Corporate Finance

12th Edition

ISBN: 9781259918940

Author: Ross, Stephen A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 9CQ

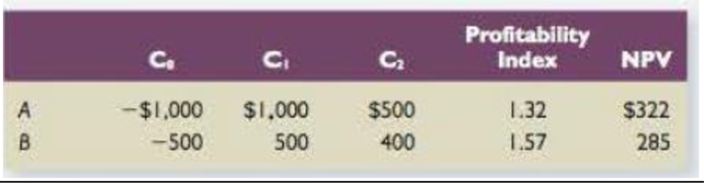

The appropriate discount rate for the projects is 10 percent. Global Investments chose to undertake Project A. At a luncheon for shareholders, the manager of a pension fund that owns a substantial amount of the firm’s stock asks you why the firm chose Project A instead of Project B when Project B has a higher profitability index.

How would you, the CFO, justify your firm’s action? Are there any circumstances under which Global Investments should choose Project B?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

How do companies evaluate the feasibility of a project using NPV and IRR?

What are derivatives, and how are they used in hedging?

What are index funds, and why are they popular among long-term investors in finance?

Chapter 5 Solutions

Corporate Finance

Ch. 5 - Payback Period and Net Present Value If a project...Ch. 5 - Net Present Value Suppose a project has...Ch. 5 - Comparing Investment Criteria Define each of the...Ch. 5 - Payback and Internal Rate of Return A project has...Ch. 5 - Prob. 5CQCh. 5 - Capital Budgeting Problems What are some of the...Ch. 5 - Prob. 7CQCh. 5 - Prob. 8CQCh. 5 - Net Present Value versus Profitability Index...Ch. 5 - Internal Rate of Return Projects A and B have the...

Ch. 5 - Net Present Value You are evaluating Project A and...Ch. 5 - Modified Internal Rate of Return One of the less...Ch. 5 - Net Present Value It is sometimes stated that the...Ch. 5 - Prob. 14CQCh. 5 - Prob. 1QAPCh. 5 - Prob. 2QAPCh. 5 - Prob. 3QAPCh. 5 - Prob. 4QAPCh. 5 - Prob. 5QAPCh. 5 - Prob. 6QAPCh. 5 - Prob. 7QAPCh. 5 - Prob. 8QAPCh. 5 - Prob. 9QAPCh. 5 - Prob. 10QAPCh. 5 - NPV versus IRR Consider the following cash flows...Ch. 5 - Prob. 12QAPCh. 5 - Prob. 13QAPCh. 5 - Prob. 14QAPCh. 5 - Prob. 15QAPCh. 5 - Comparing Investment Criteria Consider the...Ch. 5 - Prob. 17QAPCh. 5 - Comparing Investment Criteria Consider the...Ch. 5 - Prob. 19QAPCh. 5 - Prob. 20QAPCh. 5 - MIRR Suppose the company in the previous problem...Ch. 5 - Prob. 22QAPCh. 5 - Prob. 23QAPCh. 5 - Prob. 24QAPCh. 5 - Prob. 25QAPCh. 5 - Prob. 26QAPCh. 5 - Prob. 27QAPCh. 5 - Prob. 28QAPCh. 5 - Prob. 29QAPCh. 5 - Prob. 30QAPCh. 5 - Construct a spreadsheet to calculate the payback...Ch. 5 - Based on your analysis, should the company open...Ch. 5 - Prob. 3MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial leverage explained; Author: The Finance story teller;https://www.youtube.com/watch?v=GESzfA9odgE;License: Standard YouTube License, CC-BY