Financial Accounting

3rd Edition

ISBN: 9780133791129

Author: Jane L. Reimers

Publisher: Pearson Higher Ed

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 9SEA

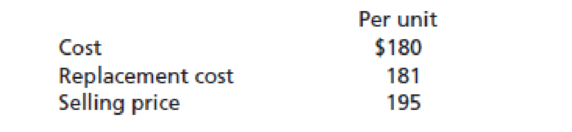

The following information pertains to item #007SS of inventory of Marine Aquatic Sales, Inc.:

The physical inventory indicates 2,000 units of item #007SS on hand. What amount will be reported on the Marine Aquatic Sales, Inc.’s

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide the correct answer to this general accounting problem using valid calculations.

Please help me solve this general accounting question using the right accounting principles.

I am trying to find the accurate solution to this general accounting problem with appropriate explanations.

Chapter 5 Solutions

Financial Accounting

Ch. 5 - In each separate situation, identify which company...Ch. 5 - Prob. 2YTCh. 5 - Prob. 3YTCh. 5 - Prob. 4YTCh. 5 - Prob. 5YTCh. 5 - Jaynes Jewelry Store purchased three diamond and...Ch. 5 - Prob. 7YTCh. 5 - Prob. 8YTCh. 5 - Prob. 9YTCh. 5 - Prob. 1Q

Ch. 5 - What is the difference between freight-in and...Ch. 5 - What is the difference between a purchase return...Ch. 5 - What is a purchase discount? What is the effect of...Ch. 5 - Prob. 5QCh. 5 - Prob. 6QCh. 5 - Prob. 7QCh. 5 - What is the difference between a periodic and...Ch. 5 - What is inventory shrinkage?Ch. 5 - What is the difference between the physical flow...Ch. 5 - What are the common cost flow methods for...Ch. 5 - If inventory costs are rising, which method (FIFO,...Ch. 5 - If inventory costs are rising, which method (FIFO,...Ch. 5 - Does LIFO or FIFO give the bestmost currentbalance...Ch. 5 - How do taxes affect the choice between LIFO and...Ch. 5 - Does the periodic or perpetual choice affect the...Ch. 5 - What is the lower-of-cost-or-market rule and why...Ch. 5 - What does the gross profit percentage measure? How...Ch. 5 - What does the inventory turnover ratio measure?...Ch. 5 - What are some of the risks associated with...Ch. 5 - Prob. 1MCQCh. 5 - Prob. 2MCQCh. 5 - Prob. 3MCQCh. 5 - Prob. 4MCQCh. 5 - Prob. 5MCQCh. 5 - Prob. 6MCQCh. 5 - Prob. 7MCQCh. 5 - Prob. 8MCQCh. 5 - Prob. 9MCQCh. 5 - Prob. 10MCQCh. 5 - Prob. 1SEACh. 5 - Prob. 2SEACh. 5 - Prob. 3SEACh. 5 - Prob. 4SEACh. 5 - Prob. 5SEACh. 5 - Prob. 6SEACh. 5 - Prob. 7SEACh. 5 - Prob. 8SEACh. 5 - The following information pertains to item #007SS...Ch. 5 - Prob. 10SEACh. 5 - Prob. 11SEBCh. 5 - Prob. 12SEBCh. 5 - Prob. 13SEBCh. 5 - Prob. 14SEBCh. 5 - Prob. 15SEBCh. 5 - Prob. 16SEBCh. 5 - Prob. 17SEBCh. 5 - Given the following information, calculate the...Ch. 5 - Prob. 19SEBCh. 5 - Prob. 20SEBCh. 5 - Prob. 21EACh. 5 - Prob. 22EACh. 5 - Prob. 23EACh. 5 - Prob. 24EACh. 5 - August 11Purchased four units at 400 each August...Ch. 5 - Prob. 26EACh. 5 - Prob. 27EACh. 5 - Prob. 28EACh. 5 - Prob. 29EACh. 5 - Prob. 30EACh. 5 - Given the following information, calculate the...Ch. 5 - Prob. 32EBCh. 5 - Prob. 33EBCh. 5 - Prob. 34EBCh. 5 - Prob. 35EBCh. 5 - Prob. 36EBCh. 5 - Prob. 37EBCh. 5 - Assume Radio Tech uses a perpetual inventory...Ch. 5 - Prob. 39EBCh. 5 - Prob. 40EBCh. 5 - Prob. 41EBCh. 5 - Prob. 42EBCh. 5 - Prob. 43PACh. 5 - Prob. 44PACh. 5 - Prob. 45PACh. 5 - The following transactions occurred during July...Ch. 5 - Prob. 47PACh. 5 - Prob. 48PACh. 5 - Calculate cost of goods sold and ending inventory;...Ch. 5 - Prob. 50PACh. 5 - Green Bay Cheese Company is considering changing...Ch. 5 - The following information is for Leos Solar...Ch. 5 - Prob. 53PACh. 5 - Prob. 54PBCh. 5 - Prob. 55PBCh. 5 - Prob. 56PBCh. 5 - Prob. 57PBCh. 5 - Prob. 58PBCh. 5 - Prob. 59PBCh. 5 - Calculate cost of goods sold and ending inventory;...Ch. 5 - Prob. 61PBCh. 5 - Castana Company is considering changing inventory...Ch. 5 - The following information is for Falling Numbers...Ch. 5 - Prob. 64PBCh. 5 - Prob. 1FSACh. 5 - Prob. 2FSACh. 5 - Prob. 3FSACh. 5 - Prob. 1CTPCh. 5 - Prob. 2CTP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forward

- I am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License