Concept explainers

Time-Driven Activity-Based Costing LO5—6

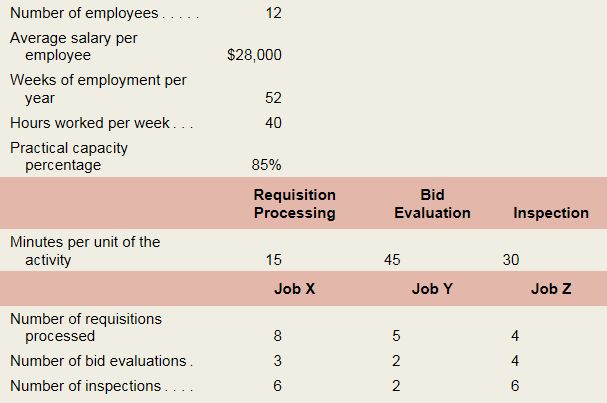

Saratoga Company manufactures jobs to customer specifications. The company is conducting a time-driven activity-based costing study in its Purchasing Department to better understand how Purchasing Department labor costs are consumed by individual jobs. To aid the study, the company provided the following data regarding its Purchasing Department and three of its many jobs:

Required:

Calculate the cost per minute of the resource supplied in the Purchasing Department.

1.

Concept introduction:

Activity-based costing (ABC):

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. After establishing the relationship, the indirect cost is allocated to the products.

The cost per minute of the resource supplied.

Answer to Problem 5A.1E

The cost per minute of the resource supplied is 0.40.

Explanation of Solution

Determine the cost per minute of the resource supplied:

Thus, the cost per minute of the resource supplied is 0.40.

Working note 1:

Calculate the total cost of resources supplied:

Working note 2:

Calculate the capacity per employee:

Working note 3:

Calculate the practical capacity of resources supplied:

2.

Concept introduction:

Activity-based costing (ABC):

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. After establishing the relationship, the indirect cost is allocated to the products.

To Calculate: The time-driven activity rate for the given activities.

Answer to Problem 5A.1E

The time-driven activity rate is $6, $18 and $12 for requisition processing,bid evaluation, and inspection.

Explanation of Solution

Calculate the time-driven activity rate for the given activities:

| Particulars | Requisition Processing | Bid Evaluation | Inspection |

| Minutes per unit of the activity (a) | 15 | 45 | 30 |

| Cost per minute of the resource supplied (b) | $0.40 | $0.40 | $0.40 |

| Time-driven activity rate (a × b) | $6.00 | $18.00 | $12.00 |

Table: (1)

Thus, the time-driven activity rate is $6, $18, and $12 for requisition processing,bid evaluation, and inspection.

3.

Concept introduction:

Cost allocation:

Costallocation refers to the process where the common cost of the production and service rendered to the various departments of the business are distributed. It is used to calculate the actual cost attributed to a specific department.

The purchasing labor cost for Job X, Job Y, and Job Z.

Answer to Problem 5A.1E

The total cost of Job X, Job Y, and Job Z is $102, $162 and $168 respectively.

Explanation of Solution

Determine the purchasing labor cost for Job X, Job Y, and Job Z:

| Particulars | Job X | Job Y | Job Z |

| Requisition processing costs | $48 | $30 | $24 |

| Bid evaluation costs | $54 | $36 | $72 |

| Inspection costs | $72 | $24 | $72 |

| Total costs | $174 | $90 | $168 |

Table: (2)

Thus, the total cost of Job X, Job Y, and Job Z is $102, $162 and $168 respectively.

Working note 1:

Calculate the requisition processing costs:

| Particulars | Time-driven activity rate(a) | Number of requisitions processed(b) | Requisition processing costs(c = a × b) |

| Job X | $6.00 | 8 | $48.00 |

| Job Y | $6.00 | 5 | $30.00 |

| Job Z | $6.00 | 4 | $24.00 |

Table: (3)

Calculate the bid evaluation costs:

| Particulars | Time-driven activity rate(a) | Number of bid evaluations(b) | Bid evaluation costs(c = a × b) |

| Job X | $18.00 | 3 | $54.00 |

| Job Y | $18.00 | 2 | $36.00 |

| Job Z | $18.00 | 4 | $72.00 |

Table: (4)

Calculate the bid inspection costs:

| Particulars | Time-driven activity rate(a) | Number of inspections(b) | Inspection costs(c = a × b) |

| Job X | $12.00 | 6 | $72.00 |

| Job Y | $12.00 | 2 | $24.00 |

| Job Z | $12.00 | 6 | $72.00 |

Table: (5)

Want to see more full solutions like this?

Chapter 5A Solutions

MGMR ACCT F/MANAGERS-CONNECT 180-DAY COD

- Dear tutor. I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardno aiWhich of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forwardDon't use chatgpt Which of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understated i need help in this question quiarrow_forwardI need correct answer 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardNo chatgpt 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedneed anarrow_forwardNo ai 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardDevelopment costs in preparing the mine $ 3,400,000 Mining equipment 159,600 Construction of various structures on site 77,900 After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $12,000. The structures will be torn down. Geologists estimate that 820,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the state of New Mexico. The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow Probability $ 620,000 40% 720,000 30% 820,000 30% Hecala’s credit-adjusted risk-free interest rate is 7%. During 2024, Hecala extracted 122,000 tons of ore from the mine. The company’s fiscal year ends on December 31. Required: Determine the amount at which Hecala will record the mine. Calculate the…arrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College