GEN COMBO FUNDAMENTALS OF COST ACCOUNTING; CONNECT 1S ACCESS CARD

5th Edition

ISBN: 9781259911651

Author: William N. Lanen Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 59P

Cost Estimation: Simple Regression

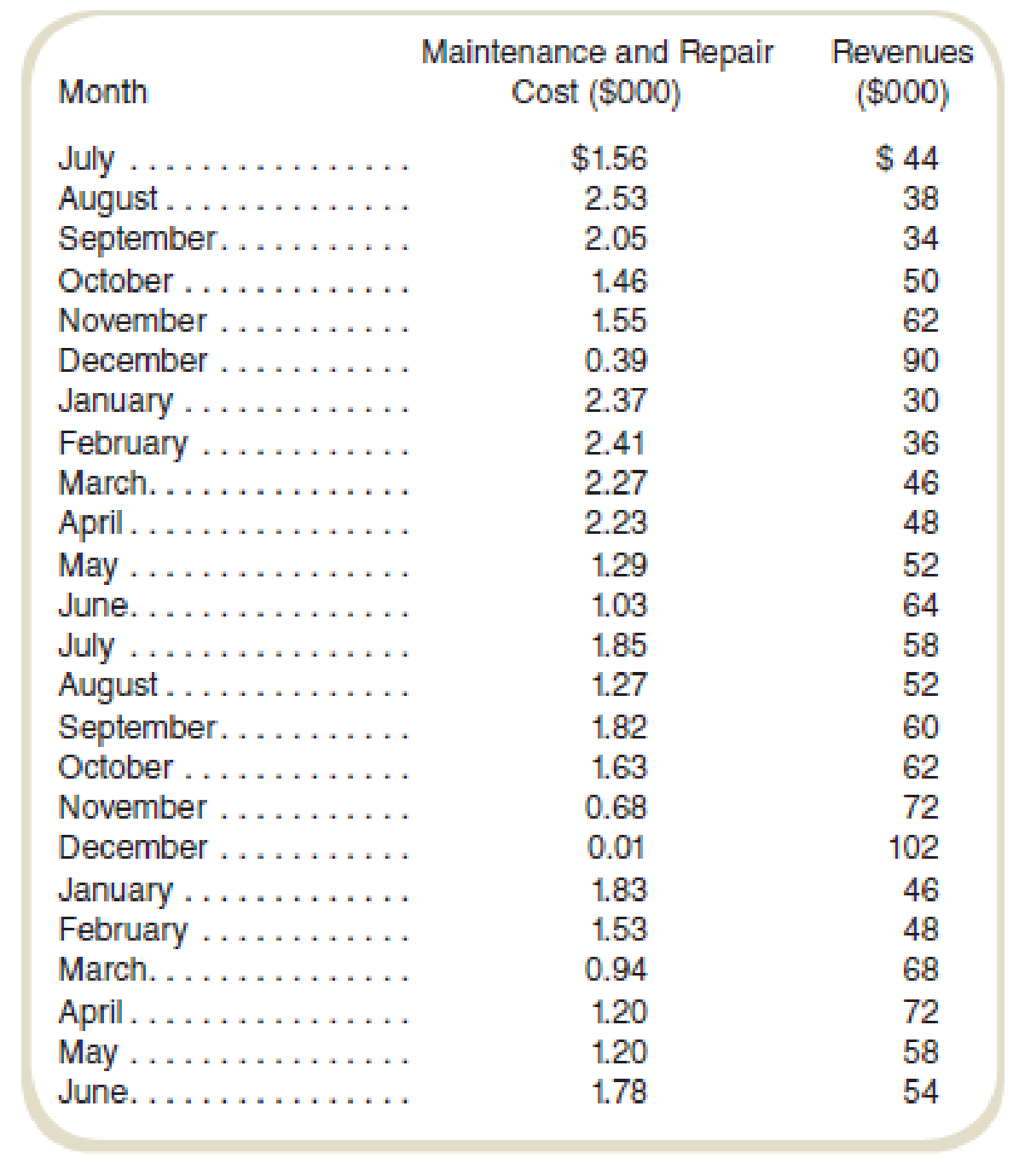

The following information on maintenance and repair costs and revenues for the last two years is available from the accounting records at Arnie’s Arcade & Video Palace. Arnie has asked you to help him understand the relation between business volume and maintenance and repair cost.

Required

- a. Ignoring the data, would you predict that, in general, there is a positive relation between revenues and maintenance and repair costs? Why?

- b. Estimate a linear regression with maintenance and repair cost as the dependent variable and revenue as the independent variable. Does the result support your prediction in requirement (a)? What are some factors that may explain the result?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Applying the Accounting Equation and Assessing Financial Statement LinkagesThe following information is available for Advanced Micro Devices (AMD) and Intel for a recent fiscal year.• AMD’s assets increased by $1,004 million and its liabilities increased by $334 million.• Intel’s assets increased by $4,714 million and its liabilities decreased by $830 million.a. Complete the following table.

Assets, beginning

Assets, end

Liabilities,

Liabilities,

Stockholders’ Equity,

(in $ millions)

of year

of year

beginning of year

end of year

end of year

AMD

Answer 1

$4,556

$2,956

Answer 2

Answer 3

Intel

$123,249

Answer 4

Answer 5

$53,400

Answer 6

b. Calculate average assets for each company.

(in $ millions)

Average Assets

AMD

Answer 7

Intel

Answer 8

c. Which company has the larger proportion of its assets financed by the company’s owners at year-end? Answer 9

Applying the Accounting Equation and Assessing Financial Statement LinkagesThe following information is available for Advanced Micro Devices (AMD) and Intel for a recent fiscal year.• AMD’s assets increased by $1,004 million and its liabilities increased by $334 million.• Intel’s assets increased by $4,714 million and its liabilities decreased by $830 million.a. Complete the following table.

Assets, beginning

Assets, end

Liabilities,

Liabilities,

Stockholders’ Equity,

(in $ millions)

of year

of year

beginning of year

end of year

end of year

AMD

Answer 1

$4,556

$2,956

Answer 2

Answer 3

Intel

$123,249

Answer 4

Answer 5

$53,400

Answer 6

b. Calculate average assets for each company.

(in $ millions)

Average Assets

AMD

Answer 7

Intel

Answer 8

c. Which company has the larger proportion of its assets financed by the company’s owners at year-end? Answer 9

Formulating Financial Statements from Raw Data and Calculating RatiosFollowing is selected financial information from JM Smucker Co. for a recent fiscal year ($ millions).

Current assets, end of year

$2,010.1

Noncurrent liabilities, end of year

$5,962.1

Cash, end of year

169.9

Stockholders' equity, end of year

8,140.1

Cash for investing activities

(355.5)

Cash from operating activities

1,136.3

Cost of product sold

5,298.2

Total assets, beginning of year

16,284.2

Total liabilities, end of year

7,914.9

Revenue

7,998.9

Cash for financing activities

(945.2)

Total expenses, other than cost of product sold

2,069.0

Stockholders' equity, beginning of year

8,124.8

Dividends paid

(418.1)

Requireda. Prepare the income statement for the year.

J.M. Smucker Company, Inc.

Income Statement ($ millions)

Answer 1

Answer 2

Answer 3

Answer 4

Answer 5

Answer 6

Answer 7

Answer 8

Answer 9

Answer 10

b. Prepare the balance sheet at the end of the year.

J.M.…

Chapter 5 Solutions

GEN COMBO FUNDAMENTALS OF COST ACCOUNTING; CONNECT 1S ACCESS CARD

Ch. 5 - What are the common methods of cost estimation?Ch. 5 - Prob. 2RQCh. 5 - Under what conditions is the engineering estimates...Ch. 5 - If one wishes simply to prepare a cost estimate...Ch. 5 - When using cost estimation methods based on past...Ch. 5 - Prob. 6RQCh. 5 - What is the difference between R2 and adjusted R2?Ch. 5 - Why are accurate cost estimates important?Ch. 5 - What are three practical implementation problems...Ch. 5 - Why is it important to incorporate learning into...

Ch. 5 - What are some complications that can arise when...Ch. 5 - The following costs are labeled fixed or variable...Ch. 5 - Prob. 13CADQCh. 5 - When preparing cost estimates for account analysis...Ch. 5 - How can one compensate for the effects of price...Ch. 5 - Prob. 16CADQCh. 5 - Prob. 17CADQCh. 5 - A decision maker is interested in obtaining a cost...Ch. 5 - Consider the Business Application item Using...Ch. 5 - A friend comes to you with the following problem....Ch. 5 - After doing an account analysis and giving the...Ch. 5 - In doing cost analysis, you realize that there...Ch. 5 - Prob. 23CADQCh. 5 - Are learning curves likely to affect materials...Ch. 5 - McDonalds, the fast-food restaurant, is known for...Ch. 5 - Prob. 26CADQCh. 5 - A manager asks you for a cost estimate to open a...Ch. 5 - Methods of Estimating Costs: Engineering Estimates...Ch. 5 - Methods of Estimating Costs: Engineering Estimates...Ch. 5 - Methods of Estimating Costs: Account Analysis The...Ch. 5 - Methods of Estimating Costs: Account Analysis...Ch. 5 - Methods of Estimating Costs: High-Low, Ethical...Ch. 5 - Methods of Estimating Costs: High-Low Adriana...Ch. 5 - Prob. 34ECh. 5 - Methods of Estimating Costs: Scattergraph Prepare...Ch. 5 - Methods of Estimating Costs: Simple Regression...Ch. 5 - Prob. 37ECh. 5 - Methods of Estimating Costs: Multiple Regression...Ch. 5 - Methods of Estimating Costs: High-Low Davis Stores...Ch. 5 - Methods of Estimating Costs: Scattergraph Prepare...Ch. 5 - Prob. 41ECh. 5 - Interpretation of Regression Results: Multiple...Ch. 5 - Interpretation of Regression Results Brodie...Ch. 5 - Prob. 44ECh. 5 - Interpretation of Regression Results: Simple...Ch. 5 - Learning Curves Assume that General Dynamics,...Ch. 5 - Learning Curves Assume that Whee, Cheatham, and...Ch. 5 - Learning Curves (Appendix B) Refer to the example...Ch. 5 - Prob. 49PCh. 5 - Regressions from Published Data Obtain 13 years of...Ch. 5 - Prob. 51PCh. 5 - High-Low Method, Scattcrgraph Cubicle Solutions...Ch. 5 - High-Low Method, Scattcrgraph Academy Products...Ch. 5 - Interpretation of Regression Results: Simple...Ch. 5 - Interpretation of Regression Results: Simple...Ch. 5 - Interpretation of Regression Results: Multiple...Ch. 5 - Interpretation of Regression Results: Simple...Ch. 5 - Interpretation of Regression Results Brews 4 U is...Ch. 5 - Cost Estimation: Simple Regression The following...Ch. 5 - Cost Estimation: Simple and Multiple Regression...Ch. 5 - Methods of Cost Analysis: Account Analysis, Simple...Ch. 5 - Learning Curves (Appendix B) Refer to the example...Ch. 5 - Learning Curves (Appendix B) Krylon Company...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial Accounting Question Solution with Correct Methodarrow_forwardComputing Return on Assets and Applying the Accounting Equation Nordstrom Inc. reports net income of $564 million for a recent fiscal year. At the beginning of that fiscal year, Nordstrom had $8,115 million in total assets. By fiscal year end, total assets had decreased to $7,886 million. What is Nordstrom’s ROA? Note: Enter answer as a percentage rounded to the nearest 2 decimal places (ex: 24.58%). ROA Answer 1arrow_forwardGive Answer of this Questionarrow_forward

- Val Sims is a self-employed CPA and is the sole practitioner in her tax practice. She has had several situations arise this year involving client representation, client records, and client fee arrangements. Val is concerned that her actions may be in violation of the Circular 230 regulations governing practice before the Internal Revenue Service (IRS). Indicate whether Val is in violation of the regulations for each of the actions described. 1. Howard Corporation's prior-year income tax return was prepared and filed by the company's controller. The return was audited and Howard Corporation paid the additional income taxes assessed by the IRS, including penalties and interest. Although Howard Corporation agreed with income tax assessment, it did not agree with the penalties and interest determined by the IRS. Howard Corporation engaged Val to file a refund claim in connection with the penalties and interest assessed. Val charged the client a fee based on 30 percent of the amount by…arrow_forwardHello I'm Waiting For This General Accounting Question Solutionarrow_forwardPlease I want Answer of this Financial Accounting Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

How to Estimate Project Costs: A Method for Cost Estimation; Author: Online PM Courses - Mike Clayton;https://www.youtube.com/watch?v=YQ2Wi3Jh3X0;License: Standard Youtube License