Concept explainers

1.

General Ledger

General ledger refers to the ledger that records all the transactions of the business related to the company’s assets, liabilities, owners’ equities, revenues, and expenses. Each subsidiary ledger is represented in the general ledger by summarizing the account.

Accounts payable control account and subsidiary ledger

Accounts payable account and subsidiary ledger is the ledger which is used to post the creditors transaction in one particular ledger account. It helps the business to locate the error in the creditor ledger balance. After all transactions of creditor accounts are posted, the balances in the accounts payable subsidiary ledger should be totaled, and compare with the balance in the general ledger of accounts payable. If both the balance does not agree, the error has been located and corrected.

Purchase journal

Purchase journal refers to the journal that is used to record all purchases on account. In the purchase journal, all purchase transactions are recorded only when the business purchased the goods on account. For example, the business purchased cleaning supplies on account.

Cash payments journal

Cash payments journal refers to the journal that is used to record all transaction which involves the cash payments. For example, the business paid cash to employees (salary paid to employees).

To Prepare: A single column revenue journal and cash receipt journal, and post the accounts in the accounts payable subsidiary ledger.

1.

Explanation of Solution

Purchase journal

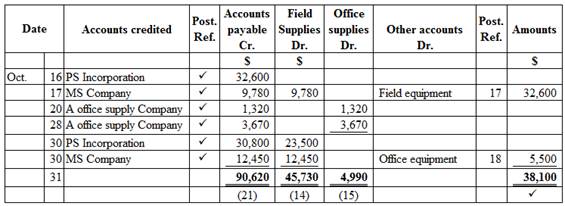

Purchase journal of Company WTE in the month of October 2016 is as follows:

Figure (1)

Cash payment journal

Cash payment journal of Company WTE in the month of October 2016 is as follows:

Cash payment journal

| Date | Check No. | Account debited | Post Ref. | Other accounts Dr. | Accounts payable Dr. | Cash Dr. | |

| Oct. | 16 | 1 | Rent expense | 71 | 7,000 | 7,000 | |

| 18 | 2 | Field supplies | 14 | 4,570 | 4,570 | ||

| Office supplies | 15 | 650 | 650 | ||||

| 24 |

|

✓ | 32,600 | 32,600 | |||

| 26 |

|

✓ | 9,780 | 9,780 | |||

| 28 | Land | 240,000 | 240,000 | ||||

| 30 |

|

✓ | 1,320 | 1,320 | |||

| 31 | Salary expense | 61 | 32,000 | 32,000 | |||

| 31 | 284,220 | 43,700 | 327,920 | ||||

| ✓ | (21) | (11) | |||||

Table (1)

Accounts payable subsidiary ledger

| Name: A Office supply Company | ||||||

| Date | Item | Post. Ref | Debit ($) |

Credit ($) | Balance ($) | |

| Oct. | 20 | P1 | 1,320 | 1,320 | ||

| 28 | P1 | 3,670 | 4,990 | |||

| 30 | CP1 | 1,320 | 3,670 | |||

Table (2)

| Name: MS Company | ||||||

| Date | Item | Post. Ref | Debit ($) |

Credit ($) | Balance ($) | |

| Oct. | 17 | P1 | 9,780 | 9,780 | ||

| 26 | CP1 | 9,780 | - | |||

| 30 | P1 | 12,450 | 12,450 | |||

Table (3)

| Name: PS Incorporation | ||||||

| Date | Item | Post. Ref | Debit ($) |

Credit ($) | Balance ($) | |

| Oct. | 16 | P1 | 32,600 | 32,600 | ||

| 24 | CP1 | 32,600 | - | |||

| 30 | P1 | 30,800 | 30,800 | |||

Table (4)

2. and 3.

To

2. and 3.

Explanation of Solution

Prepare the general ledger for given accounts as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 31 | CP1 | 327,920 | 327,920 | |||

Table (5)

| Account: Field supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 18 | CP1 | 4,570 | 4,570 | |||

| 31 | P1 | 47,530 | 52,100 | ||||

Table (6)

| Account: Office supplies Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 18 | CP1 | 650 | 650 | |||

| 31 | P1 | 4,990 | 5,460 | ||||

Table (7)

| Account: Prepaid rent Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 31 | J1 | 15,000 | 15,000 | |||

Table (8)

| Account: Field equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 16 | P1 | 32,600 | 32,600 | |||

| 31 | J1 | 15,000 | 17,600 | ||||

Table (9)

| Account: Office equipment Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 31 | P1 | 5,500 | 5,500 | ||||

Table (10)

| Account: Land Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 23 | CP1 | 240,000 | 240,000 | |||

Table (11)

| Account: Accounts payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 31 | P1 | 90,620 | 90,620 | |||

| 31 | CP1 | 43,700 | 46,920 | ||||

Table (12)

| Account: Salary expense Account no. 61 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 31 | CP1 | 32,000 | 32,000 | |||

Table (13)

| Account: Rent expense Account no. 71 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 16 | CP1 | 7,000 | 7,000 | |||

Table (14)

| Journal Page 01 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| Oct. | 31 | Prepaid rent | 16 | 15,000 | |

| Field equipment | 17 | 15,000 | |||

| (To record leasing of field equipment) | |||||

Table (15)

4.

To prepare: The accounts payable creditor balances.

4.

Explanation of Solution

Accounts payable creditor balance

Accounts payable creditor balance is as follows:

| Company WTE | |

| Accounts payable creditor balances | |

| October 31, 2016 | |

| Amount ($) | |

| A Office supply Company | 3,670 |

| MS Company | 12,450 |

| PS Incorporation | 30,800 |

| Total |

46,920 |

Table (16)

Accounts payable controlling account

Ending balance of accounts payable controlling account is as follows:

| Company WTE | |

| Accounts payable (Controlling account) | |

| October 31, 2016 | |

| Amount ($) | |

| Opening balance | 0 |

| Add: | |

| Total credits (from purchase journal) | 90,620 |

| 90,620 | |

| Less: | |

| Total debits (from cash payment journal) | (43,700) |

| Total accounts payable | 46,920 |

Table (17)

In this case, accounts payable subsidiary ledger is used to identify, and locate the error by way of cross-checking the creditor balance and accounts payable controlling account. From the above calculation, we can understand that both balances of accounts payable is agree, hence there is no error in the recording and posing of transactions.

5.

To discuss: The reason for using subsidiary ledger for the field equipment.

5.

Explanation of Solution

A subsidiary ledger for the field equipment helps the company to track the cost of each piece of equipment, location, useful life, and other necessary data. This information is used for safeguarding the equipment and determining depreciation of equipment.

Want to see more full solutions like this?

Chapter 5 Solutions

Accounting (Text Only)

- I am looking for a reliable way to solve this financial accounting problem using accurate principles.arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardThe stockholders' equity at the beginning of the period was $212,000; at the end of the period, assets were $305,000 and liabilities were $70,000. If the owner made no additional investments or paid no dividends during the period, did the business incur a net income or a net loss for the period, and how much?arrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardWhich statement is correct? Question 10 options: Diluted EPS will always be equal to EPS. Diluted EPS will always be less than basic EPS. Diluted EPS will always be greater than basic EPS. Diluted EPS will be less than or equal to basic EPS.arrow_forwardWhich statement is correct regarding a company which buys call options on its own shares from an outside company? Question 9 options: Purchased options are always dilutive. Issued options are always dilutive. Issued options are always antidilutive.ordinary shares. Purchased options are always antidilutive. Previous PageNext Pagearrow_forward

- Pinewood Corporation provides the following extracts from income statement for the year 2023: Net sales $840,000 Cost of Goods Sold (290,000) Gross profit $550,000 Calculate the gross profit percentage.arrow_forwardStranger Things Company reported the following information for its fiscal year: Net income $500,000 Preferred dividends 30,000 Common share dividends 20,000 Preferred shares are cumulative and carry an annual dividend of 10,000 The preferred dividends listed above include the current year and prior accumulated dividends. What is the amount of net income available to common shareholders? Question 8 options: $490,000 $440,000 $470,000 $450,000 Previous PageNext Pagearrow_forwardexpert of accounting answerarrow_forward

- What is the meaning of "net income attributable to ordinary shareholders"? Question 7 options: It means net income less dividends on common and preferred shares. It means net income plus dividends on common and preferred shares. It means net income plus dividends on common shares. It means net income less dividends on preferred shares.arrow_forwardIf Transcend Corporation has a cash cycle of 42 days and an operating cycle of 105 days, what is its average payment period? a) 63 b) 42 c) 105 d) 147arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning