Concept explainers

All journals and general ledger;

The transactions completed by Revere Courier Company during December 2016, the first month of the fiscal year, were as follows:

Dec. 1. Issued Check No. 610 for December rent, $4,500.

2. Issued Invoice No. 940 to Capps Co., $1,980.

3. Received check for $5,100 from Trimble Co. in payment of account.

5. Purchased a vehicle on account from Boston Transportation, $39,500.

6. Purchased office equipment on account from Austin Computer Co., $4,800.

6. Issued Invoice No. 941 to Dawar Co., $5,680.

9. Issued Check No. 611 for fuel expense, $800.

10. Received check from Sing Co. in payment of $4,850 invoice.

10. Issued Check No. 612 for $360 to Office To Go Inc. in payment of invoice.

10. Issued Invoice No. 942 to Joy Co., $2,140.

11. Issued Check No. 613 for $3,240 to Essential Supply Co. in payment of account.

11. Issued Check No. 614 for $650 to Porter Co. in payment of account.

12. Received check from Capps Co. in payment of $1,980 invoice of December 2.

13. Issued Check No. 615 to Boston Transportation in payment of $39,500 balance of

December 5.

16. Issued Check No. 616 for $40,900 for cash purchase of a vehicle.

16. Cash fees earned for December 1-16, $21,700.

17. Issued Check No. 617 for miscellaneous administrative expense, $600.

18. Purchased maintenance supplies on account from Essential Supply Co., $1,750.

19. Purchased the following on account from McClain Co.: maintenance supplies, $1,500; office supplies, $325.

20. Issued Check No. 618 in payment of advertising expense, $1,990.

20. Used $3,600 maintenance supplies to repair delivery vehicles.

23. Purchased office supplies on account from Office To Go Inc., $440.

24. Issued Invoice No. 943 to Sing Co., $6,400.

24. Issued Check No. 619 to S. Holmes as a personal withdrawal, $3,200.

25. Issued Invoice No. 944 to Dawar Co., $5,720.

25. Received check for $4,100 from Trimble Co. in payment of balance.

26. Issued Check No. 620 to Austin Computer Co. in payment of $4,800 invoice of December 6.

30. Issued Check No. 621 for monthly salaries as follows: driver salaries, $16,900; office salaries, $7,600.

31. Cash fees earned for December 17-31, $19,700.

31. Issued Check No. 622 in payment for office supplies, $310.

Instructions

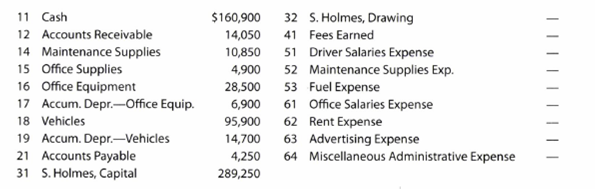

1. Enter the following account balances in the general ledger as of December 1:

2. Journalize the transactions for December 2016, using the following journals similar to those illustrated in this chapter: cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), single column revenue journal (p. 35), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the

3. Post the appropriate individual entries to the general ledger.

4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances.

5. Prepare a trial balance.

1, 3 and 4.

General Ledger

General ledger refers to the ledger that records all the transactions of the business related to the company’s assets, liabilities, owners’ equities, revenues, and expenses. Each subsidiary ledger is represented in the general ledger by summarizing the account.

Purchase journal:

Purchase journal refers to the journal that is used to record all purchases on account. In the purchase journal, all purchase transactions are recorded only when the business purchased the goods on account. For example, the business purchased cleaning supplies on account.

Cash receipts journal:

Cash receipts journal refers to the journal that is used to record all transaction which involves the cash receipts. For example, the business received cash from rent.

Cash payments journal:

Cash payments journal refers to the journal that is used to record all transaction which involves the cash payments. For example, the business paid cash to employees (salary paid to employees).

Revenue journal:

Revenue journal refers to the journal that is used to record the fees earned on account. In the revenue journal, all revenue transactions are recorded only when the business performed service to customer on account (credit).

To post: The account balances and individual entries to the appropriate general ledger accounts.

Explanation of Solution

Prepare the general ledger for given accounts as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

Debit ($) |

Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 1,60,900 | |||

| 31 | CR31 | 57,430 | 2,18,330 | ||||

| 31 | CP34 | 1,25,350 | 92,980 | ||||

Table (1)

|

Account: Accounts receivable |

Account no. 12 | ||||||

| Date | Items | Post Ref. |

Debit ($) |

Credit ($) | Balance | ||

Debit ($) |

Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 14,050 | |||

| 31 | R35 | 21,920 | 35,970 | ||||

| 31 | CR31 | 16,030 | 19,940 | ||||

Table (2)

| Account: Maintenance Supplies | Account no. 14 | ||||||

| Date | Items | Post Ref. |

Debit ($) |

Credit ($) | Balance | ||

Debit ($) |

Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 10,850 | |||

| 20 | J1 | 3,600 | 7,250 | ||||

| 31 | P37 | 3,250 | 10,500 | ||||

Table (3)

| Account: Office Supplies | Account no. 15 | ||||||

| Date | Items | Post Ref. |

Debit ($) |

Credit ($) | Balance | ||

Debit ($) |

Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 4,900 | |||

| 31 | CP34 | 310 | 5,210 | ||||

| 31 | P37 | 765 | 5,975 | ||||

Table (4)

| Account: Office Equipment | Account no. 16 | ||||||

| Date | Items | Post Ref. |

Debit ($) |

Credit ($) | Balance | ||

Debit ($) |

Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 28,500 | |||

| 6 | P37 | 4,800 | 33,300 | ||||

Table (5)

|

Account: Accumulated Depreciation-Office Equip. | Account no. 17 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 6,900 | |||

Table (6)

| Account: Vehicles | Account no.18 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 95,900 | |||

| 5 | P37 | 39,500 | 1,35,400 | ||||

| 16 | CP34 | 40,900 | 1,76,300 | ||||

Table (7)

|

Account: Accumulated Depreciation -Vehicles | Account no. 19 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 14,700 | |||

Table (8)

| Account: Accounts Payable | Account Number 21 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 4,250 | |||

| 31 | P37 | 48,315 | 52,565 | ||||

| 31 | CP34 | 48,550 | 4,015 | ||||

Table (9)

| Account: S. Holmes, Capital | Account Number 31 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 2,89,250 | |||

Table (10)

| Account: S. Holmes, Drawing | Account Number 32 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 24 | CP34 | 3,200 | 3,200 | |||

Table (11)

| Account: Fees Earned | Account Number 41 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 16 | CR31 | 21,700 | 21,700 | |||

| 31 | CR31 | 19,700 | 41,400 | ||||

| 31 | R35 | 21,920 | 63,320 | ||||

Table (12)

| Account: Driver Salaries Expense | Account Number 51 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 30 | CP34 | 16,900 | 16,900 | |||

Table (13)

| Account: Maintenance Supplies Exp. | Account Number 52 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 20 | J1 | 3,600 | 3,600 | |||

Table (14)

| Account: Fuel Expense | Account Number 53 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 9 | CP34 | 800 | 800 | |||

Table (15)

| Account: Office Salaries Expense | Account Number 61 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 30 | CP34 | 7,600 | 7,600 | |||

Table (16)

| Account: Rent Expense | Account Number 62 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | CP34 | 4,500 | 4,500 | |||

Table (17)

| Account: Advertising Expense | Account Number 63 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 20 | CP34 | 1,990 | 1,990 | |||

Table (18)

|

Account: Miscellaneous Administrative Expense | Account Number 64 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 17 | CP34 | 600 | 600 | |||

Table (19)

2 and 4.

To Prepare: Purchase journal, Cash receipts journal, single column revenue journal, cash payments journal and two column general journal

Explanation of Solution

Purchase journal

Purchase journal of Company RC in the month of December, 2016 is as follows:

Purchase Journal

Page 37

| Date | Account Credited | Post Ref. | Accounts Payable Cr. | Maintenance Supplies Dr. | Office Supplies Dr. | Other Accounts Dr. | Post Ref. | Amount ($) | |

| Dec. | 5 | B Transportation | ✓ | 39,500 | Vehicles | 18 | 39,500 | ||

| 6 | A Computer Co. | ✓ | 4,800 | Office Equipment | 16 | 4,800 | |||

| 18 | E Supply Co. | ✓ | 1,750 | 1,750 | |||||

| 19 | M Co. | ✓ | 1,825 | 1,500 | 325 | ||||

| 23 | O T G Inc. | ✓ | 440 | 440 | |||||

| 31 | 48,315 | 3,250 | 765 | 44,300 | |||||

| (21) | (14) | (15) | ✓ | ||||||

Table (20)

Cash Receipt Journal

Cash receipts journal of Company RC in the month of December, 2016 is as follows:

Cash Receipts Journal

Page 31

| Date | Account Credited | Post Ref. | Other Accounts Cr. | Accounts Receivable Cr. | Cash Dr. | |

| Dec. | 3 | T Co. | ✓ | 5,100 | 5,100 | |

| 10 | S Co. | ✓ | 4,850 | 4,850 | ||

| 12 | C Co. | ✓ | 1,980 | 1,980 | ||

| 16 | Fees Earned | 41 | 21,700 | 21,700 | ||

| 25 | T Co. | ✓ | 4,100 | 4,100 | ||

| 31 | Fees Earned | 41 | 19,700 | 19,700 | ||

| 31 | 41,400 | 16,030 | 57,430 | |||

| ✓ | (12) | (11) | ||||

Table (21)

Revenue Journal

Revenue journal of Company RC in the month of December, 2016 is as follows:

Revenue Journal

Page 35

| Date | Invoice No. | Accounts Debited | Post Ref. | Accounts Receivable Dr. Fees Earned Cr. | |

| Dec. | 2 | 940 | C Co. | ✓ | 1,980 |

| 6 | 941 | D Co. | ✓ | 5,680 | |

| 10 | 942 | J Co. | ✓ | 2,140 | |

| 24 | 943 | S Co. | ✓ | 6,400 | |

| 25 | 944 | D Co. | ✓ | 5,720 | |

| 31 | 21,920 | ||||

| (12)(41) | |||||

Table (22)

Cash Payment Journal

Cash payment journal of Company RC in the month of December is as follows:

Cash payment journal

Page 34

| Date | Ck No. | Account Credited | Post Ref. | Other Accounts Dr. | Accounts Payable Dr. | Cash Cr. | |

| Dec. | 1 | 610 | Rent Expense | 62 | 4,500 | 4,500 | |

| 9 | 611 | Fuel Expense | 53 | 800 | 800 | ||

| 10 | 612 | O T G Inc. | ✓ | 360 | 360 | ||

| 11 | 613 | E Supply Co. | ✓ | 3,240 | 3,240 | ||

| 11 | 614 | Porter Co. | ✓ | 650 | 650 | ||

| 13 | 615 | B Transportation | ✓ | 39,500 | 39,500 | ||

| 16 | 616 | Vehicles | 18 | 40,900 | 40,900 | ||

| 17 | 617 | Misc. Admin. Expense | 64 | 600 | 600 | ||

| 20 | 618 | Advertising Expense | 63 | 1,990 | 1,990 | ||

| 24 | 619 | S. Holmes, Drawing | 32 | 3,200 | 3,200 | ||

| 26 | 620 | A Computer Co. | ✓ | 4,800 | 4,800 | ||

| 30 | 621 | Driver Salaries Exp. | 51 | 16,900 | 16,900 | ||

| Office Salaries Exp. | 61 | 7,600 | 7,600 | ||||

| 31 | 622 | Office Supplies | 15 | 310 | 310 | ||

| 31 | 76,800 | 48,550 | 1,25,350 | ||||

| ✓ | (21) | (11) | |||||

Table (23)

3.

To Prepare: Two column general journal to record individual entry of RC Company.

Explanation of Solution

General journal

General journal of Company RC in the month of December is as follows:

| Journal | Page 1 | ||||

| Date | Description | Post Ref. | Debit ($) |

Credit ($) | |

| 2016 | |||||

| Dec. | 20 | Maintenance Supplies Expenses | 52 | 3,600 | |

| Maintenance Supplies | 14 | 3,600 | |||

| (To record the use of maintenance supplies to repair delivery vehicles) | |||||

Table (24)

5.

To Prepare: Unadjusted Trial balances of RC Company at December 31, 2016.

Explanation of Solution

Unadjusted Trial balances of RC Company at December 31, 2016 is presented below:

| REVERE COURIER COMPANY | |||

| Unadjusted Trial Balance | |||

| December 31, 2016 | |||

| Account No. | Debit Balances ($) |

Credit Balances ($) | |

| Cash | 11 | 92,980 | |

| Accounts Receivable | 12 | 19,940 | |

| Maintenance Supplies | 14 | 10,500 | |

| Office Supplies | 15 | 5,975 | |

| Office Equipment | 16 | 33,300 | |

| Accumulated Depreciation—Office Equipment | 17 | 6,900 | |

| Vehicles | 18 | 1,76,300 | |

| Accumulated Depreciation—Vehicles | 19 | 14,700 | |

| Accounts Payable | 21 | 4,015 | |

| S. Holmes, Capital | 31 | 2,89,250 | |

| S. Holmes, Drawing | 32 | 3,200 | |

| Fees Earned | 41 | 63,320 | |

| Driver Salaries Expense | 51 | 16,900 | |

| Office Salaries Expense | 61 | 7,600 | |

| Maintenance Supplies Expense | 52 | 3,600 | |

| Fuel Expense | 53 | 800 | |

| Rent Expense | 62 | 4,500 | |

| Advertising Expense | 63 | 1,990 | |

| Miscellaneous Administrative Expense | 64 | 600 | |

| 3,78,185 | 3,78,185 | ||

Table (25)

This problem will help us to understand the process of recording of accounting transactions in journal and its further posting into respective ledgers. Additionally, it shows the process of reporting of different ledger balances in unadjusted Trial balance.

Want to see more full solutions like this?

Chapter 5 Solutions

Bundle: Accounting, Loose-Leaf Version, 26th + CengageNOWv2, 2 term Printed Access Card

- Calculate the times-interest-earned ratios for PEPSI CO, Given the following informationarrow_forwardCalculate the times-interest-earned ratios for Coca Cola in 2020. Explain if the times-interest-earned ratios is adequate? Is the times-interest-earned ratio greater than or less than 2.5? What does that mean for the companies' income? Can the company afford the interest expense on a new loan?arrow_forwardWhich of the following is a temporary account?A. EquipmentB. Accounts PayableC. Utilities ExpenseD. Common Stockarrow_forward

- Unearned revenue becomes revenue when:A. A sale is madeB. Cash is receivedC. The service is performedD. The revenue is recordedarrow_forwardWhat is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardIf total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forward

- Which of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage