Concept explainers

Inventory: These are goods which are owned by company and expected to sell in its normal course of business

Periodic Inventory System: The physical inventory balance is updated at the end of accounting balance by actual physical counting at the end of accounting period and the quantity is taken as closing balance. The cost of merchandise is calculated by opening a temporary purchase account and all purchases of merchandise are debited to purchase account.

Sales under periodic Inventory System : When merchandiser sells the goods it can be through cash sale or credit Sale. There will be one entry for each sales transaction as explained below

- When sale of merchandise is made as per revenue recognition principle. The revenue will be recognized by debiting "Accounts receivable" if there is credit sales or "Cash" if it cash sales and by crediting "Sales"

Purchases under periodic Inventory System : when merchandiser sells the goods it can be through cash sale or credit Sale. There will be one entry for each purchase transaction as explained below

- When purchase of merchandise is made. the accounting entry will be by debiting "Purchases" by crediting "Accounts payable" if there is credit purchase if cash is paid than "Cash" will be credited

Sales under perpetual Inventory System : when merchandiser sells the goods it can be through cash sale or credit Sale. There will be two entries for each sales transaction as explained below

- When sale of merchandise is made as per revenue recognition principle. The revenue will be recognized by debiting "Accounts receivable" if there is credit sales or "Cash" if it cash sales and by crediting "Sales"

- The amount of cost of inventory which is sold the accounting entry will debiting " cost of goods sold" and crediting "Merchandise Inventory"

Purchases under perpetual Inventory System : when merchandiser sells the goods it can be through cash sale or credit Sale. There will be one entry for each purchase transaction as explained below

- When purchase of merchandise is made. the accounting entry will be by debiting "Merchandise Inventory" by crediting "Accounts payable" if there is credit purchase if cash is paid than "Cash" will be credited

Cost of goods sold: The amount of cost of inventory which is sold is determined and is part of expense shown in Income statement. The formula to calculate Cost of goods sold is given below

The amount of cost of goods sold using periodic inventory system is as under

- As per FIFO method it is $19,220

- As per LIFO method it is $21,500

The amount of ending inventory using periodic inventory system is as under

- As per FIFO method it is $12,300

- As per LIFO method it is $14,580

The calculation of ending inventory and total goods available for sale is shown below

| Date of purchases | Number of units | Unit cost($) | Total cost($) | |

| A | B | C=A x B | ||

| 1/1 Beginning inventory | 150 | 60 | 9000 | |

| 24-Jan | 70 | 66 | 4620 | |

| 7-Mar | 90 | 70 | 6300 | |

| 10-Apr | 140 | 72 | 10080 | |

| 28-Sep | 50 | 76 | 3800 | |

| Total units available for sale | I | 500 | 33800 | |

| Date of sales | ||||

| 22-Feb | 100 | |||

| 11-Jun | 100 | |||

| 4-Dec | 100 | |||

| Total units sold | II | 300 | ||

| Closing inventory | III= I - II | 200 |

In FIFO method it is assumed the goods purchased first will be sold first and the ending inventory will be balances from last purchases and will be posted in inventory account. The calculation of ending inventory amount is given as below

In FIFO method it is assumed the goods purchased first will be sold first and the ending inventory will be balances from last purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

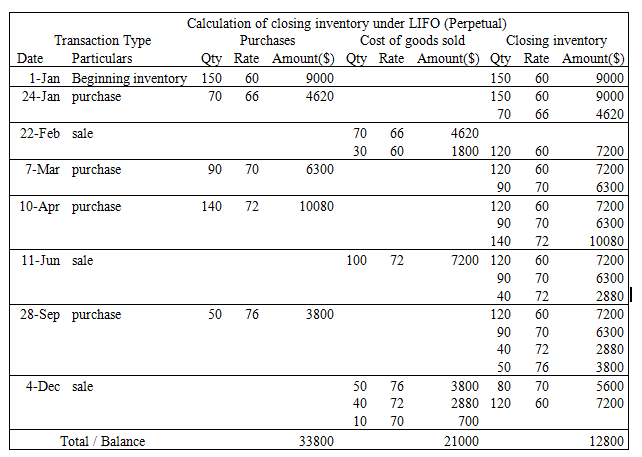

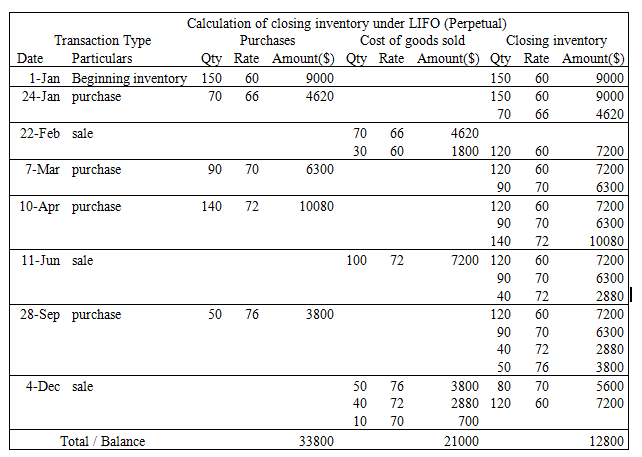

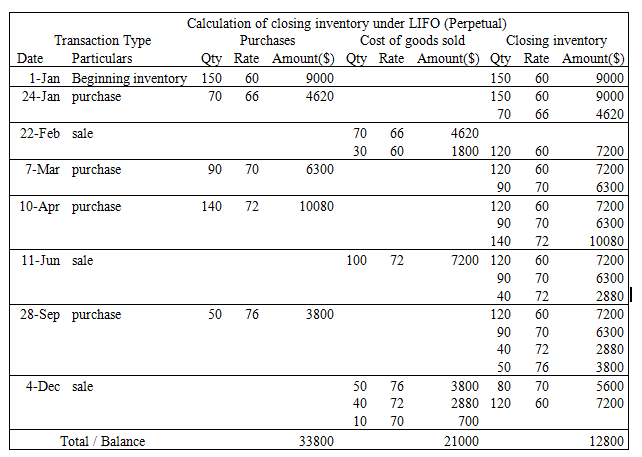

In LIFO method it is assumed the goods purchased last will be sold first and the ending inventory will be balances from beginning purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

The cost of goods sold as per LIFO method is $21,000 and FIFO method is $19,220 and cost of ending inventory as per LIFO is $12,800 and FIFO is $14,480 using periodic inventory system

The reason for difference in valuation of ending inventory and cost of goods sold in LIFO under periodic inventory system and perpetual inventory system

In FIFO method the valuation is same in periodic inventory system and perpetual inventory system because the goods purchased first is assumed to sold first and ending inventory under both inventory are from last purchases

In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases but in perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

In Periodic Inventory System the physical inventory balance is updated at the end of accounting balance by actual physical counting at the end of accounting period and the quantity is taken as closing balance. In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases

In Perpetual Inventory System each merchandise purchase and sales cost are recorded and updated continuously for all merchandise. In perpetual Inventory system if merchandise is sold. The company determines the cost of goods sold and passes an accounting entry. It will debit "Cost of goods sold" and credit "Merchandise Inventory". In LIFO method under perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

IN LIFO method the valuation of cost of goods sold and ending inventory will different under periodic inventory system and perpetual inventory system

In FIFO method the valuation is same in periodic inventory system and perpetual inventory system because the goods purchased first is assumed to sold first and ending inventory under both inventory are from last purchases

In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases but in perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

In Periodic Inventory System the physical inventory balance is updated at the end of accounting balance by actual physical counting at the end of accounting period and the quantity is taken as closing balance. In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases

In Perpetual Inventory System each merchandise purchase and sales cost are recorded and updated continuously for all merchandise. In perpetual Inventory system if merchandise is sold. The company determines the cost of goods sold and passes an accounting entry. It will debit "Cost of goods sold" and credit "Merchandise Inventory". In LIFO method under perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

IN LIFO method the valuation of cost of goods sold and ending inventory will different under periodic inventory system and perpetual inventory system

Answer to Problem 5.33P

The amount of cost of goods sold using periodic inventory system is as under

- As per FIFO method it is $19,220

- As per LIFO method it is $21,500

The amount of ending inventory using periodic inventory system is as under

- As per FIFO method it is $12,300

- As per LIFO method it is $14,580

The calculation of ending inventory and total goods available for sale is shown below

| Date of purchases | Number of units | Unit cost($) | Total cost($) | |

| A | B | C=A x B | ||

| 1/1 Beginning inventory | 150 | 60 | 9000 | |

| 24-Jan | 70 | 66 | 4620 | |

| 7-Mar | 90 | 70 | 6300 | |

| 10-Apr | 140 | 72 | 10080 | |

| 28-Sep | 50 | 76 | 3800 | |

| Total units available for sale | I | 500 | 33800 | |

| Date of sales | ||||

| 22-Feb | 100 | |||

| 11-Jun | 100 | |||

| 4-Dec | 100 | |||

| Total units sold | II | 300 | ||

| Closing inventory | III= I - II | 200 |

In FIFO method it is assumed the goods purchased first will be sold first and the ending inventory will be balances from last purchases and will be posted in inventory account. The calculation of ending inventory amount is given as below

In FIFO method it is assumed the goods purchased first will be sold first and the ending inventory will be balances from last purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

In LIFO method it is assumed the goods purchased last will be sold first and the ending inventory will be balances from beginning purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

The cost of goods sold as per LIFO method is $21,000 and FIFO method is $19,220 and cost of ending inventory as per LIFO is $12,800 and FIFO is $14,480 using periodic inventory system

In FIFO method the valuation is same in periodic inventory system and perpetual inventory system because the goods purchased first is assumed to sold first and ending inventory under both inventory are from last purchases

In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases but in perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

In Periodic Inventory System the physical inventory balance is updated at the end of accounting balance by actual physical counting at the end of accounting period and the quantity is taken as closing balance. In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases

In Perpetual Inventory System each merchandise purchase and sales cost are recorded and updated continuously for all merchandise. In perpetual Inventory system if merchandise is sold. The company determines the cost of goods sold and passes an accounting entry. It will debit "Cost of goods sold" and credit "Merchandise Inventory". In LIFO method under perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

IN LIFO method the valuation of cost of goods sold and ending inventory will different under periodic inventory system and perpetual inventory system

Explanation of Solution

The calculation of ending inventory and total goods available for sale is shown below

| Date of purchases | Number of units | Unit cost($) | Total cost($) | |

| A | B | C=A x B | ||

| 1/1 Beginning inventory | 150 | 60 | 9000 | |

| 24-Jan | 70 | 66 | 4620 | |

| 7-Mar | 90 | 70 | 6300 | |

| 10-Apr | 140 | 72 | 10080 | |

| 28-Sep | 50 | 76 | 3800 | |

| Total units available for sale | I | 500 | 33800 | |

| Date of sales | ||||

| 22-Feb | 100 | |||

| 11-Jun | 100 | |||

| 4-Dec | 100 | |||

| Total units sold | II | 300 | ||

| Closing inventory | III= I - II | 200 |

In FIFO method it is assumed the goods purchased first will be sold first and the ending inventory will be balances from last purchases and will be posted in inventory account. The calculation of ending inventory amount is given as below

In FIFO method it is assumed the goods purchased first will be sold first and the ending inventory will be balances from last purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

In LIFO method it is assumed the goods purchased last will be sold first and the ending inventory will be balances from beginning purchases and will be posted in inventory account and cost of goods sold after every sale transaction. The calculation of ending inventory amount and cost of goods sold is given as below

The cost of goods sold as per LIFO method is $21,000 and FIFO method is $19,220 and cost of ending inventory as per LIFO is $12,800 and FIFO is $14,480 using periodic inventory system

In FIFO method the valuation is same in periodic inventory system and perpetual inventory system because the goods purchased first is assumed to sold first and ending inventory under both inventory are from last purchases

In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases but in perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

In Periodic Inventory System the physical inventory balance is updated at the end of accounting balance by actual physical counting at the end of accounting period and the quantity is taken as closing balance. In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases

In Perpetual Inventory System each merchandise purchase and sales cost are recorded and updated continuously for all merchandise. In perpetual Inventory system if merchandise is sold. The company determines the cost of goods sold and passes an accounting entry. It will debit "Cost of goods sold" and credit "Merchandise Inventory". In LIFO method under perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

IN LIFO method the valuation of cost of goods sold and ending inventory will different under periodic inventory system and perpetual inventory system

The cost of goods sold as per LIFO method is $21,000 and FIFO method is $19,220 and cost of ending inventory as per LIFO is $12,800 and FIFO is $14,480 using periodic inventory system

In FIFO method the valuation is same in periodic inventory system and perpetual inventory system because the goods purchased first is assumed to sold first and ending inventory under both inventory are from last purchases

In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases but in perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

In Periodic Inventory System the physical inventory balance is updated at the end of accounting balance by actual physical counting at the end of accounting period and the quantity is taken as closing balance. In LIFO method under periodic inventory system the last purchases of the period are booked in cost of goods sold account for sales quantity even if sales are before the last purchases

In Perpetual Inventory System each merchandise purchase and sales cost are recorded and updated continuously for all merchandise. In perpetual Inventory system if merchandise is sold. The company determines the cost of goods sold and passes an accounting entry. It will debit "Cost of goods sold" and credit "Merchandise Inventory". In LIFO method under perpetual inventory system the last purchases before every sales transaction are booked first in cost of goods sold, hence there is difference in valuation of cost of goods sold and ending inventory

IN LIFO method the valuation of cost of goods sold and ending inventory will different under periodic inventory system and perpetual inventory system

Want to see more full solutions like this?

Chapter 5 Solutions

Accounting: What the Numbers Mean

- Prada Manufacturing had a Work in Process balance of $72,000 on January 1, 2022. The year-end balance of Work in Process was $95,000, and the Cost of Goods Manufactured was $730,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2022.arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forwardThe basis of asingle overhead allocation rate based on direct labor hours?arrow_forward

- General accountingarrow_forwardIf the cost of the beginning work in process inventory is $92,000, costs of goods manufactured is $1,050,000, direct materials cost is $375,000, direct labor cost is $255,000, and overhead cost is $360,000, calculate the ending work in process inventory.arrow_forwardFinancial Accounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education