Requirement1:

The Break-even point in terms of dollar sales company as a wholeshall be determined.

Requirement1:

Answer to Problem 10E

Solution: The Break-even point in terms of dollar sales shall be computed as under:

Break-even point (in dollar sales) = $800,000

Explanation of Solution

Given: The Total fixed cost and Contribution earned and sales revenue is given.

Formula: The formula for computing break-even point in dollar sales is as follows

Break-even point in terms of dollar sales =

Calculations: The Break-even point in terms of dollar sales shall be computed by dividing the fixed cost incurred by contribution margin ratio. If the break-even point for the segment is to be computed, then the traceable fixed cost for the segment and the contribution margin of the segment is taken. However, when the break-even point for the company as a whole has to be taken then the total fixed cost (traceable and common fixed cost) and contribution margin ratio for company as a whole has to be taken. The Break-even point in terms of dollar sales shall be computed with the help of following formula:

Break-even point in terms of dollar sales =

The Companywide Break-even point in terms of sales dollar shall be computed as follows:

Break-even point in terms of dollar sales =

Break-even point in terms of dollar sales =

Total fixed costis the sum total of Traceable fixed cost and Common fixed cost (i.e. $141,000 + $ 59,000 = $200,000)

Contribution margin ratio is expressed as a percentage of contribution earned over total sales revenue i.e.25%

To conclude, it must be said that the break-even point for company shall be computed on the basis of total fixed cost and company contribution margin ratio.

Requirement2:

The break-even point for East segment shall be computed.

Requirement2:

Answer to Problem 10E

Solution: The break-even point for East segment shall be computedas under:

Break-even point (in dollar sales) = $ 250,000

Explanation of Solution

Given: The Contribution earned, sales revenue and Fixed cost for East region is given in the problem.

Formula: The break-even point for East segment shall be computed as under:

Break-even point in terms of dollar sales =

Calculation: Break-even point in terms of dollar sales =

Fixed costis the Traceable fixed cost of East region of $ 50,000

Contribution margin ratio is expressed as a percentage of contribution earned over total sales revenue i.e.20%

To conclude, it must be said that the break-even point for segment shall be computed on the basis of traceable fixed expense of the segment and its contribution margin ratio.

Requirement3:

The break-even point for West Segment shall be computed.

Requirement3:

Answer to Problem 10E

Solution: The break-even point for West Segment shall be computedas under:

Break-even point (in dollar sales) = $260,000

Explanation of Solution

Given: The Contribution earned, sales revenue and Fixed cost for East region is given in the problem.

Formula: The break-even point for East segment shall be computed as under:

Break-even point in terms of dollar sales =

Calculations: The break-even point for West Segment shall be computed as under:

Break-even point in terms of dollar sales =

Break-even point in terms of dollar sales =

Fixed cost is the Traceable fixed cost of East region of $ 91,000

Contribution margin ratio is expressed as a percentage of contribution earned over total sales revenue i.e.35%

To conclude, it must be said that the break-even point for segment shall be computed on the basis of traceable fixed expense of the segment and its contribution margin ratio.

Requirement4:

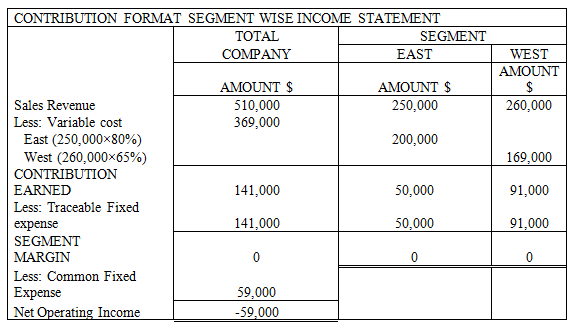

The Segmented Income Statement based on break-even sales of segment as computed above shall be made.

Requirement4:

Answer to Problem 10E

Note: Variable cost ratio of each segment = 100% - Contribution margin ratio of each segment

Explanation of Solution

Under the segment-wise contribution margin statement, sales revenue and variable cost for each products need to be computed. On this basis, the contribution margin of each product is computed and contribution margin earned for the company as a whole is the sum total of contribution earned for each product. The fixed cost traceable to products are deducted from contribution margin to compute the Segment margin income. The common fixed cost which cannot be allocated to products shall be deducted from total margin of the company to determine the net operating income of the company.

To conclude, segmented income statement shall be prepared after classifying the fixed expenses as traceable and untraceable fixed cost.

Requirement5:

The method of computing the break-even sales for segment is appropriate shall be determined.

Answer to Problem 10E

Solution: The break even sales based on company as a whole shall be computed otherwise, there may remain some untraceable fixed cost to be recovered.

Explanation of Solution

The Common fixed cost shall be allocated on some predetermined basis among the segments for computing the break-even sales. Otherwise, the common fixed cost remain unrecovered from the break-even point sales.

The other way to compute the break-even point for recovering all the fixed cost (both traceable and untraceable) shall be compute the company-wide break-even sales based on total fixed cost and weighted contribution margin ratio. Then the total break-even sales shall be apportioned among the segment on the basis of original sales mix.

To conclude, it must be said that the Break-even point in terms of sales dollar shall be computed by dividing the fixed cost expenditures by contribution margin ratio of segment or company as the case may be.

Want to see more full solutions like this?

Chapter 6 Solutions

Managerial Accounting

- E-M:11-18 Using payback to make capital investment decisions Consider the following three projects. All three have an initial investment of $600,000. Net Cash Inflows Year Project L Project M Project N Annual Accumulated Annual Accumulated Annual Accumulated 1 $ 150,000 $ 150,000 $ 100,000 $ 100,000 $ 300,000 $300,000 2 150,000 300,000 200,000 300,000 300,000 600,000 3 150,000 450,000 300,000 600,000 4 150,000 600,000 400,000 1,000,000 5 150,000 750,000 500,000 1,500,000 6 150,000 900,000 7 150,000 1,050,000 8 150,000 1,200,000 1. Determine the payback period of each project. Rank the projects from most desirable to least desirable based on payback. 2. Are there other factors that should be considered in addition to the payback period?arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forwardPlease help me solve this general accounting problem with the correct financial process.arrow_forward

- Can you solve this general accounting problem using accurate calculation methods?arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forwardHorngren's Financial & Managerial Accounting: The Managerial Chapters, 8th Edition E-M:10-12 Making pricing decisions Sufyan Builders builds 1,500-square-foot starter tract homes in the fast-growing suburbs of Atlanta. Competition among developers is fierce. The homes are a standard model, with any upgrades added by the buyer after the sale. Sufyan Builders’ costs per developed sublot are as follows:Land $ 59,000Construction 124,000Landscaping 6,000Variable selling costs 5,000 Sufyan Builders would like to earn a profit of 14% of the variable cost of each home sold. Similar homes offered by competing builders sell for $208,000 each. Assume the company has no fixed costs. Questions:1. Which approach to pricing should Sufyan Builders emphasize? Why? 2. Will Sufyan Builders be able to achieve its target profit levels? 3. Bathrooms and kitchens are typically the most important selling features of a home. Sufyan Builders could…arrow_forward

- Can you provide a detailed solution to this financial accounting problem using proper principles?arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education