Principles of Corporate Finance

13th Edition

ISBN: 9781260465099

Author: BREALEY, Richard

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 7PS

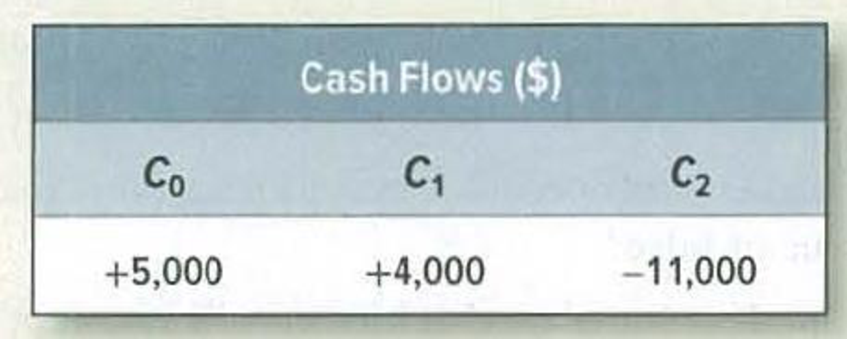

IRR rule You have the chance to participate in a project that produces the following cash flows:

The

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

In each of the following cases, certain qualifying education expenses were paid during the tax year for individuals who were the

taxpayer, spouse, or dependent. The taxpayer has a tax liability and no other credits.

Required:

Determine the amount of the American opportunity tax credit (AOTC) and/or the lifetime learning credit that should be taken in each

instance.

a. A single individual with modified AGI of $32,900 and expenses of $2,440 for a

child who is a full-time college freshman.

b. A single individual with modified AGI of $44,500 and expenses of $3,080 for a

child who is a full-time college junior.

c. A couple, married filing jointly, with modified AGI of $79,300 and expenses of

$6,100 for a child who is a full-time graduate student.

Allowable

Credit

Type of Credit

Required:

Determine the amount of the child tax credit in each of the following cases:

a. A single parent with modified AGI of $214,700 and one child age 4.

b. A single parent with modified AGI of $79,300 and three children ages 7, 9, and 12.

c. A married couple, filing jointly, with modified AGI of $409,233 and two children ages 14 and 16.

d. A married couple, filing jointly, with modified AGI of $133,355 and one child age 13.

Child Tax

Credit

Allowed

Get correct answer with financial accounting question

Chapter 5 Solutions

Principles of Corporate Finance

Ch. 5 - (IRR) Check the IRRs for project F in Section 5-3.Ch. 5 - (IRR) What is the IRR of a project with the...Ch. 5 - (XIRR) What is the IRR of a project with the...Ch. 5 - Payback a. What is the payback period on each of...Ch. 5 - Payback Consider the following projects: a. If the...Ch. 5 - Prob. 3PSCh. 5 - IRR Write down the equation defining a projects...Ch. 5 - Prob. 5PSCh. 5 - IRR Calculate the IRR (or IRRs) for the following...Ch. 5 - IRR rule You have the chance to participate in a...

Ch. 5 - IRR rule Consider a project with the following...Ch. 5 - IRR rule Consider projects Alpha and Beta: The...Ch. 5 - IRR rule Consider the following two mutually...Ch. 5 - IRR rule Mr. Cyrus Clops, the president of Giant...Ch. 5 - Prob. 12PSCh. 5 - Investment criteria Consider the following two...Ch. 5 - Profitability index Look again at projects D and E...Ch. 5 - Capital rationing Suppose you have the following...Ch. 5 - Prob. 17PSCh. 5 - Prob. 18PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License