Concept explainers

a)

Calculate the cost of ending inventory and cost of goods sold using FIFO method.

a)

Explanation of Solution

Perpetual Inventory System:

Perpetual Inventory System refers to the inventory system that maintains the detailed records of every inventory transactions related to purchases, and sales on a continuous basis. It shows the exact on-hand-inventory at any point of time.

First-in-First-Out:

In First-in-First-Out method, the costs of the initially purchased items are considered as cost of goods sold, for the items which are sold first. The value of the ending inventory consists of the recent purchased items.

Ending Inventory:

It represents the quantity and price of the goods unsold and laying at the store at the end of a particular period.

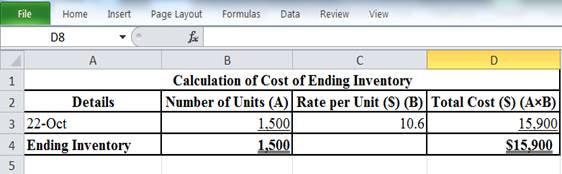

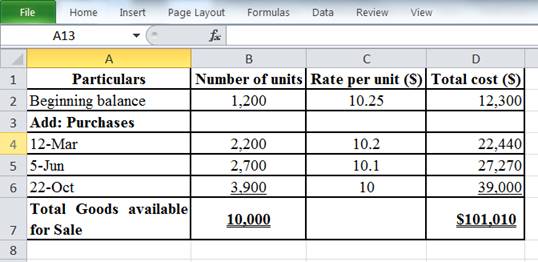

Calculate the cost of ending inventory:

Table 1

Note:

- The ending inventory is 1,500 units.

- In FIFO method the ending inventory comprises of the inventory purchased last, because the inventory purchased first were sold first.

- Therefore, the ending inventory of 1,500 units from October 22nd purchases.

Cost of goods sold:

Cost of goods sold is the accumulate total of all direct cost incurred in manufacturing the goods or the products which has been sold during a period. Cost of goods sold involves direct material, direct labor, and manufacturing

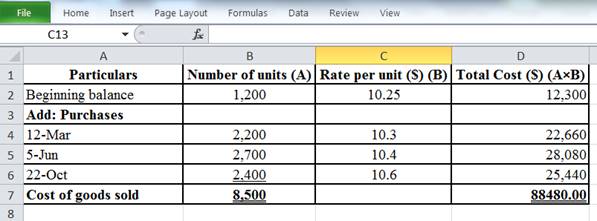

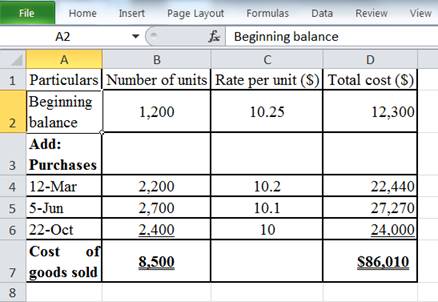

Determine the cost of goods sold:

Table 2

Note:

- 8,500 units are sold.

- As it is FIFO method, the earlier purchased items will be sold first.

- Hence, the cost of goods sold will be the earlier purchased items.

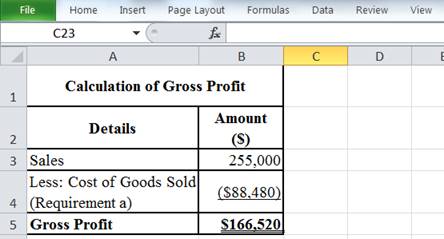

Therefore, the cost of Ending Inventory, and cost of goods sold in the FIFO is $15,900 and $88,480, respectively.

b)

Calculate the cost of ending inventory and cost of goods sold using LIFO method.

b)

Explanation of Solution

Last-in-Last-Out:

In Last-in-First-Out method, the costs of last purchased items are considered as the cost of goods sold, for the items which are sold first. The value of the closing stock consists of the initial purchased items.

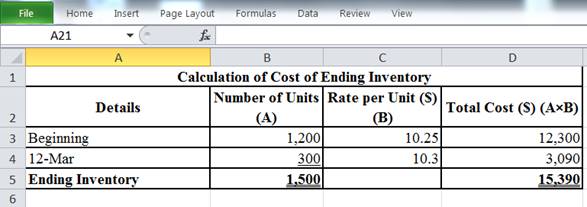

Calculate the cost of ending inventory:

Table 3

Note:

- The ending inventory is 1,500 units.

- In LIFO method, the ending inventory comprises of the inventory purchased first, because the inventory purchased last were sold first.

- Therefore, the ending inventory of 1,500 units is from the beginning inventory and from March 12 purchases.

Cost of goods sold:

Cost of goods sold is the accumulate total of all direct cost incurred in manufacturing the goods or the products which has been sold during a period. Cost of goods sold involves direct material, direct labor, and manufacturing overheads.

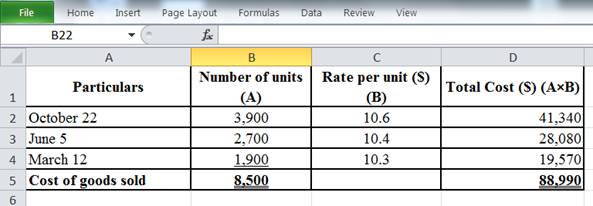

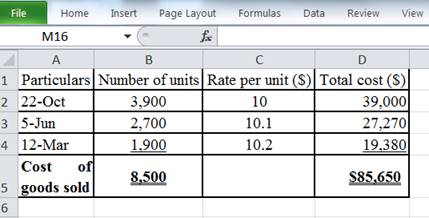

Determine the cost of goods sold:

Table 4

Note:

- 8,500 units are sold.

- As it is LIFO method, the recent purchased items will be sold first.

- Hence, the cost of goods sold will be the recent purchased items.

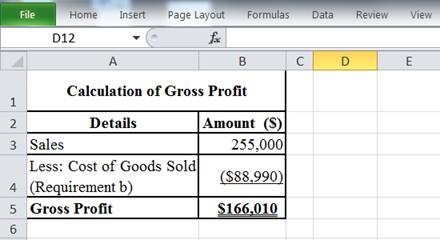

Therefore, the cost of Ending Inventory, and cost of goods sold in the LIFO is $15,390 and $88,990, respectively.

c)

Calculate the cost of ending inventory and cost of goods sold using weighted-average method.

c)

Explanation of Solution

Weighted-average cost method:

Under Weighted average cost method, the company calculates a new average cost after every purchase is made. It is determined by dividing the cost of goods available for sale by the units on hand.

Calculate the cost of ending inventory:

Working note:

Calculate the Weighted-average cost:

Calculate the Cost of Goods Sold.

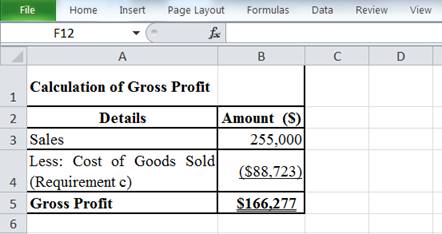

Therefore, the cost of Ending Inventory, and cost of goods sold in the weighted-average method is $15,657 and $88,723, respectively.

d)

Calculate gross profit for each method and calculate gross profit if the unit costs were different.

d)

Explanation of Solution

Gross profit is the difference between the sales and the cost of goods sold.

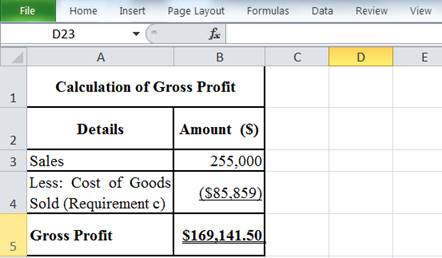

Calculate the gross profit:

Determine the amount of sales revenue:

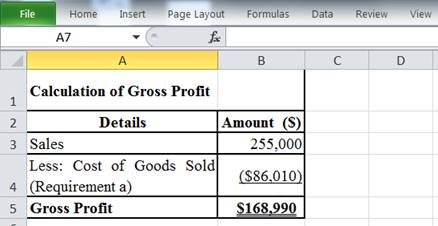

Calculate gross profit under FIFO method:

Table 5

Calculate gross profit under LIFO method:

Table 6

Calculate gross profit under weighted-average method:

Table 7

Calculate cost of goods sold under each method if the unit costs were different as follows:

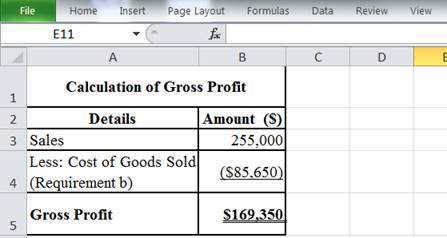

Cost of goods sold under FIFO method:

Table 8

Cost of goods sold under LIFO method:

Table 9

Cost of goods sold under Weighted-average method:

Calculate the Weighted-average cost:

Calculate the Cost of Goods Sold.

Calculate the total Cost and units of Goods Available for Sales:

Table 10

Calculate gross profit under each method if the unit costs were different as follows:

Calculate gross profit under FIFO method:

Table 11

Calculate gross profit under LIFO method:

Table 12

Calculate gross profit under weighted-average method:

Table 13

Want to see more full solutions like this?

Chapter 6 Solutions

FIN ACC W/ CONNECT & PROCTORIO >BI<

- PLEASE HELP. ALL RED CELLS ARE INCORRECT. NOTICE, REVENUE ACCOUNTS ARE IN THE DROPDOWN!arrow_forwardJournalize these transactions, also post the transcations to T-accounts and determine month-end balances. Finally prepare a trail balance.arrow_forwardSuppose during 2023, BlueStar Shipping reported the following financial information (in millions): Net Sales: $40,000 Net Income: $150 Total Assets at Beginning of Year: $26,000 • Total Assets at End of Year: $24,800 Calculate the following: (a) Asset Turnover (b) Return on Assets (ROA) as a percentagearrow_forward

- Please fill all cells! I need helparrow_forwardHilary owns a fruit smoothie shop at the local mall. Each smoothie requires 1/2 pound of mixed berries, which are expected to cost $5.50 per pound during the summer months. Shop employees are paid $7.00 per hour. Variable overhead consists of utilities and supplies, with a variable overhead rate of $0.12 per minute of direct labor time. Each smoothie should require 4 minutes of direct labor time. Determine the following standard costs per smoothie: Direct materials cost Direct labor cost Variable overhead costarrow_forwardgeneral accountingarrow_forward

- The following financial information is provided for Brightstar Corp.: Net Income (2023): $500 million Total Assets on January 1, 2023: $3,500 million Total Assets on December 31, 2023: $4,500 million What is Brightstar Corp. _ s return on assets (ROA) for 2023? A. 11.80% B. 12.50% C. 13.20% D. 14.00%arrow_forwardPLEASE FILL ALL CELLS. ALL RED CELLS ARE INCORRECT OR EMPTY.arrow_forwardAssume Bright Cleaning Service had a net income of $300 for the year. The company's beginning total assets were $4,500, and ending total assets were $4,100. Calculate Bright Cleaning Service's Return on Assets (ROA). A. 6.50% B. 7.25% C. 6.98% D. 5.80%arrow_forward

- what is the investment turnover?arrow_forwardA California-based company had a raw materials inventory of $135,000 on December 31, 2022, and $115,000 on December 31, 2023. During 2023, the company purchased $160,000 worth of raw materials, incurred direct labor costs of $230,000, and manufacturing overhead costs of $340,000. What is the total manufacturing cost incurred by the company? A. $720,000 B. $750,000 C. $705,000 D. $735,000arrow_forwardPLEASE HELP WITH THIS PROBLEM. ALL RED CELLS ARE EMPTY OR INCORRECT.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education