Concept explainers

a)

Calculate the cost of ending inventory and cost of goods sold using FIFO method.

a)

Explanation of Solution

Perpetual Inventory System:

Perpetual Inventory System refers to the inventory system that maintains the detailed records of every inventory transactions related to purchases, and sales on a continuous basis. It shows the exact on-hand-inventory at any point of time.

First-in-First-Out:

In First-in-First-Out method, the costs of the initially purchased items are considered as cost of goods sold, for the items which are sold first. The value of the ending inventory consists of the recent purchased items.

Ending Inventory:

It represents the quantity and price of the goods unsold and laying at the store at the end of a particular period.

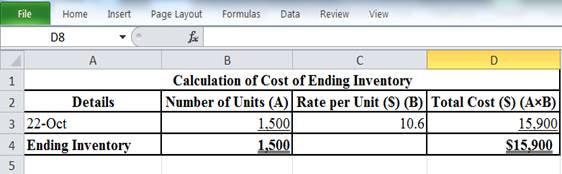

Calculate the cost of ending inventory:

Table 1

Note:

- The ending inventory is 1,500 units.

- In FIFO method the ending inventory comprises of the inventory purchased last, because the inventory purchased first were sold first.

- Therefore, the ending inventory of 1,500 units from October 22nd purchases.

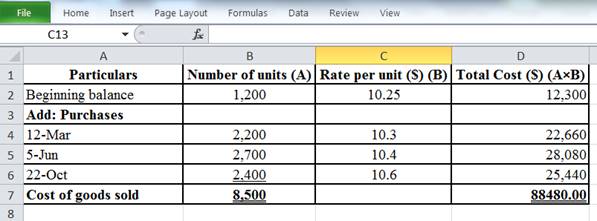

Cost of goods sold:

Cost of goods sold is the accumulate total of all direct cost incurred in manufacturing the goods or the products which has been sold during a period. Cost of goods sold involves direct material, direct labor, and manufacturing

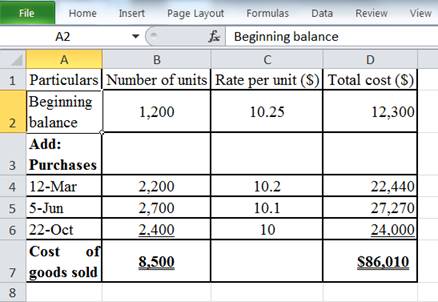

Determine the cost of goods sold:

Table 2

Note:

- 8,500 units are sold.

- As it is FIFO method, the earlier purchased items will be sold first.

- Hence, the cost of goods sold will be the earlier purchased items.

Therefore, the cost of Ending Inventory, and cost of goods sold in the FIFO is $15,900 and $88,480, respectively.

b)

Calculate the cost of ending inventory and cost of goods sold using LIFO method.

b)

Explanation of Solution

Last-in-Last-Out:

In Last-in-First-Out method, the costs of last purchased items are considered as the cost of goods sold, for the items which are sold first. The value of the closing stock consists of the initial purchased items.

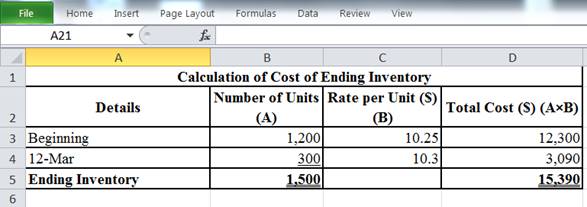

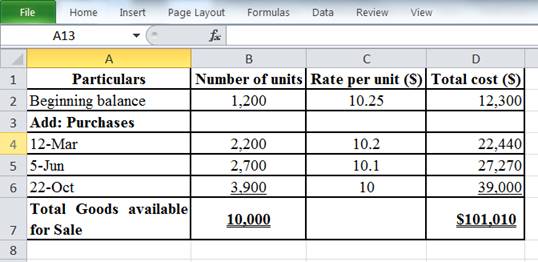

Calculate the cost of ending inventory:

Table 3

Note:

- The ending inventory is 1,500 units.

- In LIFO method, the ending inventory comprises of the inventory purchased first, because the inventory purchased last were sold first.

- Therefore, the ending inventory of 1,500 units is from the beginning inventory and from March 12 purchases.

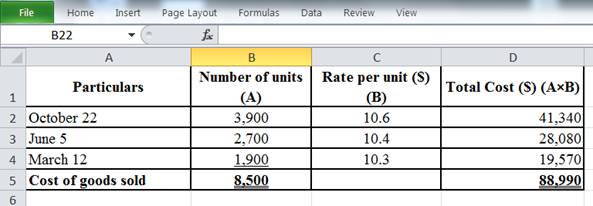

Cost of goods sold:

Cost of goods sold is the accumulate total of all direct cost incurred in manufacturing the goods or the products which has been sold during a period. Cost of goods sold involves direct material, direct labor, and manufacturing overheads.

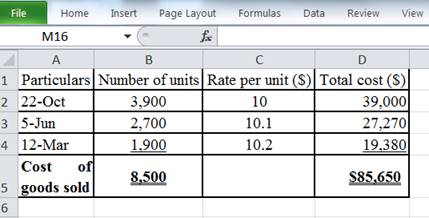

Determine the cost of goods sold:

Table 4

Note:

- 8,500 units are sold.

- As it is LIFO method, the recent purchased items will be sold first.

- Hence, the cost of goods sold will be the recent purchased items.

Therefore, the cost of Ending Inventory, and cost of goods sold in the LIFO is $15,390 and $88,990, respectively.

c)

Calculate the cost of ending inventory and cost of goods sold using weighted-average method.

c)

Explanation of Solution

Weighted-average cost method:

Under Weighted average cost method, the company calculates a new average cost after every purchase is made. It is determined by dividing the cost of goods available for sale by the units on hand.

Calculate the cost of ending inventory:

Working note:

Calculate the Weighted-average cost:

Calculate the Cost of Goods Sold.

Therefore, the cost of Ending Inventory, and cost of goods sold in the weighted-average method is $15,657 and $88,723, respectively.

d)

Calculate gross profit for each method and calculate gross profit if the unit costs were different.

d)

Explanation of Solution

Gross profit is the difference between the sales and the cost of goods sold.

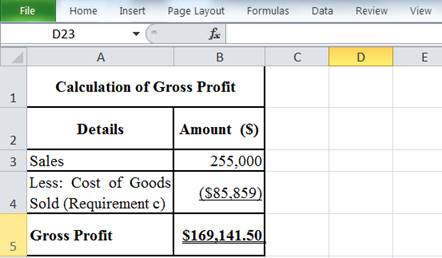

Calculate the gross profit:

Determine the amount of sales revenue:

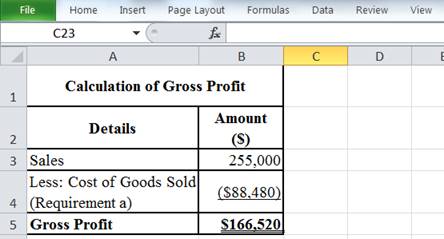

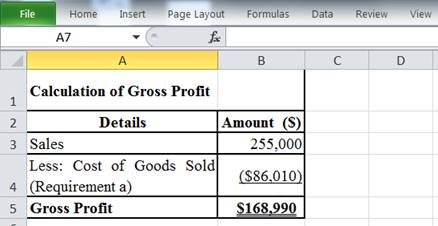

Calculate gross profit under FIFO method:

Table 5

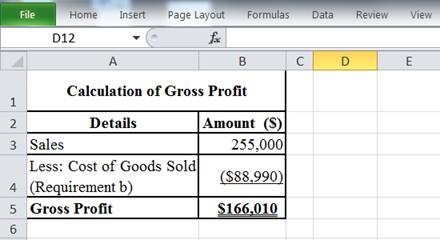

Calculate gross profit under LIFO method:

Table 6

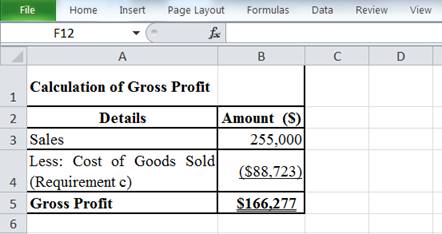

Calculate gross profit under weighted-average method:

Table 7

Calculate cost of goods sold under each method if the unit costs were different as follows:

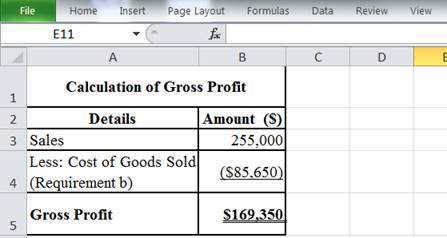

Cost of goods sold under FIFO method:

Table 8

Cost of goods sold under LIFO method:

Table 9

Cost of goods sold under Weighted-average method:

Calculate the Weighted-average cost:

Calculate the Cost of Goods Sold.

Calculate the total Cost and units of Goods Available for Sales:

Table 10

Calculate gross profit under each method if the unit costs were different as follows:

Calculate gross profit under FIFO method:

Table 11

Calculate gross profit under LIFO method:

Table 12

Calculate gross profit under weighted-average method:

Table 13

Want to see more full solutions like this?

Chapter 6 Solutions

FINANCIAL ACCOUNTING

- Solve with explanation and accounting questionarrow_forwardBoston Supplies had cash sales of $78,450, credit sales of $45,670, sale returns and allowances of $6,890, and sales discounts of $3,750. What is the company's net sales for this period?arrow_forwardWhat is the company's net sales for this period?arrow_forward

- What is the primary purpose of preparing a trial balance? a) To calculate net profit or lossb) To check the mathematical accuracy of the ledger accountsc) To prepare the income statementd) To report cash flowsarrow_forwardMachinery was purchased for $78,500 on January 1, 2018. Shipping costs were $2,200 and installation expenses totaled $4,300. It is estimated that the machinery will have a $15,000 salvage value at the end of its 8-year useful life. What is the amount of accumulated depreciation on December 31, 2020, if the straight-line method of depreciation is used?arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forward

- What is the primary goal of financial management?A) Maximizing profitsB) Maximizing shareholder wealthC) Minimizing costsD) Ensuring liquidityarrow_forwardWhich of the following is NOT an example of an operating activity in cash flow statement? a) Receipts from customersb) Payments to suppliersc) Proceeds from issuing sharesd) Payments to employeesarrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education