ACCOUNTING (LOOSELEAF)-W/STD.GDE+ACCESS

27th Edition

ISBN: 9781337692298

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 5.4APE

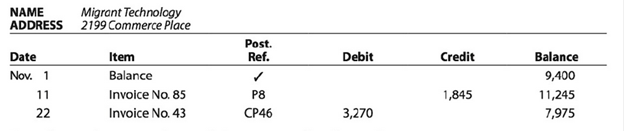

Accounts payable subsidiary ledger

The debits and credits from two transactions are presented in the following creditor’s (supplier’s) account:

Describe each transaction and the source of each posting.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need assistance with this general accounting question using appropriate principles.

I need help with this general accounting question using the proper accounting approach.

Subject: financial accounting

Chapter 5 Solutions

ACCOUNTING (LOOSELEAF)-W/STD.GDE+ACCESS

Ch. 5 - Why would a company maintain separate accounts...Ch. 5 - What are the major advantages of the use of...Ch. 5 - Prob. 3DQCh. 5 - How many postings to Fees Earned for the month...Ch. 5 - During the current month, the following errors...Ch. 5 - Prob. 6DQCh. 5 - What is an electronic form, and how is it used in...Ch. 5 - When are transactions posted in a computerized...Ch. 5 - What happens to the special journal in a...Ch. 5 - Prob. 10DQ

Ch. 5 - Revenue journal The following revenue transactions...Ch. 5 - Revenue journal The following revenue transactions...Ch. 5 - Accounts receivable subsidiary ledger The debits...Ch. 5 - Accounts receivable subsidiary ledger The debits...Ch. 5 - Purchases journal The following purchase...Ch. 5 - Purchases journal The following purchase...Ch. 5 - Accounts payable subsidiary ledger The debits and...Ch. 5 - Accounts payable subsidiary ledger The debits and...Ch. 5 - Segment analysis McHale Company does business in...Ch. 5 - Segment analysis Back Country Life, Inc., does...Ch. 5 - Identify postings from revenue journal Using the...Ch. 5 - Accounts receivable ledger Based on the data...Ch. 5 - Identify journals Assuming the use of a two-column...Ch. 5 - Identify journals Assuming the use of a two-column...Ch. 5 - Identify transactions in accounts receivable...Ch. 5 - Prepare journal entries in a revenue journal...Ch. 5 - Posting a revenue journal The revenue journal for...Ch. 5 - Accounts receivable subsidiary ledger The revenue...Ch. 5 - Revenue and cash receipts journals Transactions...Ch. 5 - Revenue and cash receipts journals Lasting Summer...Ch. 5 - Prob. 5.11EXCh. 5 - Prob. 5.12EXCh. 5 - Identify transactions in accounts payable...Ch. 5 - Prepare journal entries in a purchases journal...Ch. 5 - Posting a purchases journal The purchases journal...Ch. 5 - Accounts payable subsidiary ledger The cash...Ch. 5 - Purchases and cash payments journals Transactions...Ch. 5 - Purchases and cash payments journals Happy Tails...Ch. 5 - Error in accounts payable subsidiary ledger After...Ch. 5 - Prob. 5.20EXCh. 5 - Cash receipts journal The following cash receipts...Ch. 5 - Computerized accounting systems Most computerized...Ch. 5 - Prob. 5.23EXCh. 5 - Prob. 5.24EXCh. 5 - Segment revenue horizontal analysis Starbucks...Ch. 5 - Prob. 5.26EXCh. 5 - Segment revenue horizontal and vertical analyses...Ch. 5 - Revenue journal; accounts receivable subsidiary...Ch. 5 - Revenue and cash receipts journals; accounts...Ch. 5 - Purchases, accounts payable subsidiary account,...Ch. 5 - Purchases and cash payments journals; accounts...Ch. 5 - All journals and general ledger; trial balance The...Ch. 5 - Revenue journal; accounts receivable subsidiary...Ch. 5 - Revenue and cash receipts journals; accounts...Ch. 5 - Purchases, accounts payable account, and accounts...Ch. 5 - Purchases and cash payments journals; accounts...Ch. 5 - All journals and general ledger; trial balance The...Ch. 5 - Ethics in Action Netbooks Inc. provides accounting...Ch. 5 - Communication Internet-based accounting software...Ch. 5 - Manual vs. computerized accounting systems The...Ch. 5 - Accounts receivable and accounts payable A...Ch. 5 - Design of accounting systems For the past few...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Meena manufacturing company has budgeted overhead costs of $750,000 and expected machine hours of 25,000. During the period, actual overhead costs were $765,000 and actual machine hours were 24,000. Calculate the amount of over or underapplied overhead.arrow_forwardexplain properly all the answer for General accounting question Please given fastarrow_forwardPlease provide the solution to this financial accounting question with accurate financial calculations.arrow_forward

- Can you explain the correct approach to solve this general accounting question?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License