Engineering Economy (17th Edition)

17th Edition

ISBN: 9780134870069

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5.A, Problem 1P

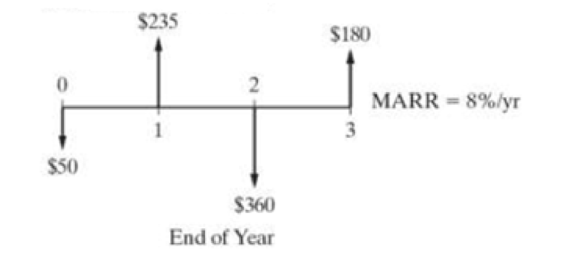

Use the ERR method with ∈= 8% per year to solve for a unique

Expert Solution & Answer

Learn your wayIncludes step-by-step video

schedule01:45

Students have asked these similar questions

Problem 3

You are given the following demand for European luxury automobiles:

Q=1,000 P-0.5.2/1.6

where P-Price of European luxury cars

PA = Price of American luxury cars

P, Price of Japanese luxury cars

I= Annual income of car buyers

Assume that each of the coefficients is statistically significant (i.e., that they passed the t-test).

On the basis of the information given, answer the following questions

1. Comment on the degree of substitutability between European and American luxury cars and

between European and Japanese luxury cars. Explain some possible reasons for the results in

the equation.

2. Comment on the coefficient for the income variable. Is this result what you would expect?

Explain.

3. Comment on the coefficient of the European car price variable. Is that what you would expect?

Explain.

Problem 2:

A manufacturer of computer workstations gathered average monthly sales figures from its 56 branch

offices and dealerships across the country and estimated the following demand for its product:

Q=+15,000-2.80P+150A+0.3P+0.35Pm+0.2Pc

(5,234) (1.29) (175) (0.12) (0.17) (0.13)

R²=0.68 SER 786 F=21.25

The variables and their assumed values are

P = Price of basic model = 7,000

Q==Quantity

A = Advertising expenditures (in thousands) = 52

P = Average price of a personal computer = 4,000

P.

Average price of a minicomputer = 15,000

Pe Average price of a leading competitor's workstation = 8,000

1. Compute the elasticities for each variable. On this basis, discuss the relative impact that each

variable has on the demand. What implications do these results have for the firm's marketing

and pricing policies?

2. Conduct a t-test for the statistical significance of each variable. In each case, state whether

a one-tail or two-tail test is required. What difference, if any, does it make to…

You are the manager of a large automobile dealership who wants to learn more about the effective-

ness of various discounts offered to customers over the past 14 months. Following are the average

negotiated prices for each month and the quantities sold of a basic model (adjusted for various

options) over this period of time.

1. Graph this information on a scatter plot. Estimate the demand equation. What do the

regression results indicate about the desirability of discounting the price? Explain.

Month

Price

Quantity

Jan.

12,500

15

Feb.

12,200

17

Mar.

11,900

16

Apr.

12,000

18

May

11,800

20

June

12,500

18

July

11,700

22

Aug.

12,100

15

Sept.

11,400

22

Oct.

11,400

25

Nov.

11,200

24

Dec.

11,000

30

Jan.

10,800

25

Feb.

10,000

28

2. What other factors besides price might be included in this equation? Do you foresee any

difficulty in obtaining these additional data or incorporating them in the regression analysis?

Chapter 5 Solutions

Engineering Economy (17th Edition)

Ch. 5.A - Use the ERR method with = 8% per year to solve for...Ch. 5.A - Apply the ERR method with = 12% per year to the...Ch. 5.A - Are there multiple IRRs for the following...Ch. 5.A - Are there multiple IRRs for the following cash...Ch. 5 - Tennessee Tool Works (TTW) is considering...Ch. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Prob. 4PCh. 5 - What is the capitalized worth of a project that...Ch. 5 - A large induced-draft fan is needed for an...

Ch. 5 - Prob. 7PCh. 5 - Prob. 8PCh. 5 - Prob. 9PCh. 5 - A corporate bond pays 5% of its face value once...Ch. 5 - Prob. 11PCh. 5 - Prob. 12PCh. 5 - Prob. 13PCh. 5 - The cash-flow diagram below has an internal rate...Ch. 5 - Prob. 15PCh. 5 - Prob. 16PCh. 5 - Prob. 17PCh. 5 - Prob. 18PCh. 5 - Prob. 19PCh. 5 - Your firm is thinking about investing 200,000in...Ch. 5 - Determine the FW of the following engineering...Ch. 5 - Prob. 22PCh. 5 - Fill in Table P5-23 below when P = 10,000, S = 2,...Ch. 5 - An asset has an initial capital investment of4...Ch. 5 - A simple, direct space heating system is currently...Ch. 5 - Prob. 26PCh. 5 - Prob. 27PCh. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Its easier to make money when interest rates in...Ch. 5 - Prob. 31PCh. 5 - Prob. 32PCh. 5 - Stan Moneymaker has been informed of a major...Ch. 5 - The required investment cost of a new, large...Ch. 5 - Prob. 35PCh. 5 - A parking garage has a capital investment cost of...Ch. 5 - The city of Oak Ridge is considering the...Ch. 5 - Prob. 38PCh. 5 - Prob. 39PCh. 5 - Prob. 40PCh. 5 - Prob. 41PCh. 5 - Prob. 42PCh. 5 - Prob. 43PCh. 5 - To purchase a used automobile, you borrow 10,000...Ch. 5 - Your boss has just presented you with the summary...Ch. 5 - Experts agree that the IRR of a college education...Ch. 5 - A company has the opportunity to take over a...Ch. 5 - The prospective exploration for oil in the outer...Ch. 5 - Prob. 49PCh. 5 - An integrated, combined cycle power plant produces...Ch. 5 - A computer call center is going to replace all of...Ch. 5 - Prob. 52PCh. 5 - Prob. 53PCh. 5 - Prob. 54PCh. 5 - The upturned wingtips on jet aircraft reduce drag...Ch. 5 - Prob. 56PCh. 5 - Prob. 57PCh. 5 - Prob. 58PCh. 5 - In southern California a photovoltaic (PV) system...Ch. 5 - a. Calculate the IRR for each of the three...Ch. 5 - Prob. 61PCh. 5 - A hospital germ-fighting and floor cleaning robot,...Ch. 5 - Prob. 63PCh. 5 - Prob. 64SECh. 5 - Prob. 65SECh. 5 - Prob. 66SECh. 5 - A certain medical device will result in an...Ch. 5 - Refer to Problem 5-61. Develop a spreadsheet to...Ch. 5 - Prob. 69CSCh. 5 - Prob. 70CSCh. 5 - Suppose that the average utilization of the CVD...Ch. 5 - Prob. 72FECh. 5 - Prob. 73FECh. 5 - Prob. 74FECh. 5 - Prob. 75FECh. 5 - Prob. 76FECh. 5 - Prob. 77FECh. 5 - Prob. 78FECh. 5 - Prob. 79FECh. 5 - A new machine was bought for 9,000 with life of...Ch. 5 - Prob. 81FECh. 5 - Prob. 82FECh. 5 - Prob. 83FECh. 5 - Prob. 84FECh. 5 - Prob. 85FE

Additional Business Textbook Solutions

Find more solutions based on key concepts

Create an Excel spreadsheet on your own that can make combination forecasts for Problem 18. Create a combinatio...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

15-18 Societal moral issue: Although enforcement of worker safety in Bangladesh is clearly lax, government offi...

Fundamentals of Management (10th Edition)

••• 4.13 As you can see in the following table, demand for heart transplant surgery at Washington General Hospi...

Operations Management

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

What is the relationship between management by exception and variance analysis?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Similar questions

- simple steps on how it should look like on excelarrow_forwardConsider options on a stock that does not pay dividends.The stock price is $100 per share, and the risk-free interest rate is 10%.Thestock moves randomly with u=1.25and d=1/u Use Excel to calculate the premium of a10-year call with a strike of $100.arrow_forwardCompute the Fourier sine and cosine transforms of f(x) = e.arrow_forward

- 17. Given that C=$700+0.8Y, I=$300, G=$600, what is Y if Y=C+I+G?arrow_forwardUse the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all. Write explanation in paragraphs and if you use currency use USD currency: 10. What is the mechanism or process that allows the expenditure multiplier to “work” in theKeynesian Cross Model? Explain and show both mathematically and graphically. What isthe underpinning assumption for the process to transpire?arrow_forwardUse the Feynman technique throughout. Assume that you’reexplaining the answer to someone who doesn’t know the topic at all. Write it all in paragraphs: 2. Give an overview of the equation of exchange (EoE) as used by Classical Theory. Now,carefully explain each variable in the EoE. What is meant by the “quantity theory of money”and how is it different from or the same as the equation of exchange?arrow_forward

- Zbsbwhjw8272:shbwhahwh Zbsbwhjw8272:shbwhahwh Zbsbwhjw8272:shbwhahwhZbsbwhjw8272:shbwhahwhZbsbwhjw8272:shbwhahwharrow_forwardUse the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all:arrow_forwardUse the Feynman technique throughout. Assume that you’reexplaining the answer to someone who doesn’t know the topic at all: 4. Draw a Keynesian AD curve in P – Y space and list the shift factors that will shift theKeynesian AD curve upward and to the right. Draw a separate Classical AD curve in P – Yspace and list the shift factors that will shift the Classical AD curve upward and to the right.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co

Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Economics Today and Tomorrow, Student Edition

Economics

ISBN:9780078747663

Author:McGraw-Hill

Publisher:Glencoe/McGraw-Hill School Pub Co

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc