Accounting

27th Edition

ISBN: 9781337514071

Author: WARREN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 5.8EX

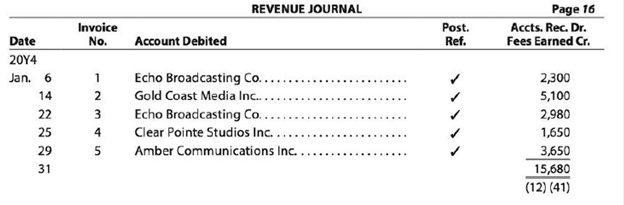

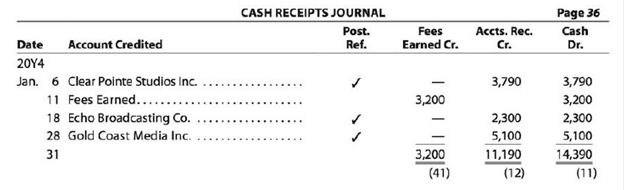

The revenue and cash receipts journals for Polaris Productions Inc. follow. The accounts receivable control account has a January 1, 20Y4, balance of $3,790 consisting of an amount due from Clear Pointe Studios Inc.

Prepare a listing of the accounts receivable customer balances and verify that the total agrees with the ending balance of the accounts receivable controlling account.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

General Accounting

Can you please solve this financial accounting issue?

Please get correct solution this accounting problem not use ai

Chapter 5 Solutions

Accounting

Ch. 5 - Why would a company maintain separate accounts...Ch. 5 - What are the major advantages of the use of...Ch. 5 - Prob. 3DQCh. 5 - How many postings to Fees Earned for the month...Ch. 5 - During the current month, the following errors...Ch. 5 - Prob. 6DQCh. 5 - What is an electronic form, and how is it used in...Ch. 5 - When are transactions posted in a computerized...Ch. 5 - What happens to the special journal in a...Ch. 5 - Prob. 10DQ

Ch. 5 - Revenue journal The following revenue transactions...Ch. 5 - Revenue journal The following revenue transactions...Ch. 5 - Accounts receivable subsidiary ledger The debits...Ch. 5 - Accounts receivable subsidiary ledger The debits...Ch. 5 - Purchases journal The following purchase...Ch. 5 - Purchases journal The following purchase...Ch. 5 - Accounts payable subsidiary ledger The debits and...Ch. 5 - Accounts payable subsidiary ledger The debits and...Ch. 5 - Segment analysis McHale Company does business in...Ch. 5 - Segment analysis Back Country Life, Inc., does...Ch. 5 - Identify postings from revenue journal Using the...Ch. 5 - Accounts receivable ledger Based on the data...Ch. 5 - Identify journals Assuming the use of a two-column...Ch. 5 - Identify journals Assuming the use of a two-column...Ch. 5 - Identify transactions in accounts receivable...Ch. 5 - Prepare journal entries in a revenue journal...Ch. 5 - Posting a revenue journal The revenue journal for...Ch. 5 - Accounts receivable subsidiary ledger The revenue...Ch. 5 - Revenue and cash receipts journals Transactions...Ch. 5 - Revenue and cash receipts journals Lasting Summer...Ch. 5 - Prob. 5.11EXCh. 5 - Prob. 5.12EXCh. 5 - Identify transactions in accounts payable...Ch. 5 - Prepare journal entries in a purchases journal...Ch. 5 - Posting a purchases journal The purchases journal...Ch. 5 - Accounts payable subsidiary ledger The cash...Ch. 5 - Purchases and cash payments journals Transactions...Ch. 5 - Purchases and cash payments journals Happy Tails...Ch. 5 - Error in accounts payable subsidiary ledger After...Ch. 5 - Prob. 5.20EXCh. 5 - Cash receipts journal The following cash receipts...Ch. 5 - Computerized accounting systems Most computerized...Ch. 5 - Prob. 5.23EXCh. 5 - Prob. 5.24EXCh. 5 - Segment revenue horizontal analysis Starbucks...Ch. 5 - Prob. 5.26EXCh. 5 - Segment revenue horizontal and vertical analyses...Ch. 5 - Revenue journal; accounts receivable subsidiary...Ch. 5 - Revenue and cash receipts journals; accounts...Ch. 5 - Purchases, accounts payable subsidiary account,...Ch. 5 - Purchases and cash payments journals; accounts...Ch. 5 - All journals and general ledger; trial balance The...Ch. 5 - Revenue journal; accounts receivable subsidiary...Ch. 5 - Revenue and cash receipts journals; accounts...Ch. 5 - Purchases, accounts payable account, and accounts...Ch. 5 - Purchases and cash payments journals; accounts...Ch. 5 - All journals and general ledger; trial balance The...Ch. 5 - Ethics in Action Netbooks Inc. provides accounting...Ch. 5 - Communication Internet-based accounting software...Ch. 5 - Manual vs. computerized accounting systems The...Ch. 5 - Accounts receivable and accounts payable A...Ch. 5 - Design of accounting systems For the past few...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help with this accounting questionarrow_forwardWhat is the number of shares outstanding for this accounting question?arrow_forwardQuestion 2Anti-Pandemic Pharma Co. Ltd. reports the following information inits income statement:Sales = $5,250,000;Costs = $2, 173,000;Other expenses = $187,400;Depreciation expense = $79,000;Interest expense= $53,555;Taxes = $76,000;Dividends = $69,000.$136,700 worth of new shares were also issued during the year andlong-term debt worth $65,300 was redeemed.a) Compute the cash flow from assetsb) Compute the net change in working capitalarrow_forward

- What is the total cost of job number w2398 on these financial accounting question?arrow_forwardHow much is the direct materials price variance for this accounting question?arrow_forwardMiguel Manufacturing Company uses a predetermined manufacturing overhead rate based on direct labor hours. At the beginning of 2023, they estimated total manufacturing overhead costs at $2,352,000, and they estimated total direct labor hours at 7,000. The administration and selling overheads are to be absorbed in each job cost at 15% of prime cost. Distribution cost should be added to each job according to quotes from outside carriage companies. The company wishes to quote for job # 222. Job stats are as follows: Direct materials cost Direct labour cost $173,250 $240,000 500 hours Direct labour hours Special Design Cost Distribution quote from haulage company Units of product produced $8,750 $21,700 400 cartons a) Compute Miguel's Manufacturing Company predetermined manufacturing overhead rate for 2023. b) How much manufacturing overhead was allocated to Job #222? c) Calculate the total cost & quotation price of Job #222, given that a margin of 25% is applied. d) How much was the…arrow_forward

- Faced with rising pressure for a $17 per hour minimum wage rate, the farming industry is currently exploring the possible use of robotics to replace some farm workers. The Produce Bot is one such robot; its job is to thin out a field of lettuce, removing the least promising buds of lettuce. By removing these weaker plants, the stronger lettuce plants have more room to grow. Assume the following facts: i (Click the icon to view the information.) While the Produce Bot itself may be in workable condition for up to five years, assume that the farm would view its implementation as a one-year experiment. Requirement Perform a cost-benefit analysis for the first year of implementation to determine whether the Produce Bot would be a financially viable investment if the minimum wage is raised to $17 per hour. (Round your answers to the „bola dallon\ Cost-Benefit Analysis Expected Benefits (Cost Savings): Total expected benefits Expected Costs: Total expected costs Net expected benefit (cost)…arrow_forwardPlease help me with the last entry. The dropdown options are the revenue accounts i can usearrow_forwardPlease help me with this problem!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License