15944 | 0.202913 | 2/1/2016 | 1932.23 | -0.0041369 |

| 3/1/2016 | 22.79773 | 0.074575 | 3/1/2016 | 2059.74 | 0.06390499 |

| 4/1/2016 | 26.58148 | 0.153554 | 4/1/2016 | 2065.3 | 0.00269576 |

| 5/1/2016 | 22.06001 | -0.18645 | 5/1/2016 | 2096.95 | 0.01520837 |

| 6/1/2016 | 22.12414 | 0.002903 | 6/1/2016 | 2098.86 | 0.00091051 |

| 7/1/2016 | 25.3461 | 0.135956 | 7/1/2016 | 2173.6 | 0.03499043 |

| 8/1/2016 | 24.05732 | -0.05219 | 8/1/2016 | 2170.95 | -0.00122 |

| 9/1/2016 | 24.27107 | 0.008846 | 9/1/2016 | 2168.27 | -0.0012352 |

| 10/1/2016 | 21.3561 | -0.12795 | 10/1/2016 | 2126.15 | -0.0196168 |

| 11/1/2016 | 28.85664 | 0.301002 | 11/1/2016 | 2198.81 | 0.03360355 |

| 12/1/2016 | 28.08 | -0.02728 | 12/1/2016 | 2238.83 | 0.01803711 |

| 1/1/2017 | 36.45 | 0.260884 | 1/1/2017 | 2278.87 | 0.01772631 |

| 2/1/2017 | 34.59 | -0.05238 | 2/1/2017 | 2363.64 | 0.036523 |

| 3/1/2017 | 34.4 | -0.00551 | 3/1/2017 | 2362.72 | -0.0003893 |

| 4/1/2017 | 33.73 | -0.01967 | 4/1/2017 | 2384.2 | 0.00905013 |

| 5/1/2017 | 32.94 | -0.0237 | 5/1/2017 | 2411.8 | 0.01150976 |

| 6/1/2017 | 32.65 | -0.00884 | 6/1/2017 | 2423.41 | 0.00480223 |

| 7/1/2017 | 36.4 | 0.108724 | 7/1/2017 | 2470.3 | 0.01916402 |

| 8/1/2017 | 43.88 | 0.18689 | 8/1/2017 | 2471.65 | 0.00054628 |

| 9/1/2017 | 46.62 | 0.060571 | 9/1/2017 | 2519.36 | 0.01911904 |

| 10/1/2017 | 47.78 | 0.024578 | 10/1/2017 | 2575.26 | 0.02194556 |

| 11/1/2017 | 41.51 | -0.14067 | 11/1/2017 | 2584.84 | 0.00371314 |

| 12/1/2017 | 53.87 | 0.260639 | 12/1/2017 | 2673.61 | 0.03376601 |

| 1/1/2018 | 52.02 | -0.03495 | 1/1/2018 | 2823.81 | 0.0546574 |

| 2/1/2018 | 44.97 | -0.14563 | 2/1/2018 | 2713.83 | -0.0397261 |

| 3/1/2018 | 44.96 | -0.00022 | 3/1/2018 | 2640.87 | -0.0272525 |

| 4/1/2018 | 51.2 | 0.129966 | 4/1/2018 | 2648.05 | 0.00271509 |

| 5/1/2018 | 48.07 | -0.06308 | 5/1/2018 | 2705.27 | 0.02137819 |

| 6/1/2018 | 46.88 | -0.02507 | 6/1/2018 | 2718.37 | 0.00483075 |

| 7/1/2018 | 43.27 | -0.08013 | 7/1/2018 | 2816.29 | 0.03538795 |

| 8/1/2018 | 44.67 | 0.031843 | 8/1/2018 | 2901.52 | 0.02981431 |

| 9/1/2018 | 40.4 | -0.10047 | 9/1/2018 | 2913.98 | 0.00428509 |

| 10/1/2018 | 34.99 | -0.14377 | 10/1/2018 | 2711.74 | -0.0719293 |

| 11/1/2018 | 31.81 | -0.09528 | 11/1/2018 | 2760.17 | 0.01770175 |

| 12/1/2018 | 29.65 | -0.07032 | 12/1/2018 | 2695.95 | -0.0235416 |

| 12/6/2018 | 29.65 | 0 | 12/6/2018 | 2695.95 | 0 |

Then we can again prepare scatter plot between returns of AA and S&P like mentioned below.

Scatter Plot can be made by using MS Excel plot function by selecting Returns of LLY and S&P.4

The scatter plot will look like this.

Also then we can insert regression equation. The regression equation will look like this:

Y = 6E-05x + 0.0126

t

t

Now from the trend line we have the slope of trend line that shows that beta of stock AA is -0.00006.

The result shows that Eli Lilly has a negative beta and AA has positive beta. Eli Lilly's negative beta is useful to diversify the portfolio in which this stock would be added, for the reason that this stock's returns are negatively correlated with market returns and thus increasing diversification, lowering risk at the cost of less expected returns.

Want to see more full solutions like this?

Chapter 6 Solutions

CONNECT WITH LEARNSMART FOR BODIE: ESSE

- Can you explain what swaps are in simple terms? .arrow_forwardDefine Fair Value? explain.arrow_forwardAP Associates needs to raise $35 million. The investment banking firm of Squeaks, Emmie, andChippy will handle the transaction.a. If stock is used, 1,800,000 shares will be sold to the public at $21.30 per share. The corporation willreceive a net price of $20 per share. What is the percentage underwriting spread per share?b. If bonds are utilized, slightly over 37,500 bonds will be sold to the public at $1,000 per bond. Thecorporation will receive a net price of $980 per bond. What is the percentage of underwritingspread per bond? (Relate the dollar spread to the public price.)c. Which alternative has the larger percentage of spread?arrow_forward

- Gracie’s Dog Vests currently has 5,200,000 shares of stock outstanding and will report earnings of$8.8 million in the current year. The company is considering the issuance of 1,500,000 additionalshares that will net $28 per share to the corporation.a. What is the immediate dilution potential for this new stock issue?b. Assume that Grace’s Dog Vests can earn 8 percent on the proceeds of the stock issue in time toinclude them in the current year’s results. Calculate earnings per share. Should the new issuebe undertaken based on earnings per share?arrow_forwardYou plan to contribute seven payments of $2,000 a year, with the first payment made today (beginning of year 0) and the final payment made at the beginning of year 6, earning 11% annually. How much will you have after 6 years? a. $12,000 b.$21,718 c.$19,567 d.$3,741arrow_forwardNo AI i need help in this finance question..arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education