Concept explainers

Time-Driven Activity-Based Costing LO5—6

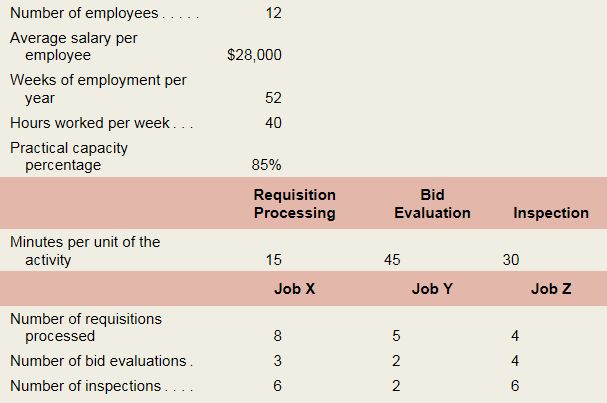

Saratoga Company manufactures jobs to customer specifications. The company is conducting a time-driven activity-based costing study in its Purchasing Department to better understand how Purchasing Department labor costs are consumed by individual jobs. To aid the study, the company provided the following data regarding its Purchasing Department and three of its many jobs:

Required:

Calculate the cost per minute of the resource supplied in the Purchasing Department.

1.

Concept introduction:

Activity-based costing (ABC):

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. After establishing the relationship, the indirect cost is allocated to the products.

The cost per minute of the resource supplied.

Answer to Problem 5A.1E

The cost per minute of the resource supplied is 0.40.

Explanation of Solution

Determine the cost per minute of the resource supplied:

Thus, the cost per minute of the resource supplied is 0.40.

Working note 1:

Calculate the total cost of resources supplied:

Working note 2:

Calculate the capacity per employee:

Working note 3:

Calculate the practical capacity of resources supplied:

2.

Concept introduction:

Activity-based costing (ABC):

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. After establishing the relationship, the indirect cost is allocated to the products.

To Calculate: The time-driven activity rate for the given activities.

Answer to Problem 5A.1E

The time-driven activity rate is $6, $18 and $12 for requisition processing,bid evaluation, and inspection.

Explanation of Solution

Calculate the time-driven activity rate for the given activities:

| Particulars | Requisition Processing | Bid Evaluation | Inspection |

| Minutes per unit of the activity (a) | 15 | 45 | 30 |

| Cost per minute of the resource supplied (b) | $0.40 | $0.40 | $0.40 |

| Time-driven activity rate (a × b) | $6.00 | $18.00 | $12.00 |

Table: (1)

Thus, the time-driven activity rate is $6, $18, and $12 for requisition processing,bid evaluation, and inspection.

3.

Concept introduction:

Cost allocation:

Costallocation refers to the process where the common cost of the production and service rendered to the various departments of the business are distributed. It is used to calculate the actual cost attributed to a specific department.

The purchasing labor cost for Job X, Job Y, and Job Z.

Answer to Problem 5A.1E

The total cost of Job X, Job Y, and Job Z is $102, $162 and $168 respectively.

Explanation of Solution

Determine the purchasing labor cost for Job X, Job Y, and Job Z:

| Particulars | Job X | Job Y | Job Z |

| Requisition processing costs | $48 | $30 | $24 |

| Bid evaluation costs | $54 | $36 | $72 |

| Inspection costs | $72 | $24 | $72 |

| Total costs | $174 | $90 | $168 |

Table: (2)

Thus, the total cost of Job X, Job Y, and Job Z is $102, $162 and $168 respectively.

Working note 1:

Calculate the requisition processing costs:

| Particulars | Time-driven activity rate(a) | Number of requisitions processed(b) | Requisition processing costs(c = a × b) |

| Job X | $6.00 | 8 | $48.00 |

| Job Y | $6.00 | 5 | $30.00 |

| Job Z | $6.00 | 4 | $24.00 |

Table: (3)

Calculate the bid evaluation costs:

| Particulars | Time-driven activity rate(a) | Number of bid evaluations(b) | Bid evaluation costs(c = a × b) |

| Job X | $18.00 | 3 | $54.00 |

| Job Y | $18.00 | 2 | $36.00 |

| Job Z | $18.00 | 4 | $72.00 |

Table: (4)

Calculate the bid inspection costs:

| Particulars | Time-driven activity rate(a) | Number of inspections(b) | Inspection costs(c = a × b) |

| Job X | $12.00 | 6 | $72.00 |

| Job Y | $12.00 | 2 | $24.00 |

| Job Z | $12.00 | 6 | $72.00 |

Table: (5)

Want to see more full solutions like this?

Chapter 5A Solutions

MANAGERIAL ACCOUNTING FOR MANAGERS

- I need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardPlease explain the solution to this financial accounting problem using the correct financial principles.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

- Please provide the correct answer to this financial accounting problem using valid calculations.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardCan you solve this financial accounting problem using appropriate financial principles?arrow_forward

- Can you help me solve this financial accounting question using the correct financial procedures?arrow_forwardI need guidance on solving this financial accounting problem with appropriate financial standards.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College