Concept explainers

(a)

Introduction: Profit & loss statement is a statement which presents the revenues and expenses of the company in a structured way to reflect the net income/loss earned the company. Primarily, there are two methods of presenting the profit & loss statement i.e. condensed and detailed.

To construct: The base case projected P&L statement for radiologist group.

(a)

Answer to Problem 5.3P

Radiologist group’s net income is $62,500.

Explanation of Solution

Projected P&L statement for group is as follows:

| Particulars | Per procedure | Amount |

| Charge (revenue) for 7,500 patients | $ 100 | $ 750,000 |

| Less: Variable cost | $ 25 | $ 187,500 |

| Contribution | $ 75 | $ 562,500 |

| Less: Fixed cost | $ 500,000 | |

| Net income | $ 62,500 |

(b)

Introduction: Contribution margin can be computed by deducting variable cost from the sales value. Break-even point refers to a point where total expenses and total revenue of a company are equal. Break-even point can be described as a situation where there is no net profit or loss.

To find: Group’s contribution margin and breakeven point.

(b)

Answer to Problem 5.3P

Group’s contribution margin is $562,500 and breakeven point is$666,667.

Explanation of Solution

(c)

Sales volume at which group can earn a pre-tax profit of $100,000 and $200,000.

(c)

Answer to Problem 5.3P

- Sales volume to earn a profit level of $100,000 is $800,000.

- Sales volume to earn a profit level of $200,000 is $933,333.

Explanation of Solution

Desired sales volume to earn a profit level of $100,000

Desired sales volume to earn a profit level of $200,000

(d)

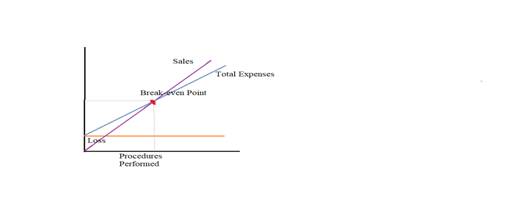

Sketch out CVP analysis graph depicting base situation.

(d)

Answer to Problem 5.3P

Breakeven point in CVP analysis graph is $666,667.

Explanation of Solution

The graph above depicts the CVP analysis. The horizontal line depicts the fixed costs in the above diagram which is to be incurred irrespective of sales volumes. The intersection point of sales and total expenses on CVP graph is referred to as “Break-even point”.

(e)

Recalculate sub-parts (a) to (d) when 20% discount is given from charges (revenue).

(e)

Answer to Problem 5.3P

- Radiologist group’s net loss is $87,500.

- Group’s contribution margin is $412,500 and breakeven point is $727,273.

- Sales volume to earn a profit level of $100,000 is $872,727.

- Sales volume to earn a profit level of $200,000 is $1,018,182.

Explanation of Solution

(a) Radiologist group’s net income

| Particulars | Per procedure | Amount |

| Charge (revenue) for 7,500 patients | $ 80 | $ 600,000 |

| Less: Variable cost | $ 25 | $ 187,500 |

| Contribution | $ 55 | $ 412,500 |

| Less: Fixed cost | $ 500,000 | |

| Net loss | $ (87,500) |

(b) Group’s contribution margin and breakeven point

(c) Sales volume to earn a profit level of $100,000 and $200,000

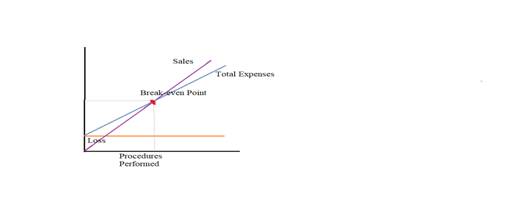

(d) CVP analysis graph

The graph above depicts the CVP analysis. The horizontal line depicts the fixed costs in the above diagram which is to be incurred irrespective of sales volumes. The intersection point of sales and total expenses on CVP graph is referred to as “Break-even point”. Break-even point in the graph above is $727,273.

Want to see more full solutions like this?

Chapter 5 Solutions

EBK HEALTHCARE FINANCE: AN INTRODUCTION

- please don't use ai and if you cant understand given values please don't answer question otherwise unhelpful will be given.arrow_forwardfinance subjectarrow_forwardCould you help explain, what is the complete salary survey analysis, and ensuring the data is relevant and up-to-date? What is the job evaluation and compensation plan? How to ensure the final report is comprehensive, clearly structured, and aligned with the company vision?arrow_forward

- The maturity value of an $35,000 non-interest-bearing, simple discount 4%, 120-day note is:arrow_forwardCarl Sonntag wanted to compare what proceeds he would receive with a simple interest note versus a simple discount note. Both had the same terms: $18,905 at 10% for 4 years. Use ordinary interest as needed. Calculate the simple interest note proceeds. Calculate the simple discount note proceeds.arrow_forwardWhat you're solving for Solving for maturity value, discount period, bank discount, and proceeds of a note. What's given in the problem Face value: $55300 Rate of interest: 10% Length of note: 95 days Date of note: August 23rd Date note discounted: September 18th Bank discount rate:9 percentarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning