Concept explainers

Glencoe Supply had the following

The balance in Glencoe’s allowance for doubtful accounts at the beginning of the year was $58,620 (credit). During the year, accounts in the total amount of $62,400 were written off.

Required:

1. Determine bad debt expense.

2. Prepare the

3. If Glencoe had written off $90,000 of receivables as uncollectible during the year, how much would bad debt expense reported on the income statement have changed?

(a)

Aging method:

This is a method in which the receivables are sorted according to their collectable estimation. This is done on the basis of their outstanding invoices period. Basically, aging means to check the how old an outstanding balance of receivable is present in the books.

The computation of bad debt expense.

Answer to Problem 68E

The amount of bad debt expense is

Explanation of Solution

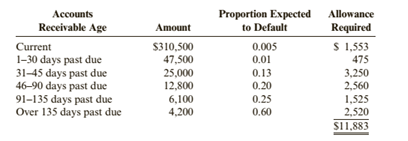

The Glencoe Supply accounts receivables and balance in allowance for doubtful accounts for the Glencoe Supply is as follows:

| Accounts Receivables | Amount |

Proportion expected | Allowance required |

| Total |

The Glencoe Supply has an opening balance in the allowance for doubtful account of

The computation of bad debt expense for Glencoe Supply is as follows:

| Allowance for doubtful accounts | |

| Opening Balance | |

| Add: Written off | |

| Add: Closing Balance |

|

| Bad Debt Expense |

(b)

Aging method:

This is a method in which the receivables are sorted according to their collectable estimation. This is done on the basis of their outstanding invoices period. Basically, aging means to check the how old an outstanding balance of receivable is present in the books.

The necessary adjusting journal entry for recording the bad debt.

Answer to Problem 68E

The necessary journal adjusting entry has been recorded properly.

Explanation of Solution

The Glencoe Supply has an opening balance in the allowance for doubtful account of

The adjusting journal entry for the Glencoe Supply is as follows:

| Date | Particulars | Debit ($) | Credit ($) |

| Bad debt expense......... Allowance for Doubtful accounts.... (Record the adjusting entry for bad debt estimation) |

(a)

Aging method:

This is a method in which the receivables are sorted according to their collectable estimation. This is done on the basis of their outstanding invoices period. Basically, aging means to check the how old an outstanding balance of receivable is present in the books.

The computation of bad debt expense after changing in the written off amount.

Answer to Problem 68E

The amount of bad debt expense after the change in the written off amount is

Explanation of Solution

The Glencoe Supply accounts receivables and balance in allowance for doubtful accounts for the Glencoe Supply is as follows:

| Accounts Receivables | Amount |

Proportion expected | Allowance required |

| Total |

The Glencoe Supply has an opening balance in the allowance for doubtful account of

The computation of bad debt expense for Glencoe Supply is as follows:

| Allowance for doubtful accounts | |

| Opening Balance | |

| Add: Written off | |

| Add: Closing Balance |

|

| Bad Debt Expense |

Want to see more full solutions like this?

Chapter 5 Solutions

Cornerstones of Financial Accounting

- General accountingarrow_forwardWhat was the total contribution margin?arrow_forwardBradford Enterprises sells two products, blue pens and green notebooks. Bradford predicts that it will sell 3,200 blue pens and 900 green notebooks in the next period. The unit contribution margins for blue pens and green notebooks are $2.80 and $4.20, respectively. What is the weighted average unit contribution margin? Provide answerarrow_forward

- can you help me with this General accounting questionarrow_forwardThe Foundational 15 (Static) [LO6-2, LO6-3, LO6-4, LO6-5, LO6-6) [The following information applies to the questions displayed below.) Cane Company manufactures two products called Alpha and Beta that sell for $120 and $80, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 100,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Cane Company manufactures two products called Alpha and Beta that sell for $120 and $80, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 100,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Direct materials Direct labor Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Total cost per unit $100 The…arrow_forwardwhat was the cost of merchandise purchased during the year?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning