Concept explainers

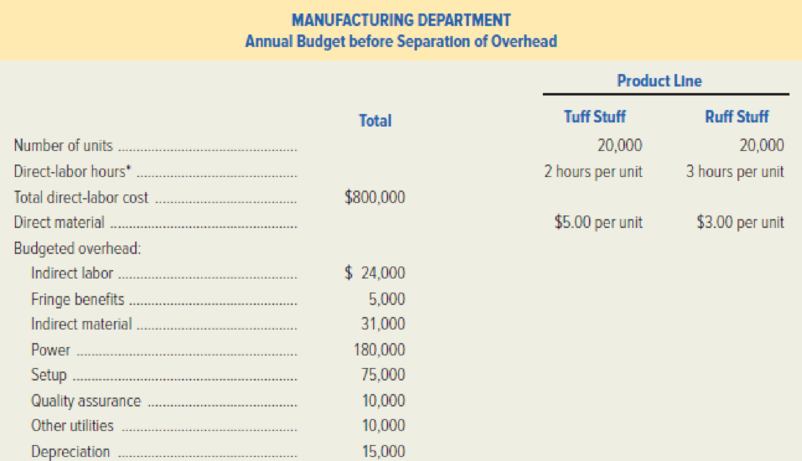

Marconi Manufacturing produces two items in its Trumbull Plant: Tuff Stuff and Ruff Stuff. Since inception, Marconi has used only one manufacturing-

The two major indirect

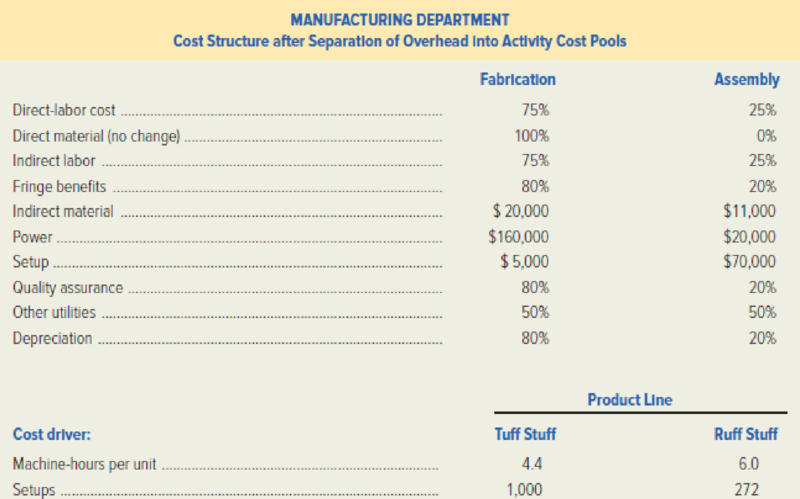

A decision was made to separate the Manufacturing Department costs into two activity cost pools as follows:

Fabrication: machine hours will be the cost driver.

Assembly: number of setups will be the cost driver.

The controller has gathered the following information.

*Direct-labor hourly rate is the same in both departments.

Required:

- 1. Assigning overhead based on direct-labor hours, calculate the following:

- a. Total budgeted cost of the Manufacturing Department.

- b. Unit cost of Tuff Stuff and Ruff Stuff.

- 2. After separation of overhead into activity cost pools, compute the total budgeted cost of each activity: Fabrication and Assembly.

- 3. Using activity-based costing, calculate the unit costs for each product. (In computing the pool rates for the Fabrication and Assembly activity cost pools, round to the nearest cent. Then, in computing unit product costs, round to the nearest cent.)

- 4. Discuss how a decision regarding the production and pricing of Ruff Stuff will be affected by the results of your calculations in the preceding requirements.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Problem Set 1 You are the audit manager in charge of the audit of Carico Ltd. The company's year-end is 31 December, and Carico has been a client for six years. The company purchases and resells products for the energy industry including valves, fittings, pumps etc. Clients vary in size from small operators to large companies. No manufacturing takes place in Carico. Information on the company's financial performance is available as follows: 2024 Forecast 2023 Actual $'000 $'000 Revenue 10,088 8,965 Cost of sales (8,184) (6,575) Gross profit 1904 2390 Administration costs (1039) (990) Distribution costs (500) (500) Net profit 365 900 Non-current assets (at net book value)…arrow_forwardDecember, and Carico has been a client for six years. The company purchases and resells products for the energy industry including valves, fittings, pumps etc. Clients vary in size from small operators to large companies. No manufacturing takes place in Carico.Information on the company's financial performance is available as follows:2024 Forecast 2023 Actual$'000 $'000Revenue 10,088 8,965Cost of sales (8,184) (6,575)Gross profit 1904 2390Administration costs (1039) (990)Distribution costs (500) (500)Net profit 365 900Non-current assets (at net book value) 840 980Current assetsInventory 50 296Receivables 1300 910Cash and bank 110 358Total assets 2300 2544Capital and reservesShare capital 200 200Accumulated profits 1100 1315Total shareholders' funds 1300 1515Non-current liabilities 300 452Current liabilities 700 5772300 2544Other information The industry that Carico trades in has seen moderate growth of 6% over the last year. Non-current assets mainly relate to company premises for…arrow_forwardOn January 1, 2025, Cheyenne Corporation purchased 20% of the common shares of Ayayai Company for $182,000. During the year, Ayayai earned net income of $90,000 and paid dividends of $22,500. Prepare the entries for Cheyenne to record the purchase and any additional entries related to this investment in Ayayai Company in 2025. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Equity Investments Cash (To record purchase of stock.) Cash Interest Revenue (To record receipt of dividends.) Equity Investments Investment Income (To record revenue.) Debit 65,000 2,600 Credit 65,000 2,600arrow_forward

- Explain what we mean by consolidation (or consolidated financial statements)?arrow_forwardWhat is the Equity Method? How and when is this method applied to account for investment securities owned by a company?arrow_forwardIndigo Corporation purchased for $277,000 a 30% interest in Murphy, Inc. This investment enables Indigo to exert significant influence over Murphy. During the year, Murphy earned net income of $183,000 and paid dividends of $64,000. Prepare Indigo's journal entries related to this investment. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation (To record the purchase.) (To record the net income.) (To record the dividend.) Debit Creditarrow_forward

- Indigo Corporation purchased for $277,000 a 30% interest in Murphy, Inc. This investment enables Indigo to exert significant influence over Murphy. During the year, Murphy earned net income of $183,000 and paid dividends of $64,000. Prepare Indigo's journal entries related to this investment. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation (To record the purchase.) (To record the net income.) (To record the dividend.) Debit Creditarrow_forwardCheyenne Corporation purchased 400 shares of Sherman Inc. common stock for $12,900 (Cheyenne does not have significant influence). During the year, Sherman paid a cash dividend of $3.25 per share. At year-end, Sherman stock was selling for $37.00 per share. Prepare Cheyenne' journal entries to record (a) the purchase of the investment, (b) the dividends received, and (c) the fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation (a) Debt Investments Cash (b) Cash Dividend Revenue (c) Fair Value Adjustment Unrealized Holding Gain or Loss - Income Debit Creditarrow_forwardCrane Corporation purchased 360 shares of Sherman Inc. common stock for $11,800 (Crane does not have significant influence). During the year, Sherman paid a cash dividend of $3.25 per share. At year-end, Sherman stock was selling for $34.50 per share. Prepare Crane' journal entries to record (a) the purchase of the investment, (b) the dividends received, and (c) the fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit (a) (b) (c)arrow_forward

- Indigo Corporation purchased trading investment bonds for $65,000 at par. At December 31, Indigo received annual interest of $2,600, and the fair value of the bonds was $62,200. Prepare Indigo' journal entries for (a) the purchase of the investment, (b) the interest received, and (c) the fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit (a) (b) (c)arrow_forwardSwifty Corporation purchased trading investment bonds for $40,000 at par. At December 31, Swifty received annual interest of $1,600, and the fair value of the bonds was $37,600. Prepare Swifty' journal entries for (a) the purchase of the investment, (b) the interest received, and (c) the fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit (a) (b) (c)arrow_forwardabout investment securities owned by a company, what do we mean by “significant influence”?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning