Concept explainers

Purchases and cash payments journals; accounts payable subsidiary and general ledgers

West Texas Exploration Co. was established on October 15 to provide oil-drilling services. West Texas uses field equipment (rigs and pipe) and field supplies (drill bits and lubricants) in its operations. Transactions related to purchases anti cash payments during the remainder of October are as follows:

| Oct. 16. | Issued Check No. 1 in payment of rent for the remainder of October, $7,000. |

| 16. | Purchased field equipment on account from Petro Services Inc., $32,600. |

| Oct.17. | Purchased field supplies on account from Midland Supply Co., $9,780. |

| 18. | Issued Check No. 2 in payment of field supplies, $4,570, and office supplies, $650. |

| 20. | Purchased office supplies on account from A-One Office Supply Co., $1,320. |

| Post the journals to the accounts payable subsidiary ledger. | |

| 24. | Issued Check No. 3 to Petro Services Inc., in payment of October 16 invoice. |

| 26. | Issued Check No. 4 to Midland Supply Co. in payment of October 17 invoice. |

| 28 | Issued Check No. 5 to purchase land, $240,000. |

| 28 | Purchased office supplies on account from A-One Office Supply Co., $3,670. |

| Post the journals to the accounts payable subsidiary ledger. | |

| 30 | Purchased the following from Petro Services Inc. on account: field supplies, $25,300 and office equipment, $5,500. |

| 30 | Issued Check No. 6 to A-One Office Supply Co. in payment of October 20 invoice. |

| 30 | Purchased field supplies on account from Midland Supply Co., $12,450. |

| 31 | Issued Check No. 7 in payment of salaries, $32,000. |

| 31 | Rented building for one year in exchange for field equipment having a cost of $15,000. |

| Post the journals to the accounts payable subsidiary ledger. | |

Instructions

1 Journalize the transactions for October. Use a purchases journal and a cash payments journal similar to those illustrated in this chapter and a two-column general journal. Set debit columns for Field Supplies, Office Supplies, and Other Accounts in the purchases journal. Refer to the following partial chart of accounts:

| 11. | Cash | 18 | Office Equipment |

| 14. | Field Supplies | 19 | Land |

| 15. | Office Supplies | 21 | Accounts Payable |

| 16. | Prepaid Rent | 61 | Salary Expense |

| 17. | Field Equipment | 71 | Rent Expense |

At the points indicated in the narrative of transactions, post to the following subsidiary accounts in the accounts payable ledger:

A-One Office Supply Co.

Midland Supply Co.

Petro Services Inc.

- 2.

Post the individual entries (Other Accounts columns of the purchases journal and the Cash payments journal; both columns of the general journal) to the appropriate general ledger accounts. - 3. Total each of the columns of the purchases journal and the cash payments journal, and post the appropriate totals to the general ledger. (Because the problem does not include transactions related to cash receipts, the cash account in the ledger will have a credit balance.)

- 4. Sum the balances of the accounts payable creditor balances.

- 5. Why might West Texas consider using a subsidiary ledger for the field equipment?

1.

General Ledger

General ledger refers to the ledger that records all the transactions of the business related to the company’s assets, liabilities, owners’ equities, revenues, and expenses. Each subsidiary ledger is represented in the general ledger by summarizing the account.

Accounts payable control account and subsidiary ledger:

Accounts payable account and subsidiary ledger is the ledger which is used to post the creditors transaction in one particular ledger account. It helps the business to locate the error in the creditor ledger balance. After all transactions of creditor accounts are posted, the balances in the accounts payable subsidiary ledger should be totaled, and compare with the balance in the general ledger of accounts payable. If both the balance does not agree, the error has been located and corrected.

Purchase journal:

Purchase journal refers to the journal that is used to record all purchases on account. In the purchase journal, all purchase transactions are recorded only when the business purchased the goods on account. For example, the business purchased cleaning supplies on account.

Cash payments journal:

Cash payments journal refers to the journal that is used to record all transaction which involves the cash payments. For example, the business paid cash to employees (salary paid to employees).

To Prepare: A single column revenue journal and cash receipt journal, and post the accounts in the accounts payable subsidiary ledger.

Explanation of Solution

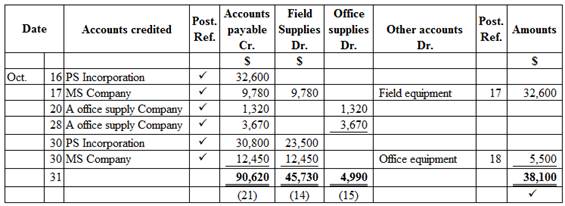

Purchase journal

Purchase journal of Company WTE in the month of October is as follows:

Figure (1)

Cash payment journal

Cash payment journal of Company WTE in the month of October is as follows:

Cash payment journal

| Date | Check No. | Account debited | Post Ref. | Other accounts Dr. | Accounts payable Dr. | Cash Dr. | |

| Oct. | 16 | 1 | Rent expense | 71 | 7,000 | 7,000 | |

| 18 | 2 | Field supplies | 14 | 4,570 | 4,570 | ||

| Office supplies | 15 | 650 | 650 | ||||

| 24 | PS Incorporation | ✓ | 32,600 | 32,600 | |||

| 26 | MS Company | ✓ | 9,780 | 9,780 | |||

| 28 | Land | 240,000 | 240,000 | ||||

| 30 | A Office supply Company | ✓ | 1,320 | 1,320 | |||

| 31 | Salary expense | 61 | 32,000 | 32,000 | |||

| 31 | 284,220 | 43,700 | 327,920 | ||||

| ✓ | (21) | (11) | |||||

Table (1)

Accounts payable subsidiary ledger

| Name: A Office supply Company | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| Oct. | 20 | P1 | 1,320 | 1,320 | ||

| 28 | P1 | 3,670 | 4,990 | |||

| 30 | CP1 | 1,320 | 3,670 | |||

Table (2)

| Name: MS Company | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| Oct. | 17 | P1 | 9,780 | 9,780 | ||

| 26 | CP1 | 9,780 | - | |||

| 30 | P1 | 12,450 | 12,450 | |||

Table (3)

| Name: PS Incorporation | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| Oct. | 16 | P1 | 32,600 | 32,600 | ||

| 24 | CP1 | 32,600 | - | |||

| 30 | P1 | 30,800 | 30,800 | |||

Table (4)

2. and 3.

To post: The individual entries to the appropriate general ledger accounts.

Explanation of Solution

Prepare the general ledger for given accounts as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 31 | CP1 | 327,920 | 327,920 | |||

Table (5)

| Account: Field supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 18 | CP1 | 4,570 | 4,570 | |||

| 31 | P1 | 47,530 | 52,100 | ||||

Table (6)

| Account: Office supplies Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 18 | CP1 | 650 | 650 | |||

| 31 | P1 | 4,990 | 5,460 | ||||

Table (7)

| Account: Prepaid rent Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 31 | J1 | 15,000 | 15,000 | |||

Table (8)

| Account: Field equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 16 | P1 | 32,600 | 32,600 | |||

| 31 | J1 | 15,000 | 17,600 | ||||

Table (9)

| Account: Office equipment Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 31 | P1 | 5,500 | 5,500 | ||||

Table (10)

| Account: Land Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 23 | CP1 | 240,000 | 240,000 | |||

Table (11)

| Account: Accounts payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 31 | P1 | 90,620 | 90,620 | |||

| 31 | CP1 | 43,700 | 46,920 | ||||

Table (12)

| Account: Salary expense Account no. 61 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 31 | CP1 | 32,000 | 32,000 | |||

Table (13)

| Account: Rent expense Account no. 71 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 16 | CP1 | 7,000 | 7,000 | |||

Table (14)

| Journal Page 01 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| Oct. | 31 | Prepaid rent | 16 | 15,000 | |

| Field equipment | 17 | 15,000 | |||

| (To record leasing of field equipment) | |||||

Table (15)

4.

To prepare: The accounts payable creditor balances.

Explanation of Solution

Accounts payable creditor balance

Accounts payable creditor balance is as follows:

| Company WTE | |

| Accounts payable creditor balances | |

| October 31 | |

| Amount ($) | |

| A Office supply Company | 3,670 |

| MS Company | 12,450 |

| PS Incorporation | 30,800 |

| Total accounts receivable | 46,920 |

Table (16)

Accounts payable controlling account

Ending balance of accounts payable controlling account is as follows:

| Company WTE | |

| Accounts payable (Controlling account) | |

| October 31 | |

| Amount ($) | |

| Opening balance | 0 |

| Add: | |

| Total credits (from purchase journal) | 90,620 |

| 90,620 | |

| Less: | |

| Total debits (from cash payment journal) | (43,700) |

| Total accounts payable | 46,920 |

Table (17)

Explanation:

In this case, accounts payable subsidiary ledger is used to identify, and locate the error by way of cross-checking the creditor balance and accounts payable controlling account. From the above calculation, we can understand that both balances of accounts payable is agree, hence there is no error in the recording and posing of transactions.

5.

To discuss: The reason for using subsidiary ledger for the field equipment.

Explanation of Solution

A subsidiary ledger for the field equipment helps the company to track the cost of each piece of equipment, location, useful life, and other necessary data. This information is used for safeguarding the equipment and determining depreciation of equipment.

Want to see more full solutions like this?

Chapter 5 Solutions

Working Papers, Chapters 1-17 for Warren/Reeve/Duchac’s Accounting, 27th and Financial Accounting, 15th

- Please provide the answer to this financial accounting question using the right approach.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease show me the correct way to solve this financial accounting problem with accurate methods.arrow_forward

- Please help me solve this financial accounting problem with the correct financial process.arrow_forwardCan you explain the process for solving this financial accounting problem using valid standards?arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

- Please explain the correct approach for solving this general accounting question.arrow_forwardI am trying to find the accurate solution to this financial accounting problem with appropriate explanations.arrow_forwardI need help finding the correct solution to this financial accounting problem with valid methods.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College