Concept explainers

Computation of Account Balances

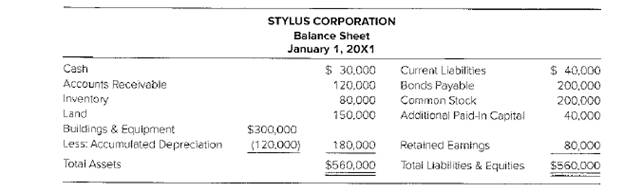

Pencil Company purchased 40 percent ownership of Stylus Corporation on January 1, 20X1,for $150,000. Stylus’s

During 20X1 Stylus Corporation reported net income of $30,000 and paid dividends of $9,000. The fair values of Stylus’s assets and liabilities were equal to their book values at the date of acquisition, with the exception of buildings and equipment, which had a fair value $35,000 above book value.

During 20X1 Stylus Corporation reported net income of $30,000 and paid dividends of $9,000. The fair values of Stylus’s assets and liabilities were equal to their book values at the date of acquisition, with the exception of buildings and equipment, which had a fair value $35,000 above book value.

All buildings and equipment had remaining lives of five year at the time of the business combination. The amount attributed to

Required

a. What amount of investment income will Pencil Company record during 20X1 under equity method accounting?

b. What amount of income will be reported under the cost method?

c. What will be the balance in the investment account on December 31, 20X1, under (1) cost method and (2) equity-method accounting?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

ADV.FIN.ACCT.LL W/CONNECT+PROCTORIO PLUS

- Please explain the solution to this general accounting problem with accurate explanations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forward