The revenue recognition principle:

The revenue recognition principle refers to the revenue that should be recognized in the time period, when the performance obligation (sales or services) of the company is completed.

Revenue recognized point of long term contract:

A long-term contract qualifies for revenue recognition over time. The seller can recognize the revenue as per percentage of the completion of the project, which is recognized as revenue minus cost of completion until date.

If a contract does not meet the performance obligation norm, then the seller cannot recognize the revenue till the project is complete.

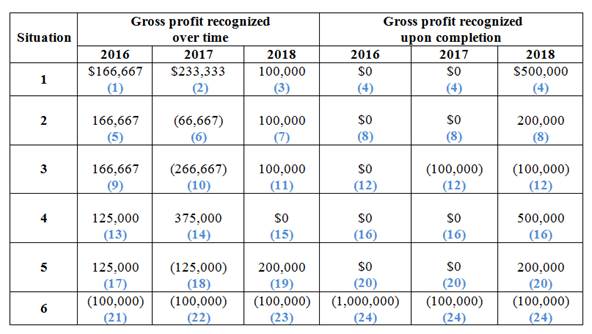

To determine: The amount of gross profit or loss to be recognized under various situations.

Explanation of Solution

The amount of gross profit or loss to be recognized under various situations is as follows:

(Figure 1)

Working note:

Situation – 1

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2016 | 2017 | 2018 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 1,500,000 | 3,600,000 | 4,500,000 |

| Estimated costs to complete | 3,000,000 | 900,000 | 0 |

| Total estimated costs (B) | 4,500,000 | 4,500,000 | 4,500,000 |

| Estimated gross profit(actual in 2018)

|

$500,000 | $500,000 | $500,000 |

Table (1)

In the year 2016:

In the year 2017:

In the year 2018:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2016 | 0 |

| 2017 | 0 |

| 2018 | $500,000 |

| Total gross profit | $500,000 |

Table (2)

(4)

Situation – 2

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2016 | 2017 | 2018 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 1,500,000 | 2,400,000 | 4,800,000 |

| Estimated costs to complete | 3,000,000 | 2,400,000 | 0 |

| Total estimated costs (B) | 4,500,000 | 4,800,000 | 4,800,000 |

| Estimated gross profit(actual in 2018)

|

$500,000 | $200,000 | $200,000 |

Table (3)

In the year 2016:

In the year 2017:

In the year 2018:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2016 | 0 |

| 2017 | 0 |

| 2018 | $200,000 |

| Total gross profit | $200,000 |

Table (4)

(8)

Situation – 3

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2016 | 2017 | 2018 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 1,500,000 | 3,600,000 | 5,200,000 |

| Estimated costs to complete | 3,000,000 | 1,500,000 | 0 |

| Total estimated costs (B) | 4,500,000 | 5,100,000 | 5,200,000 |

| Estimated gross profit(actual in 2018)

|

$500,000 | $(100,000) | $(200,000) |

Table (5)

In the year 2016:

In the year 2017:

In the year 2018:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2016 | 0 |

| 2017 | $(100,000) |

| 2018 | $(100,000) |

| Total gross profit | $(200,000) |

Table (6)

(12)

Situation – 4

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2016 | 2017 | 2018 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 500,000 | 3,500,000 | 4,500,000 |

| Estimated costs to complete | 3,500,000 | 875,000 | 0 |

| Total estimated costs (B) | 4,000,000 | 4,375,000 | 4,500,000 |

| Estimated gross profit(actual in 2018)

|

$1,000,000 | $625,000 | $500,000 |

Table (7)

In the year 2016:

In the year 2017:

In the year 2018:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2016 | 0 |

| 2017 | 0 |

| 2018 | $500,000 |

| Total gross profit | $500,000 |

Table (8)

(16)

Situation – 5

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2016 | 2017 | 2018 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 500,000 | 3,500,000 | 4,800,000 |

| Estimated costs to complete | 3,500,000 | 1,500,000 | 0 |

| Total estimated costs (B) | 4,000,000 | 5,000,000 | 4,800,000 |

| Estimated gross profit(actual in 2018)

|

$1,000,000 | $0 | $200,000 |

Table (9)

In the year 2016:

In the year 2017:

In the year 2018:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2016 | 0 |

| 2017 | 0 |

| 2018 | $200,000 |

| Total gross profit | $200,000 |

Table (10)

(20)

Situation – 6

1. Compute the value of gross profit or loss recognized over time

Here,

| Particulars | 2016 | 2017 | 2018 |

| Contract price (A) | $5,000,000 | $5,000,000 | $5,000,000 |

| Actual costs to date | 500,000 | 3,500,000 | 5,300,000 |

| Estimated costs to complete | 4,600,000 | 1,700,000 | 0 |

| Total estimated costs (B) | 5,100,000 | 5,200,000 | 5,300,000 |

| Estimated gross profit(actual in 2018)

|

$(100,000) | $(200,000) | $(300,000) |

Table (11)

In the year 2016:

In the year 2017:

In the year 2018:

2. Compute the value of gross profit or loss recognized upon completion

| Year | Gross profit recognized |

| 2016 | $(100,000) |

| 2017 | (100,000) |

| 2018 | (100,000) |

| Total gross profit | $(300,000) |

Table (12)

(24)

Want to see more full solutions like this?

Chapter 5 Solutions

INTERMEDIATE ACCOUNTING

- Can you solve this financial accounting problem with appropriate steps and explanations?arrow_forwardCan you show me the correct approach to solve this financial accounting problem using suitable standards?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- I need assistance with this financial accounting problem using valid financial procedures.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- I am looking for a step-by-step explanation of this financial accounting problem with correct standards.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardI need help with this financial accounting question using standard accounting techniques.arrow_forward

- Could you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardI am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forwardPlease give me true answer this financial accounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education