Concept explainers

Purchases and cash payments journals; accounts payable subsidiary and general ledgers

AquaFresh Water Testing Service was established on April 16. AquaFresh uses field 40 equipment and field supplies (chemicals and other supplies) to analyze water for unsafe contaminants in streams, lakes, and ponds. Transactions related to purchases and cash payments during the remainder of April are as follows:

| Apr. 16. | Issued Check No. 1 in payment of rent for the remainder of April, $3,500. |

| 16. | Purchased field supplies on account from Hydro Supply Co., $5,340. |

| 16. | Purchased field equipment on account from Pure Equipment Co., $21,450. |

| 17. | purchased office supplies on account from Best Office Supply Co., $510. |

| 19. | Issued Check No. 2 in payment of field supplies, $3,340, and office supplies, $400. |

| Post the journals to the accounts payable subsidiary ledger. | |

| 23. | Purchased office supplies on account from Best Office Supply Co., $660. |

| 23. | Issued Cheek No. 3 to purchase land, $140,000. |

| 24. | Issued Check No. 4 to Hydro Supply Co. in payment of April 16 invoice, $5,340. |

| 26 | Issued Check No. 5 to Pure Equipment Co. in payment of April 16 invoice, $21,450. |

| Post the journals to the accounts payable subsidiary ledger. | |

| 30. | Acquired land in exchange for field equipment having a cost of $12,000. |

| 30. | Purchased field supplies on account from Hydro Supply Co., $7,650. |

| 30. | Issued Check No. 6 to Best Office Supply Co. in payment of April 17 invoice, $510. |

| 30. | Purchased the following from Pure Equipment Co. on account: field supplies, 51,340, and field equipment, $4,700. |

| 30. | Issued Check No. 7 in payment of salaries, $29,400. |

| Post the journals to the accounts payable subsidiary ledger. |

Instructions

1. Journalize the transactions for April. Use a purchases journal and a cash payments journal, similar to those illustrated in this chapter, and a two-column general journal. Use debit columns for Field Supplies, Office Supplies, and Other Accounts in the purchases journal. Refer to the following partial chart of accounts:

| 11 | Cash |

| 14 | Field Supplies |

| 15 | Office Supplies |

| 17 | Field Equipment |

| 19 | Land |

| 21 | Accounts Payable |

| 61 | Salary Expense |

| 71 | Rent Expense |

At the points indicated in the narrative of transactions, post to the following accounts in the accounts payable subsidiary ledger:

- 1. Best Office Supply Co.

- 2. Hydro Supply Co.

- 3. Pure Equipment Co.

2. Post the individual entries (Other Accounts columns of the purchases journal and the cash payments journal and both columns of the general journal) to the appropriate general ledger accounts.

3. Total each of the columns of the purchases journal and the cash payments journal and post the appropriate totals to the general ledger. (Because the problem does not include transactions related to cash receipts, the cash account in the ledger will have a credit balance.)

4. Prepare a schedule of the accounts payable creditor balances.

5. Why might AquaFresh consider using a subsidiary ledger for the field equipment?

1.

General Ledger

General ledger refers to the ledger that records all the transactions of the business related to the company’s assets, liabilities, owners’ equities, revenues, and expenses. Each subsidiary ledger is represented in the general ledger by summarizing the account.

Accounts payable control account and subsidiary ledger:

Accounts payable account and subsidiary ledger is the ledger which is used to post the creditors transaction in one particular ledger account. It helps the business to locate the error in the creditor ledger balance. After all transactions of creditor accounts are posted, the balances in the accounts payable subsidiary ledger should be totaled, and compare with the balance in the general ledger of accounts payable. If both the balance does not agree, the error has been located and corrected.

Purchase journal:

Purchase journal refers to the journal that is used to record all purchases on account. In the purchase journal, all purchase transactions are recorded only when the business purchased the goods on account. For example, the business purchased cleaning supplies on account.

Cash payments journal:

Cash payments journal refers to the journal that is used to record all transaction which involves the cash payments. For example, the business paid cash to employees (salary paid to employees).

To Prepare: A single column revenue journal and cash receipt journal, and post the accounts in the accounts payable subsidiary ledger.

Explanation of Solution

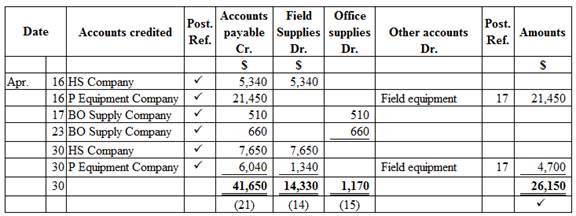

Purchase journal

Purchase journal of Company AF in the month of April is as follows:

Figure (1)

Cash payment journal

Cash payment journal of Company AF in the month of April is as follows:

Cash payment journal

| Date | Check No. | Account debited | Post Ref. | Other accounts Dr. | Accounts payable Dr. | Cash Dr. | |

| s | |||||||

| Apr. | 16 | 1 | Rent expense | 71 | 3,500 | 3,500 | |

| 19 | 2 | Field supplies | 14 | 3,340 | 3,340 | ||

| Office supplies | 15 | 400 | 400 | ||||

| 23 | 3 | Land | 19 | 140,000 | 140,000 | ||

| 24 | 4 | HS Company | ✓ | 5,340 | 5,340 | ||

| 26 | 5 | P Equipment Company | ✓ | 21,450 | 21,450 | ||

| 30 | 6 | BO Supply Company | ✓ | 510 | 510 | ||

| 30 | 7 | Salary expense | 61 | 29,400 | 29,400 | ||

| 30 | 176,640 | 27,300 | 203,940 | ||||

| ✓ | (21) | (11) | |||||

Table (1)

Accounts payable subsidiary ledger

| Name: BO Supply Company | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| April | 17 | P1 | 510 | 550 | ||

| 23 | P1 | 660 | 1,170 | |||

| 30 | CP1 | 510 | 660 | |||

Table (2)

| Name: HS Company | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| April | 16 | P1 | 5,340 | 5,340 | ||

| 24 | CP1 | 5,340 | - | |||

| 30 | P1 | 7,650 | 7,650 | |||

Table (3)

| Name: P Equipment Company | ||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) |

Balance ($) | |

| April | 16 | P1 | 21,450 | 21,450 | ||

| 26 | CP1 | 21,450 | - | |||

| 30 | P1 | 6,040 | 6,040 | |||

Table (4)

2. and 3.

To post: The individual entries to the appropriate general ledger accounts.

Explanation of Solution

Prepare the general ledger for given accounts as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 30 | CP1 | 203,940 | 203,940 | |||

Table (5)

| Account: Field supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 19 | CP1 | 3,340 | 3,340 | |||

| 30 | P1 | 14,330 | 17,670 | ||||

Table (6)

| Account: Office supplies Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 19 | CP1 | 400 | 400 | |||

| 30 | P1 | 1,170 | 1,570 | ||||

Table (7)

| Account: Field equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 16 | P1 | 21,450 | 21,450 | |||

| 30 | P1 | 4,700 | 26,150 | ||||

| 30 | J1 | 12,000 | 14,150 | ||||

Table (8)

| Account: Land Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 23 | CP1 | 140,000 | 140,000 | |||

| 30 | J1 | 12,000 | 152,000 | ||||

Table (9)

| Account: Accounts payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 30 | P1 | 41,650 | 41,650 | |||

| 30 | CP1 | 27,300 | 14,350 | ||||

Table (10)

| Account: Salary expense Account no. 61 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 30 | CP1 | 29,400 | 29,400 | |||

Table (11)

| Account: Rent expense Account no. 71 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 16 | CP1 | 3,500 | 3,500 | |||

Table (12)

| Journal Page 01 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| April | 30 | Land | 19 | 12,000 | |

| Field equipment | 17 | 12,000 | |||

| (To record the acquisition of land in exchange for field equipment) | |||||

Table (13)

4.

To prepare: The accounts payable creditor balances.

Explanation of Solution

Accounts payable creditor balance

Accounts payable creditor balance is as follows:

| Company AF | |

| Accounts payable creditor balances | |

| April 30 | |

| Amount ($) | |

| BO Supply Company | 660 |

| HS Company | 7,650 |

| P Equipment Company | 6,040 |

| Total accounts receivable | 14,350 |

Table (14)

Accounts payable controlling account

Ending balance of accounts payable controlling account is as follows:

| Company AF | |

| Accounts payable (Controlling account) | |

| April 30 | |

| Amount ($) | |

| Opening balance | 0 |

| Add: | |

| Total credits (from purchase journal) | 41,650 |

| 41,650 | |

| Less: | |

| Total debits (from cash payment journal) | (27,300) |

| Total accounts payable | 14,350 |

Table (15)

Explanation:

In this case, accounts payable subsidiary ledger is used to identify, and locate the error by way of cross check the creditor balance and accounts payable controlling account. From the above calculation, we can understand that the both balance of accounts payable is agree, hence there is no error in the recording and posing of transactions.

5.

To discuss: The reason for using subsidary ledger for the field equipment.

Explanation of Solution

A subsidiary ledger for the field equipment helps the company to track the cost of each piece of equipment, location, useful life, and other necessary data. This information is useful for safeguarding the equipment, and determining depreciation of equipment

Want to see more full solutions like this?

Chapter 5 Solutions

Working Papers, Chapters 18-26 for Warren/Reeve/Duchacâs Accounting, 27E

- A company manufactures custom lighting fixtures and uses a process costing system. During the month of November, the company started production on 720 units and completed 580 units. The remaining 140 units were65% complete in terms of materials and 35% complete in terms of labor and overhead. The total cost incurred during the month for materials was $46,400,and the cost for labor and overhead was $38,700. Using the weighted-average method, what is the equivalent unit cost for materials and conversion costs(labor and overhead)? Provide right answerarrow_forwardQuaker Industries has a cost of goods manufactured of $550,000, beginning finished goods inventory of $150,000, and ending finished goods inventory of $200,000. The cost of goods sold is: A. $400,000 B. $500,000 C. $550,000 D. $600,000arrow_forwardWhat is the ending inventory under variable costing?arrow_forward

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCleopatra Manufacturing, which uses the high-low method of estimating costs, reported total costs of $28 per unit when production was at its lowest level, at 15,000 units. When production increased to its highest level, 27,000units, the total cost per unit dropped to $20. What would Crestview estimate as the variable cost per unit? Answerarrow_forwardA constructive obligation differs from a legal obligation because it _? (a) Is created by law (b) Only applies to government entities (c) Has no financial impact (d) Is created by valid expectations from past practice solve this Accounting MCQarrow_forward

- Cleopatra Manufacturing, which uses the high-low method of estimating costs, reported total costs of $28 per unit when production was at its lowest level, at 15,000 units. When production increased to its highest level, 27,000units, the total cost per unit dropped to $20. What would Crestview estimate as the variable cost per unit?arrow_forwardAccounting?arrow_forwardNeed answerarrow_forward

- Please provide correct solution and accountingarrow_forwardA constructive obligation differs from a legal obligation because it _? (a) Is created by law (b) Only applies to government entities (c) Has no financial impact (d) Is created by valid expectations from past practice MCQarrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning