MCGRAW-HILL'S TAX.OF INDIV.+BUS.2020

20th Edition

ISBN: 9781259969614

Author: SPILKER

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 73CP

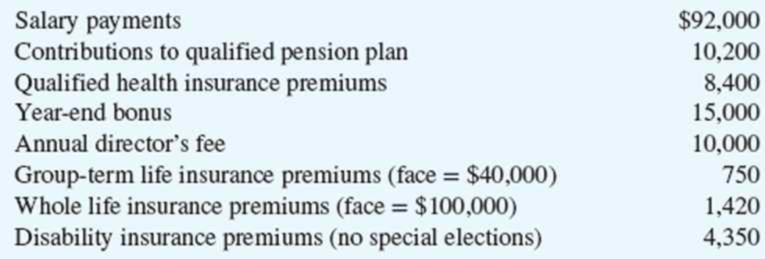

Charlie was hired by Ajax this year as a corporate executive and a member of the board of directors. During the current year, Charlie received the following payments or benefits paid on his behalf.

- a) Charlie uses the cash method and calendar year for tax purposes. Calculate Charlie’s gross income for the current year.

- b) Suppose that Ajax agrees to pay Charlie an additional $100,000 once Charlie completes five years of employment. Will this agreement alter Charlie’s gross income this year relative to your part (a) answer? Explain.

- c) Suppose that in exchange for his promise to remain with the firm for the next four years, Ajax paid Charlie four years of director’s fees in advance. Will this arrangement alter Charlie’s gross income this year relative to your part (a) answer? Explain.

- d) Assume that in lieu of a year-end bonus Ajax transferred 500 shares of Bell stock to Charlie as compensation. Further assume that the stock was listed at $35 per share and Charlie would sell the shares by year-end, at which time he expected the price to be $37 per share. Will this arrangement alter Charlie’s gross income this year relative to your part (a) answer? Explain.

- e) Suppose that in lieu of a year-end bonus Ajax made Charlie’s house payments (a total of $23,000). Will this arrangement alter Charlie’s gross income this year relative to your part (a) answer? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the total manufacturing costs charged to work in process during November

Which accounting concept supports recording bad debt expense before accounts are actually uncollectible? a) Full disclosure principle b) Matching principle c) Going concern concept d) Materiality concept need answer

Can you explain the correct approach to solve this financial accounting question?

Chapter 5 Solutions

MCGRAW-HILL'S TAX.OF INDIV.+BUS.2020

Ch. 5 - Based on the definition of gross income in 61 and...Ch. 5 - Based on the definition of gross income in 61,...Ch. 5 - Describe the concept of realization for tax...Ch. 5 - Prob. 4DQCh. 5 - Prob. 5DQCh. 5 - Prob. 6DQCh. 5 - Prob. 7DQCh. 5 - Compare how the return of capital principle...Ch. 5 - This year Jorge received a refund of property...Ch. 5 - Describe in general how the cash method of...

Ch. 5 - Prob. 11DQCh. 5 - Prob. 12DQCh. 5 - Contrast the constructive receipt doctrine with...Ch. 5 - Dewey is a lawyer who uses the cash method of...Ch. 5 - Clyde and Bonnie were married this year. Clyde has...Ch. 5 - Distinguish earned income from unearned income,...Ch. 5 - Prob. 17DQCh. 5 - Prob. 18DQCh. 5 - Prob. 19DQCh. 5 - George purchased a life annuity to provide him...Ch. 5 - Prob. 21DQCh. 5 - Prob. 22DQCh. 5 - Clem and Ida have been married for several years,...Ch. 5 - Larry Bounds has won the Gold Bat Award for...Ch. 5 - Prob. 25DQCh. 5 - Prob. 26DQCh. 5 - Prob. 27DQCh. 5 - Explain why an insolvent taxpayer is allowed to...Ch. 5 - Prob. 29DQCh. 5 - Prob. 30DQCh. 5 - Prob. 31DQCh. 5 - Prob. 32DQCh. 5 - Explain how state and local governments benefit...Ch. 5 - Prob. 34DQCh. 5 - Prob. 35DQCh. 5 - Prob. 36DQCh. 5 - Prob. 37DQCh. 5 - Tom was just hired by Acme Corporation and has...Ch. 5 - For the following independent cases, determine...Ch. 5 - Prob. 40PCh. 5 - Prob. 41PCh. 5 - Prob. 42PCh. 5 - Prob. 43PCh. 5 - Prob. 44PCh. 5 - Last year Acme paid Ralph 15,000 to install a new...Ch. 5 - Prob. 46PCh. 5 - L. A. and Paula file as married taxpayers. In...Ch. 5 - Clyde is a cash-method taxpayer who reports on a...Ch. 5 - Identify the amount, if any, that these...Ch. 5 - Ralph owns a building that he is trying to lease....Ch. 5 - Anne purchased an annuity from an insurance...Ch. 5 - Larry purchased an annuity from an insurance...Ch. 5 - Prob. 53PCh. 5 - Lanny and Shirley divorced in 2018 and do not live...Ch. 5 - Prob. 55PCh. 5 - Grady received 8,200 of Social Security benefits...Ch. 5 - Prob. 57PCh. 5 - Nikki works for the Shine Company, a retailer of...Ch. 5 - Prob. 59PCh. 5 - Prob. 60PCh. 5 - Grady is a 45-year-old employee with AMUCK Garbage...Ch. 5 - Prob. 62PCh. 5 - Prob. 63PCh. 5 - Cecil cashed in a Series EE savings bond with a...Ch. 5 - Prob. 65PCh. 5 - Prob. 66PCh. 5 - Terry was ill for three months and missed work...Ch. 5 - Prob. 68PCh. 5 - Prob. 69PCh. 5 - This year, Janelle received 200,000 in life...Ch. 5 - Prob. 71PCh. 5 - Prob. 72PCh. 5 - Charlie was hired by Ajax this year as a corporate...Ch. 5 - Irene is disabled and receives payments from a...Ch. 5 - Ken is 63 years old and unmarried. He retired at...Ch. 5 - Prob. 76CPCh. 5 - Diana and Ryan Workman were married on January 1...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

CHAPTER CASE

S&S Air’s Mortgage

Mark Sexton and Todd Story, the owners of S&S Air, Inc., were impressed by the ...

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

• Illustrate and interpret shifts in the short-run and long-run aggregate supply curves.

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Solved balance sheet December 31, 20XXarrow_forwardRose Equipment Corporation (LEC) paid $6,800 for direct materials and $11,500 for production workers' wages. Lease payments and utilities on the production facilities amounted to $7,400, while general, selling, and administrative expenses totaled $4,200. The company produced 7,500 units and sold 5,900 units at a price of $7.75 per unit. What was LEC's net income for the first year in operation? Need answerarrow_forwardSolve with explanation and accountingarrow_forward

- 6 PTSarrow_forwardDaniil Consulting is a consulting firm. The firm expects to have $64,500 in indirect costs during the year and bill customers for 8,600 hours. The cost of direct labor is $85 per hour.1. Calculate the predetermined overhead allocation rate for Daniil Consulting. 2. Daniil completed a consulting job for Sarah Miller and billed the customer for 22 hours. What was the total cost of the consulting? 3. If Daniil wants to earn a profit equal to 80% of the cost of a job, how much should the company charge Ms. Miller?arrow_forwardSales uncollected equals how many days?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

How to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation; Author: ETMONEY;https://www.youtube.com/watch?v=QdJKpSXCYmQ;License: Standard YouTube License, CC-BY

How to Calculate Federal Income Tax; Author: Edspira;https://www.youtube.com/watch?v=2LrvRqOEYk8;License: Standard Youtube License