Concept explainers

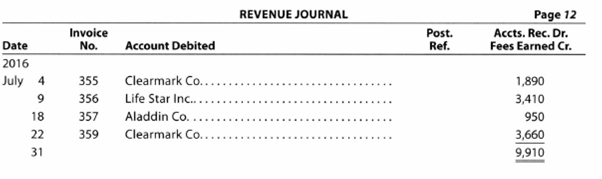

Posting a revenue journal

The revenue journal for Sapling Consulting Inc. follows. The

a. Prepare a T account for the accounts receivable customer accounts.

b.

c. Prepare T accounts for the accounts receivable and fees earned accounts. Post control totals to the two accounts, and determine the ending balances.

d. Prepare a schedule of the customer account balances to verify the equality of the sum of the customer account balances and the accounts receivable controlling account balance.

e. How might a computerized system differ from a revenue journal in recording revenue transactions?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

ACCOUNTING,CHAP.1-13

- Lockheed Corp. has assets of $342,750 and liabilities of $156,830. Then the firm receives $45,620 from an investor in exchange for new stock, which the firm issues to the investor. What is the value of stockholders' equity after the investment?arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardA manufacturing company had beginning work-in-process inventory of $24,000, direct materials added of $85,000, direct labor of $63,000, and manufacturing overhead of $42,000. If the ending work-in-process inventory is $31,000, what is the cost of goods manufactured?arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forwardPlease explain this financial accounting problem by applying valid financial principles.arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning